Market Overview:

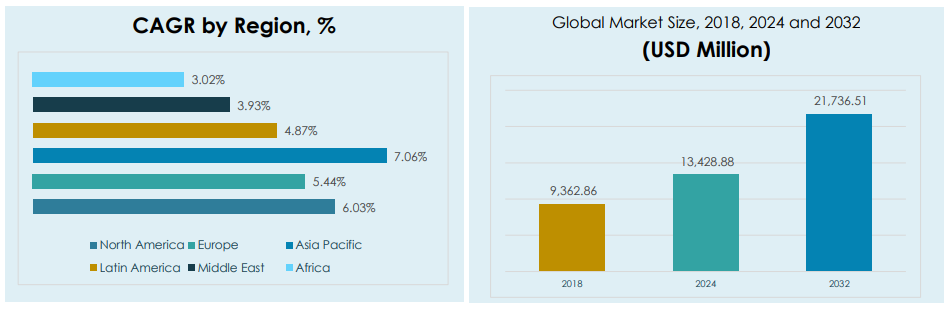

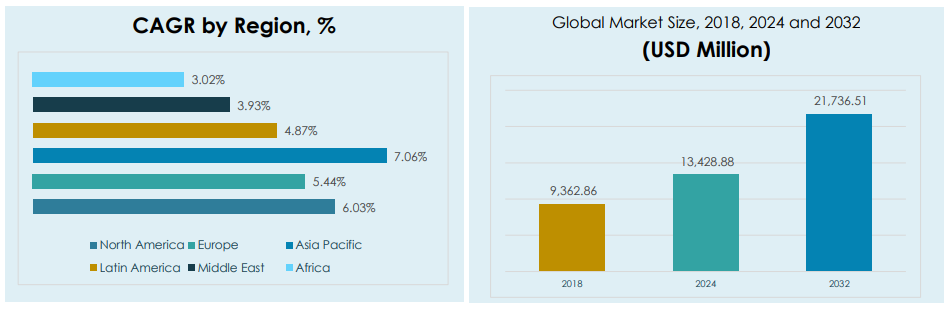

The Global Work Boots Market size was valued at USD 8,619.1 million in 2018 to USD 13,378.0 million in 2024 and is anticipated to reach USD 24,284.0 million by 2032, at a CAGR of 6.2 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Work Boots Market Size 2024 |

USD 13,378.0 Million |

| Work Boots Market, CAGR |

6.2 % |

| Work Boots Market Size 2032 |

USD 21,736.51 Million |

The market growth is driven by rising demand for protective footwear across industries such as construction, mining, oil and gas, and manufacturing. Increasing focus on workplace safety regulations has strengthened adoption of durable boots with advanced features like slip resistance, waterproofing, and electrical hazard protection. Growing awareness among employers and workers about occupational hazards further supports market expansion. Rising consumer interest in multifunctional footwear that balances protection with comfort also boosts demand.

Geographically, North America and Europe lead the market due to strict occupational safety standards and well-established industrial bases. Asia-Pacific is emerging rapidly, supported by fast industrialization, infrastructure development, and growing workforce safety concerns in countries such as China and India. Latin America and the Middle East show steady growth driven by construction and oilfield activities, while Africa presents untapped potential with expanding mining and industrial projects.

Market Insights:

- The Global Work Boots Market size was valued at USD 8,619.1 million in 2018, reached USD 13,378.0 million in 2024, and is projected to attain USD 21,736.51 million by 2032, expanding at a CAGR of 7.77%.

- Asia Pacific held the largest share at 35% in 2024, supported by industrial growth and infrastructure expansion. North America followed with 27%, driven by strong regulatory compliance, while Europe captured 22% due to strict worker safety standards.

- Latin America is the fastest-growing region, with 9% share in 2024, propelled by construction, oil and gas, and manufacturing expansion. Rising safety compliance and international brand penetration enhance its growth outlook.

- By product, boots dominate the Global Work Boots Market, accounting for over 65% share in 2024, owing to their high adoption in construction, mining, and oilfield sectors.

