Market Overview

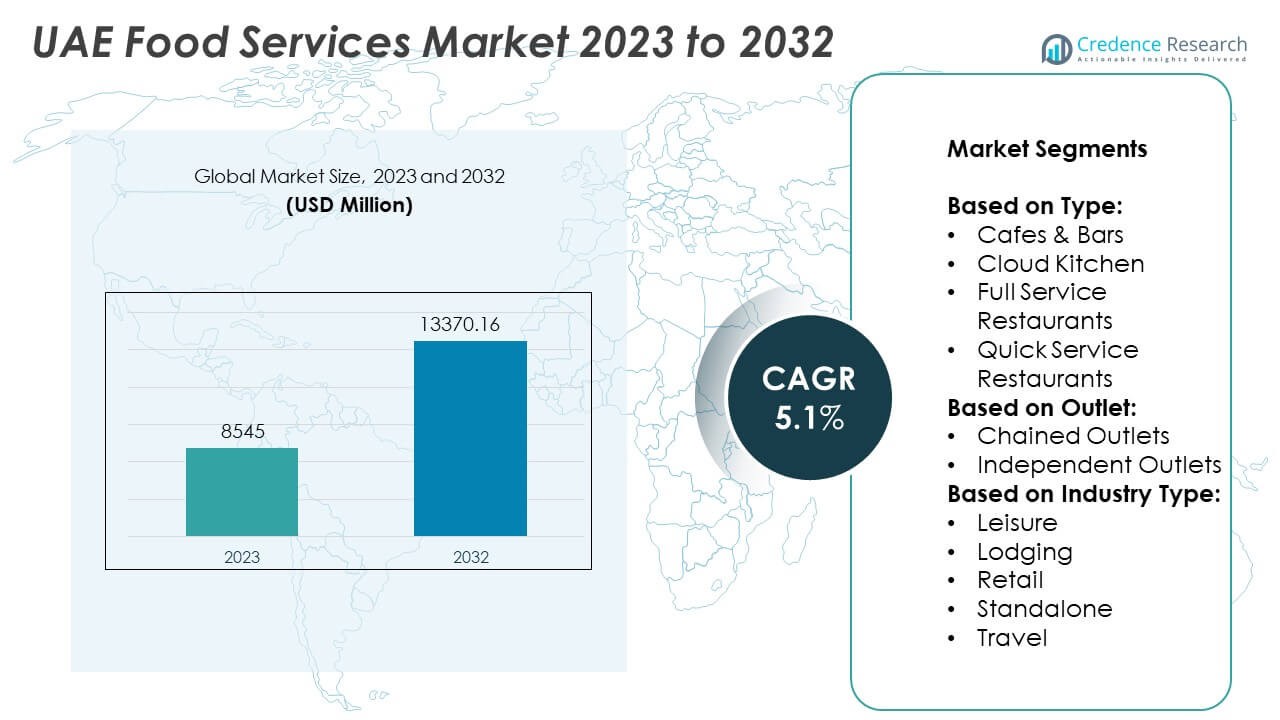

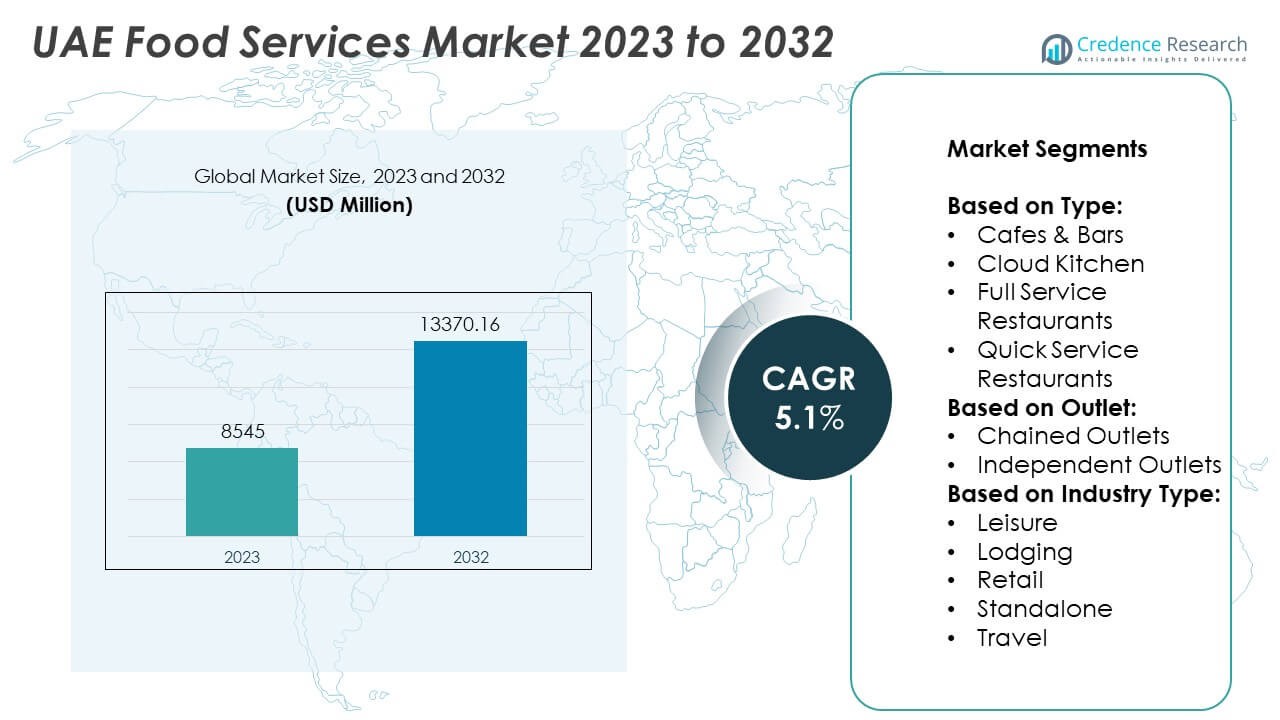

UAE Food Services Market size was valued at USD 8545 million in 2023 and is anticipated to reach USD 13,370.16 million by 2032, at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UAE Food Services Market Size 2024 |

USD 8545 Million |

| UAE Food Services Market, CAGR |

5.1% |

| UAE Food Services Market Size 2032 |

USD 13,370.16 Million |

The UAE Food Services market experiences strong growth driven by rising urbanization, increasing expatriate population, and high disposable income that fuel demand for diverse dining options. It benefits from technology adoption, including digital ordering, delivery platforms, and cloud kitchens, which enhance operational efficiency and customer convenience. Consumers increasingly seek premium, health-conscious, and sustainable menu options, prompting innovation and menu diversification. Experiential and theme-based dining concepts attract both residents and tourists, supporting market expansion.

The UAE Food Services market demonstrates strong geographical presence across major emirates, including Dubai, Abu Dhabi, Sharjah, Ajman, and Fujairah, driven by urbanization, tourism, and expatriate demand. Dubai and Abu Dhabi lead in premium and experiential dining, while Sharjah and Ajman focus on family-oriented and casual dining. The market features a mix of international and local operators, fostering competitive innovation and menu diversification. Key players include Alamar Foods Company, Americana Restaurants International PLC, BinHendi Enterprises, and Alghanim Industries & Yusuf A. Alghanim & Sons WLL, which leverage brand recognition, technological integration, and strategic outlet expansion to capture diverse consumer segments across the UAE.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UAE Food Services market was valued at USD 8,545 million in 2023 and is projected to reach USD 13,370.16 million by 2032, growing at a CAGR of 5.1% during the forecast period.

- Rising urbanization, high disposable income, and a growing expatriate population drive demand for diverse dining experiences and innovative food services.

- The market trends highlight increased adoption of digital ordering platforms, cloud kitchens, and delivery services, enhancing convenience and operational efficiency.