- Shoes contributed nearly 35% share in 2024, favored in light manufacturing, transport, and service industries where mobility and comfort are prioritized alongside safety.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Emphasis on Worker Safety Across High-Risk Industries:

The Global Work Boots Market is expanding due to stronger regulations on workplace safety across industries such as construction, mining, and oil and gas. Governments and organizations enforce stricter standards to reduce accidents, encouraging companies to adopt protective footwear. Safety boots with slip-resistant soles, electrical hazard protection, and steel toe caps are becoming mandatory in many sectors. Employers prioritize employee well-being to avoid legal liabilities and productivity loss. This rising compliance culture supports consistent demand. The market benefits from industries with frequent exposure to hazards. Employers increasingly view safety boots as investments rather than expenses. The growing scale of industrial projects also strengthens demand globally.

- For instance, Steel Blue has partnered with First Graphene to infuse graphene into their boots, launching GraphTEC™ enhanced scuff caps and outsoles to improve durability and performance—making their work boots up to 200 times stronger than steel by weight, as shown in controlled durability tests. Safety boots with slip-resistant soles, electrical hazard protection, and steel toe caps are becoming mandatory in many sectors.

Expansion of Industrial and Infrastructure Development Worldwide:

Infrastructure growth in emerging economies drives the need for protective footwear. Expanding construction projects, mining activities, and oilfield developments increase workforce exposure to risks. The Global Work Boots Market gains traction as workers require durable and safe footwear. Governments in Asia-Pacific, Latin America, and Africa are investing heavily in infrastructure, which boosts demand. New power plants, transportation systems, and urban development’s require large labor forces equipped with protective gear. Industrial expansion across sectors creates sustained demand. Employers are also focusing on providing reliable footwear as part of personal protective equipment. These developments strengthen the market outlook in multiple regions.

- For instance, Steel Blue’s graphene-infused outsoles demonstrated wear resistance improvements of over 25% in Australian mining field tests (2024), reducing annual boot replacement rates for mine operators. Governments in Asia-Pacific, Latin America, and Africa are investing heavily in infrastructure, which boosts demand. New power plants, transportation systems, and urban development’s require large labor forces equipped with protective gear.

Integration of Advanced Materials for Durability and Comfort:

Manufacturers are adopting advanced materials like lightweight composites, waterproof membranes, and shock-absorbing soles. This shift supports greater comfort, durability, and flexibility for workers. The Global Work Boots Market benefits from innovations that improve usability without compromising protection. Breathable fabrics enhance comfort in hot climates, while insulated boots support cold-weather applications. Employers are choosing advanced footwear to reduce fatigue and improve efficiency. Workers also prefer products offering protection and style together. Product development focuses on achieving compliance while ensuring extended product life. This trend ensures steady market growth and consumer acceptance globally.

Rising Consumer Awareness and Lifestyle Shifts Beyond Workplaces:

Work boots are gaining popularity beyond traditional industrial use, expanding into outdoor and lifestyle categories. Consumers prefer multifunctional footwear suitable for both work and casual wear. The Global Work Boots Market captures this trend by introducing stylish designs that combine protection and fashion. Demand for rugged footwear is increasing among outdoor enthusiasts and younger consumers. Rising awareness of safety benefits encourages broader adoption. Marketing campaigns highlight durability and versatility, creating appeal across new demographics. Companies expand retail presence to capture consumer-driven growth. This lifestyle integration strengthens demand outside workplace-focused channels, creating wider growth opportunities.

Market Trends:

Increased Focus on Sustainable Manufacturing and Eco-Friendly Materials:

The Global Work Boots Market is witnessing a transition toward sustainable materials and environmentally conscious production. Companies integrate recycled rubber, organic leather alternatives, and low-emission processes. Consumers and regulatory bodies push for lower carbon footprints, driving manufacturers to adapt. This trend aligns with global sustainability goals and brand positioning strategies. Firms investing in green innovation attract eco-conscious buyers and strengthen brand reputation. Packaging is also becoming eco-friendly to appeal to broader audiences. Companies emphasizing sustainability find better acceptance in mature markets. This development is reshaping competition and future innovation strategies.

- For instance, Caleres reported that 95% of its products in 2024 fiscal year included at least one environmentally preferred material, such as more than 70% of its synthetic materials featuring at least 50% certified recycled content, and 96% of its leather sourced from Leather Working Group Silver or Gold certified tanneries.

Adoption of Smart and Technology-Enhanced Protective Footwear:

Manufacturers are introducing smart boots equipped with sensors, GPS trackers, and fatigue monitoring systems. These innovations target industries where worker safety and productivity are critical. The Global Work Boots Market benefits from demand for connected protective gear in sectors like mining and construction. Smart features provide real-time safety alerts and data collection. Integration with workplace management systems enhances monitoring efficiency. Companies offering tech-enabled solutions gain competitive differentiation. Demand for intelligent protective gear is increasing in developed economies. This technological shift highlights a premium growth trend across safety footwear.

- For instance, an Australian bootmaker collaborated with Monash University in 2022 to develop a prototype smart boot with integrated sensors for healthcare workers, though the boot was never released to market. The Global Work Boots Market benefits from demand for connected protective gear across sectors like mining, construction, and healthcare

Growing E-Commerce Sales and Direct-to-Consumer Channels:

Online platforms are becoming major growth channels for work boot sales. The Global Work Boots Market is capitalizing on direct-to-consumer strategies supported by global e-commerce platforms. Workers and consumers prefer the convenience of online purchases with wide product availability. E-retailers provide product reviews, specifications, and comparison tools that drive confident purchasing. Discounts, return policies, and customization options also enhance online appeal. Digital platforms allow companies to bypass intermediaries and capture higher margins. Social media campaigns support brand visibility and engagement. This channel expansion significantly boosts market penetration worldwide.

Shift Toward Lightweight and Ergonomically Designed Footwear:

Workers increasingly demand boots that balance durability with comfort. The Global Work Boots Market adapts with designs that reduce fatigue and improve mobility. Lightweight composite toe caps replace heavier steel alternatives. Ergonomic designs minimize strain during long working hours. Manufacturers introduce flexible soles and cushioned insoles for greater comfort. Market demand reflects a shift from purely protective gear to user-centered footwear. Adoption is particularly strong in industries requiring extended work shifts. Companies innovating in ergonomic safety footwear capture growing customer loyalty. This shift is driving product diversification across global markets.

Market Challenges Analysis:

High Product Costs and Pressure on Affordability Across Regions:

The Global Work Boots Market faces challenges due to the high costs of advanced protective footwear. Manufacturers use premium materials and technology, raising production expenses. Employers in cost-sensitive industries hesitate to invest in higher-priced products, slowing adoption. Small firms often prioritize affordability over compliance, reducing market penetration. Economic slowdowns also discourage large-scale procurement. Price competition among regional players forces global brands to balance quality with cost. Consumers in developing economies prefer cheaper alternatives. This pricing challenge limits growth potential in emerging markets despite rising demand.

Counterfeit Products and Distribution Limitations Impact Market Growth:

The Global Work Boots Market struggles with counterfeit goods that compromise safety standards and brand trust. Low-cost replicas attract budget-conscious buyers but fail to provide adequate protection. This undermines confidence in authentic products and challenges leading manufacturers. Distribution challenges in rural and remote regions also limit availability. Companies struggle to maintain strong supply chains in diverse geographies. Limited awareness about product authenticity contributes to counterfeit sales. Weak enforcement of regulations further escalates the issue. Addressing these challenges is crucial to sustain credibility and ensure long-term market expansion.

Market Opportunities:

Rising Adoption in Emerging Economies and Expanding Workforce Safety Awareness:

The Global Work Boots Market offers opportunities in regions undergoing rapid industrialization and infrastructure growth. Countries like India, China, and Brazil are investing heavily in safety regulations. Increasing awareness among employers and workers about the benefits of protective footwear fuels adoption. Growing urbanization supports workforce expansion, creating more demand. International brands gain traction by entering untapped regional markets. Local manufacturing partnerships strengthen accessibility and cost efficiency. Companies focusing on education campaigns boost consumer awareness. This shift presents strong long-term growth prospects globally.