- Consumers show a growing preference for health-conscious, sustainable, and premium dining options, prompting menu diversification and experiential restaurant concepts.

- Competitive analysis reveals strong presence of both local and international operators, with key players including Alamar Foods Company, Americana Restaurants International PLC, BinHendi Enterprises, and Alghanim Industries & Yusuf A. Alghanim & Sons WLL. Operators focus on brand recognition, technological integration, and expansion of chained and independent outlets.

- Market restraints include high operational costs, regulatory compliance challenges, and intense competition, which limit profitability and slow rapid expansion.

- Regional analysis indicates that major emirates such as Dubai and Abu Dhabi lead the market with high tourism and business activity, while Sharjah, Ajman, and Fujairah experience steady growth driven by residential demand, localized offerings, and emerging delivery platforms.

Market Drivers

Rising Urbanization and Expanding Expatriate Population Driving Demand for Diverse Food Services

The UAE Food Services market benefits from rapid urbanization and a growing expatriate population that demands varied culinary options. It experiences increased footfall in restaurants, cafés, and fast-food outlets due to a mix of local residents and international visitors. High disposable income among urban consumers supports frequent dining out and premium food service experiences. It encourages operators to offer innovative menus and fusion cuisines that cater to diverse tastes. Tourist inflow contributes to seasonal spikes in demand, particularly in key cities like Dubai and Abu Dhabi. The presence of multinational food chains strengthens market competitiveness while meeting evolving consumer preferences. It positions the UAE as a hub for international food service standards.

- For instance, Americana Restaurants International PLC operates over 600 outlets across the UAE, catering to both local and international cuisine preferences, demonstrating its ability to serve diverse consumer segments.

Technological Advancements Enhancing Operational Efficiency and Customer Experience

The UAE Food Services market leverages digital platforms and technology to optimize operations and improve customer engagement. It integrates online ordering, delivery apps, and mobile payment systems to enhance convenience and accessibility. Smart kitchen management and inventory tracking reduce waste and improve service efficiency. Data analytics allow operators to predict demand, tailor menus, and implement loyalty programs. It supports the adoption of cloud-based solutions for staff scheduling and customer relationship management. Contactless ordering and AI-enabled recommendations improve dining experiences. Technology adoption strengthens brand loyalty and operational resilience in a competitive market.

- For instance, CKE Restaurants Holdings Inc. implemented a digital ordering system across 75 UAE outlets, which increased online orders by 40,000 transactions monthly, showing the impact of technology on accessibility.

Increasing Health and Sustainability Awareness Among Consumers Driving Menu Innovation

The UAE Food Services market responds to rising consumer focus on health, nutrition, and sustainability. It encourages restaurants and food service providers to introduce organic, plant-based, and low-calorie options. Eco-friendly packaging and sustainable sourcing practices gain prominence to meet environmental expectations. It drives differentiation strategies for operators aiming to attract health-conscious and socially responsible consumers. Partnerships with local farms and certified suppliers improve supply chain transparency. Menu diversification includes allergen-free and functional foods to cater to specific dietary needs. It strengthens market positioning by aligning offerings with evolving consumer values.

Government Initiatives Supporting Food Industry Growth and Investment Opportunities

The UAE Food Services market benefits from supportive government policies promoting tourism, hospitality, and food sector investments. It gains from initiatives encouraging foreign direct investment, streamlined licensing, and quality standards enforcement. Events like Expo 2020 and Expo 2025 stimulate demand for food services and international cuisines. It supports market expansion in underdeveloped regions and emerging urban centers. Regulatory frameworks ensure food safety, hygiene, and operational compliance. It encourages innovation in delivery models, cloud kitchens, and niche dining concepts. Government support enhances investor confidence and sector sustainability.