Expansion of Product Lines into Lifestyle and Outdoor Segments Worldwide:

Work boots are crossing over into lifestyle and outdoor categories, creating wider demand potential. The Global Work Boots Market adapts by offering versatile designs suited for casual and rugged use. Younger consumers and outdoor enthusiasts prefer durable yet stylish footwear. Brands invest in hybrid products that balance protection and fashion. Marketing strategies highlight versatility to attract new demographics. E-commerce platforms accelerate lifestyle product availability. This diversification strategy allows companies to reach beyond industrial applications. Growth in outdoor and casual demand provides untapped opportunities for global players.

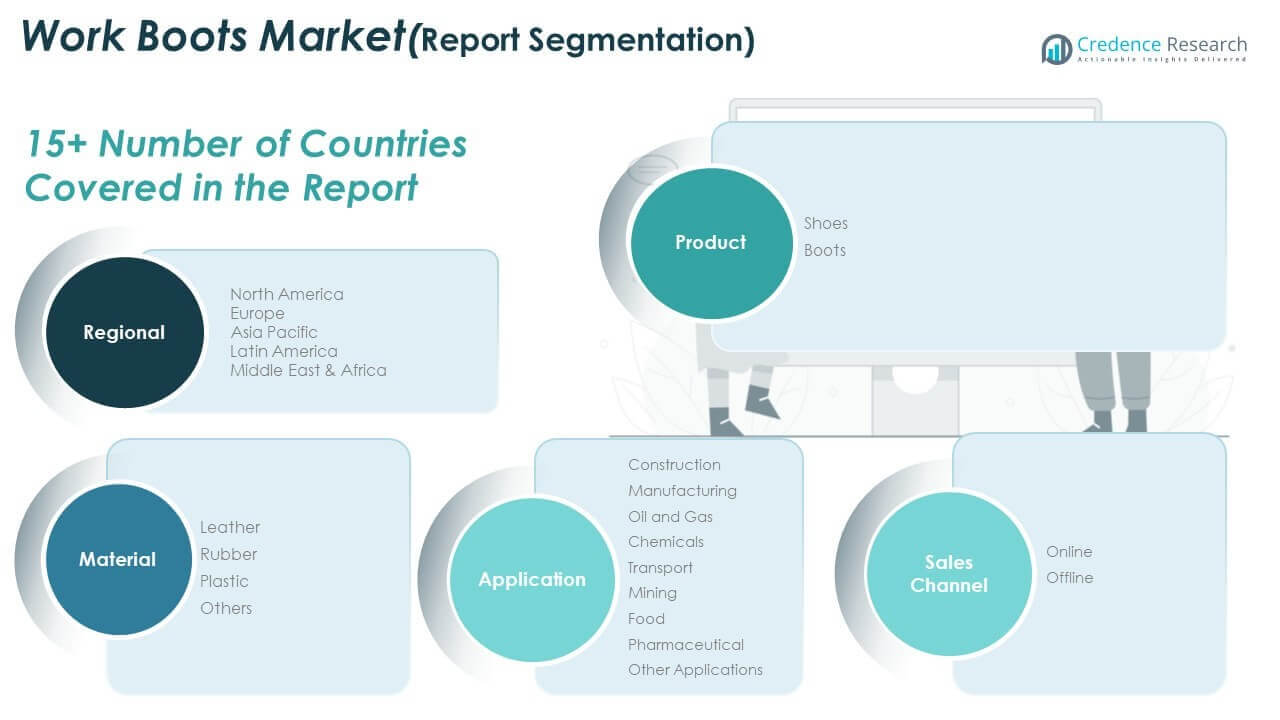

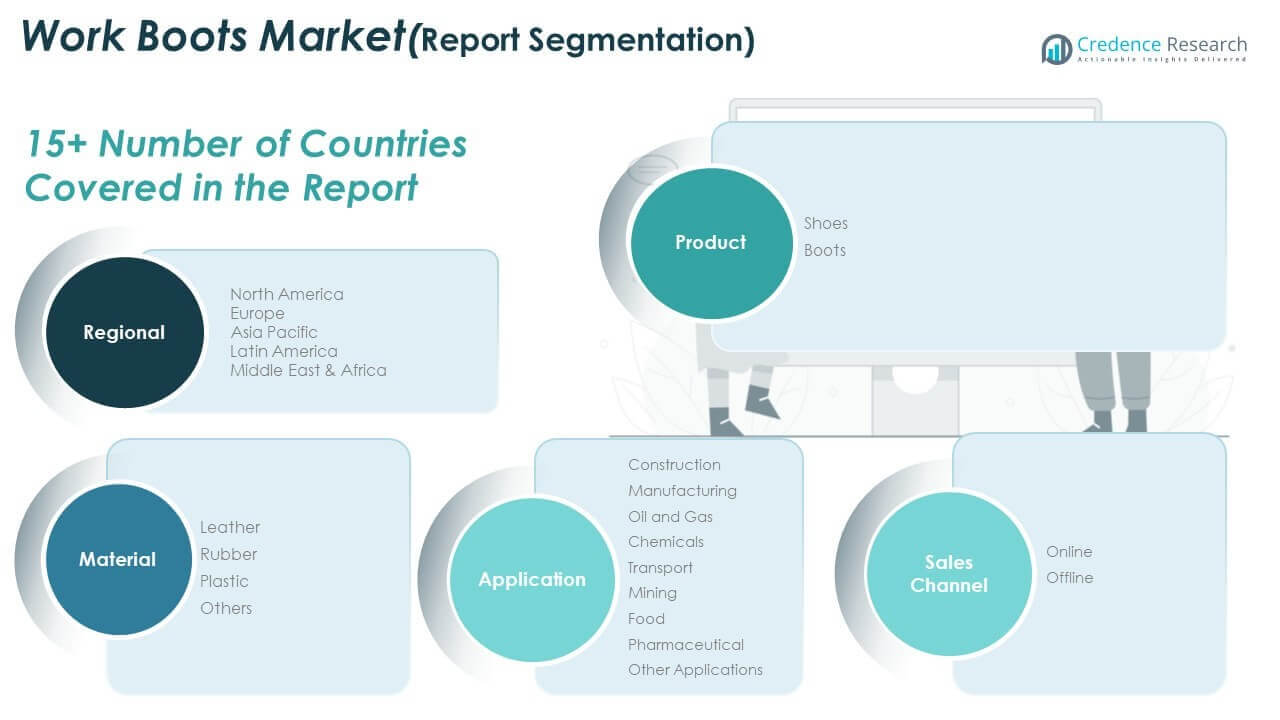

Market Segmentation Analysis:

By Material

The Global Work Boots Market shows strong demand across leather, rubber, plastic, and other materials. Leather dominates due to its durability, premium finish, and comfort in heavy-duty environments. Rubber is preferred in industries exposed to moisture and chemicals, offering waterproofing and slip resistance. Plastic and synthetic variants gain traction for their affordability and lighter weight. Other materials, including composites, address specialized requirements for insulation and extreme climates. It continues to diversify as innovation in materials reshapes performance and user preference.

- For instance, according to Caleres’ 2023 ESG Report, the company did not state a 96% leather sourcing rate for that year. However, Caleres did report that 93% of the leather it purchased in 2023 came from Leather Working Group (LWG) Gold or Silver-certified tanneries. A more recent March 2025 filing by Caleres indicated they sourced 96% of their leather from LWG-certified suppliers in 2024.

By Product

Shoes and boots form the two major product categories in the Global Work Boots Market. Boots command significant demand in industries like construction, mining, and oil and gas, where maximum protection is essential. Shoes are increasingly adopted in light manufacturing, logistics, and service-based sectors due to their comfort and mobility. It balances both segments with growing customization and industry-specific design enhancements. Companies continue to expand product portfolios to suit occupational and lifestyle needs.

- For instance, the demand for pull-on boots in heavy industrial sectors like manufacturing and mining remains strong due to practical benefits, including rapid removal and enhanced safety features like the lack of laces. At the same time, safety shoes are seeing increased adoption in light manufacturing, logistics, and service-based sectors, largely because of their greater comfort and mobility.

By Application

Construction, manufacturing, oil and gas, chemicals, transport, mining, food, pharmaceutical, and other applications drive market adoption. Construction and mining remain core demand centers due to high safety risks. Oil and gas requires heat and chemical-resistant footwear, while food and pharmaceuticals prioritize hygiene and slip resistance. Transport and manufacturing sectors demand versatile footwear balancing durability and comfort. It benefits from this wide application spectrum that sustains consistent growth across industries.

By Sales Channel

Online and offline channels distribute work boots globally. Offline sales remain dominant due to industrial procurement and retail presence. Online platforms are growing rapidly, offering accessibility, product variety, and competitive pricing. It is increasingly shaped by e-commerce penetration and direct-to-consumer strategies that enhance global reach.

Segmentation:

By Material

- Leather

- Rubber

- Plastic

- Others

By Product

By Application

- Construction

- Manufacturing

- Oil and Gas

- Chemicals

- Transport

- Mining

- Food

- Pharmaceutical

- Other Applications

By Sales Channel

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America

The North America Global Work Boots Market size was valued at USD 2,363.36 million in 2018 to USD 3,644.16 million in 2024 and is anticipated to reach USD 6,556.69 million by 2032, at a CAGR of 7.7% during the forecast period. North America holds a significant share of the Global Work Boots Market driven by stringent occupational safety standards and established industrial sectors. The U.S. dominates the region with high adoption across construction, oil and gas, and manufacturing. Canada contributes with consistent demand in mining and infrastructure projects. Mexico shows steady growth through industrial expansion and manufacturing hubs. Strong awareness of workplace safety and compliance ensures continued adoption. Leading global brands maintain strong distribution networks in this region. It remains a mature yet steadily expanding market with focus on innovation. North America accounts for nearly 27% of the global share in 2024.

Europe

The Europe Global Work Boots Market size was valued at USD 1,905.69 million in 2018 to USD 2,938.95 million in 2024 and is anticipated to reach USD 5,289.06 million by 2032, at a CAGR of 7.7% during the forecast period. Europe represents a robust market supported by strict worker protection laws and a diverse industrial base. Countries such as Germany, the UK, and France lead demand with advanced infrastructure and manufacturing. Southern and Eastern Europe add growth momentum through construction and transport activities. The market benefits from high product quality expectations and preference for durable materials. It is also influenced by sustainability trends, with rising adoption of eco-friendly products. Strong emphasis on compliance enhances adoption across sectors. Global and regional brands compete through innovation and pricing. Europe holds about 22% of the global share in 2024.

Asia Pacific

The Asia Pacific Global Work Boots Market size was valued at USD 2,997.73 million in 2018 to USD 4,716.49 million in 2024 and is anticipated to reach USD 8,715.53 million by 2032, at a CAGR of 8.0% during the forecast period. Asia Pacific is the fastest-growing regional market, driven by rapid industrialization and expanding infrastructure projects. China dominates with large-scale construction, mining, and manufacturing. India shows strong growth with rising safety awareness and government-led infrastructure investments. Japan, South Korea, and Australia contribute through advanced industries and stringent safety standards. Southeast Asia adds momentum with growing oil and gas and transport sectors. It benefits from a rising workforce and increasing urbanization. Regional brands expand alongside global companies through cost-effective products. Asia Pacific commands about 35% of the global share in 2024.

Latin America

The Latin America Global Work Boots Market size was valued at USD 767.96 million in 2018 to USD 1,222.94 million in 2024 and is anticipated to reach USD 2,294.84 million by 2032, at a CAGR of 8.2% during the forecast period. Latin America demonstrates strong potential with growth supported by construction, mining, and oil and gas activities. Brazil leads the region with significant demand in infrastructure and industrial sectors. Mexico and Argentina contribute through expanding manufacturing bases and transport development. The region’s growth is supported by rising safety compliance and economic development. It faces challenges such as affordability and limited enforcement in smaller industries. It benefits from increased presence of international brands and expanding retail networks. Online channels are gaining traction, improving accessibility. Latin America secures about 9% of the global share in 2024.