Market Trends

Expansion of Delivery and Cloud Kitchen Models Transforming Food Service Operations

The UAE Food Services market experiences strong growth in delivery services and cloud kitchens that optimize operational efficiency. It allows operators to serve high-demand areas without investing in traditional storefronts. Mobile apps and online platforms streamline order placement and enhance customer convenience. It supports flexible menu offerings tailored for home consumption and remote workers. Partnerships with third-party delivery providers expand reach and reduce logistical challenges. It encourages experimentation with virtual brands to meet niche consumer preferences. Operational scalability strengthens competitiveness and revenue generation.

- For instance, Alamar Foods Company introduced a cloud-based workforce management system covering 120 staff members per outlet, improving shift efficiency and reducing scheduling conflicts by 35,000 hours annually.

Integration of Digital Platforms and Data-Driven Customer Engagement

The UAE Food Services market leverages digital technology to improve customer interaction and loyalty. It employs mobile ordering, reservation systems, and digital loyalty programs to enhance convenience. Analytics and customer data enable personalized recommendations, menu adjustments, and targeted promotions. It supports social media engagement to strengthen brand visibility and influence purchasing decisions. Contactless payments and self-service kiosks improve operational efficiency while enhancing the dining experience. It allows real-time monitoring of consumer preferences and feedback. Technology integration fosters stronger connections with modern, tech-savvy customers.

- For instance, Galadari Ice Cream Co. LLC launched a cloud kitchen in Abu Dhabi that fulfills over 30,000 delivery orders monthly, demonstrating how specialized operators scale without physical restaurants.

Focus on Premium, Experiential, and Theme-Based Dining Concepts

The UAE Food Services market trends towards premium and immersive dining experiences that attract both residents and tourists. It encourages thematic restaurants, fine dining, and culturally immersive concepts to differentiate from standard offerings. Culinary innovation and presentation quality create memorable experiences and brand loyalty. It leverages local and international flavors to appeal to diverse consumer segments. Strategic locations in malls, airports, and tourist hubs drive footfall and visibility. It promotes collaborations with celebrity chefs and international food brands. Experiential dining strengthens market positioning and drives repeat visits.

Rising Consumer Demand for Healthy, Sustainable, and Functional Food Options

The UAE Food Services market responds to growing consumer preference for health-conscious and sustainable dining. It introduces organic, plant-based, and nutrient-rich menu options to meet dietary expectations. Sustainable sourcing, waste reduction, and eco-friendly packaging gain prominence. It fosters transparency in ingredient sourcing and nutritional information to build consumer trust. Operators diversify offerings to include allergen-free, functional, and fortified foods. It promotes awareness campaigns and nutritional education to influence dining choices. Trend adoption reinforces competitiveness and aligns market offerings with evolving consumer lifestyles.

Market Challenges Analysis

High Operational Costs and Intense Competition Limiting Profitability in the Food Sector

The UAE Food Services market faces challenges from elevated operational costs and intense competition among local and international players. It contends with high rental rates, labor expenses, and utility costs that impact overall profitability. Fluctuations in raw material prices create pressure on menu pricing and cost management. It requires continuous investment in technology, staff training, and quality control to maintain service standards. Market saturation in urban centers intensifies competition for customer attention and loyalty. It compels operators to differentiate through innovation, premium offerings, and enhanced customer experience. Profit margins remain narrow, demanding efficient operational strategies to sustain growth.

Regulatory Compliance and Supply Chain Constraints Impacting Market Stability

The UAE Food Services market encounters challenges related to strict regulatory requirements and supply chain vulnerabilities. It must comply with food safety standards, licensing regulations, and health inspections that require continuous monitoring. Disruptions in the supply of fresh ingredients or imported products affect menu consistency and service reliability. It faces difficulties in balancing compliance with cost-effectiveness while maintaining high-quality offerings. Skilled labor shortages and staff turnover add pressure to operational efficiency. It necessitates robust planning, supplier diversification, and risk management to mitigate potential disruptions. Regulatory and logistical hurdles limit rapid expansion and operational flexibility.