Middle East

The Middle East Global Work Boots Market size was valued at USD 411.99 million in 2018 to USD 613.09 million in 2024 and is anticipated to reach USD 1,049.07 million by 2032, at a CAGR of 7.0% during the forecast period. The Middle East market is driven by oil and gas, construction, and infrastructure development. GCC countries lead demand with large projects in energy and urban development. Israel and Turkey contribute through manufacturing and industrial activities. Demand for specialized boots resistant to heat, chemicals, and heavy loads remains strong. It benefits from international brands supplying advanced protective footwear. Growing investment in industrial safety programs fuels adoption. Regional economic diversification also supports demand in non-oil sectors. The Middle East holds nearly 5% of the global share in 2024.

Africa

The Africa Global Work Boots Market size was valued at USD 172.38 million in 2018 to USD 242.33 million in 2024 and is anticipated to reach USD 378.83 million by 2032, at a CAGR of 5.8% during the forecast period. Africa is an emerging market with growth centered in mining, construction, and energy sectors. South Africa leads adoption supported by large mining operations and industrial projects. Egypt contributes with infrastructure development and urban growth. Other regions show slower adoption due to affordability challenges and weaker enforcement. It faces issues with counterfeit products impacting quality perception. Growing foreign investments improve demand for compliant safety gear. Awareness campaigns and regional supply chain expansion help improve market presence. Africa accounts for about 2% of the global share in 2024.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Black Diamond Group

- Timberland PRO

- KEEN Utility

- Skechers

- Alpha Gripp

- Wolverine

- Reebok

- Ariat Work

- SR Max

- Other Key Players

Competitive Analysis:

The Global Work Boots Market is highly competitive, shaped by global brands and regional players. Companies focus on product innovation, comfort, and compliance with safety standards to strengthen their positions. Leading firms such as Timberland PRO, KEEN Utility, Wolverine, and Skechers invest in durable designs and ergonomic features. Expansion through e-commerce channels and strategic retail partnerships supports broader reach. Regional players compete on affordability, offering cost-effective products for local industries. It continues to see consolidation as large brands acquire smaller ones to expand portfolios. Competitive intensity is defined by quality differentiation, brand reputation, and distribution networks. The market’s competitive landscape remains dynamic with strong focus on safety compliance and consumer demand.

Recent Developments:

- In August 2025, Black Diamond Group made a strategic acquisition of Spencer, a high-quality small corporate travel company in Australia, to support its expansion of LodgeLink into the Asia Pacific region and enhance workforce travel services there. This acquisition adds capabilities for air travel ticketing and local infrastructure support for travel in Australia, complementing Black Diamond’s North American operations and long-term growth strategy.

- In late 2024, Timberland launched its Spring 2025 collection featuring elevated iterations of its iconic footwear, such as the Heritage 6-Inch Lace-Up Waterproof Boot and Stone Street 6-Inch Waterproof Platform Boot, combining rugged utility with modern design and sustainable materials. This collection was crafted to deliver durability, comfort, and style for work and outdoor activities.

- KEEN Utility announced several strategic updates in mid-2023, including a price reduction of nearly all their shoes by an average of five percent and key leadership additions. Scott Peterson was named Vice President and Global General Manager to lead growth and innovation in safety footwear.

- Alpha Grip Management Company signed a formal partnership in January 2025 with China National Chemical Engineering International Corporation Ltd. (CNCEC) to develop the $20 billion Ogidigben Gas Revolution Industrial Park Project in Nigeria, marking a significant industrial cooperation milestone.

Report Coverage:

The research report offers an in-depth analysis based on material, product, application, and sales channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for safety footwear will rise with stricter global workplace regulations.

- Lightweight and ergonomic designs will dominate product development.

- Sustainability initiatives will encourage use of recycled and eco-friendly materials.

- Online platforms will account for a larger share of global sales.

- Emerging economies will become critical growth hubs.

- Smart and connected safety boots will gain traction in advanced markets.

- Lifestyle integration will create opportunities in casual and outdoor footwear.

- Partnerships and mergers will strengthen competitive positioning.

- Global brands will expand manufacturing bases in cost-effective regions.

- Focus on customization will increase to meet sector-specific demands.