Market Opportunities

Expansion of Digital Ordering Platforms and Delivery Services Unlocking New Revenue Streams

The UAE Food Services market benefits from growing adoption of digital ordering and delivery platforms that expand reach and convenience. It allows operators to tap into busy urban areas and high-demand neighborhoods without heavy investment in physical outlets. Partnerships with third-party delivery providers enhance logistical efficiency and customer access. It supports the creation of virtual brands and specialized menu offerings to capture niche markets. Data-driven insights from digital platforms enable personalized promotions and improved customer engagement. It encourages flexible business models, including cloud kitchens and subscription-based meal services. Revenue diversification through technology adoption strengthens market resilience and growth potential.

Growing Tourism, Expat Population, and Premium Dining Demand Creating Market Expansion Opportunities

The UAE Food Services market experiences opportunities driven by increasing tourism, expatriate population, and demand for premium dining experiences. It benefits from international events, luxury hospitality growth, and seasonal tourist inflows that boost footfall in restaurants and cafés. Investment in experiential and theme-based dining concepts attracts high-spending consumers and differentiates operators. It encourages menu innovation and collaboration with global culinary brands to appeal to diverse preferences. Emerging urban areas provide potential for new outlets and niche food services. It supports growth in catering, events, and on-the-go food solutions for both residents and visitors. Market expansion leverages demographic diversity and evolving lifestyle trends.

Market Segmentation Analysis:

By Type:

The UAE Food Services market shows significant diversification across different service types. Cafes and bars attract urban consumers seeking social and leisure experiences while offering specialty beverages and light meals. It supports premium and niche offerings, including specialty coffees, mocktails, and themed bar concepts. Cloud kitchens gain traction due to low setup costs and high operational efficiency, catering to online delivery demand. It allows operators to experiment with multiple virtual brands without physical storefronts. Full-service restaurants maintain strong appeal among families, business diners, and tourists, emphasizing high-quality service, curated menus, and experiential dining. It leverages international cuisine and fine dining concepts to enhance market positioning. Quick service restaurants dominate volume-driven consumption, offering convenience, consistent quality, and rapid service that align with busy urban lifestyles. It ensures widespread accessibility across residential and commercial hubs.

- For instance, Circle Café & Lounge in Dubai serves over 15,000 specialty beverages monthly, demonstrating strong urban consumer engagement. Cloud kitchens gain traction due to low setup costs and high operational efficiency, catering to online delivery demand.

By Outlet:

The UAE Food Services market experiences growth through both chained and independent outlets. Chained outlets benefit from brand recognition, standardized service, and operational efficiency that attract repeat customers and high footfall. It expands rapidly through franchising and strategic urban locations, strengthening market presence. Independent outlets emphasize uniqueness, localized menus, and personalized customer experiences. It enables operators to differentiate through innovation, cultural authenticity, and niche culinary offerings. Both models coexist, creating a competitive environment that drives quality improvements and consumer choice. It allows market players to target distinct consumer segments while balancing operational strategies.

- For instance, Adventure Eats at Dubai Parks & Resorts serves 12,000 visitors monthly, reflecting recreational dining integration. Lodging services, including hotels and resorts, focus on premium dining, room service, and international cuisine to meet global guest expectations. It supports brand reputation and loyalty for hospitality operators.

By Industry Type:

The UAE Food Services market caters to diverse industry types that influence service design and consumer engagement. Leisure outlets, including entertainment centers and cultural hubs, attract customers seeking recreational dining experiences. It integrates themed menus, family-friendly options, and interactive environments to enhance engagement. Lodging services, including hotels and resorts, focus on premium dining, room service, and international cuisine to meet global guest expectations. It supports brand reputation and loyalty for hospitality operators. Retail outlets, located in malls and commercial complexes, capitalize on foot traffic, offering quick meals and casual dining options. Standalone restaurants target local communities with personalized service and unique culinary offerings. Travel-oriented outlets in airports and transport hubs provide convenient, on-the-go dining for domestic and international travelers. It adapts offerings to the operational context and consumer requirements of each segment.

Segments:

Based on Type:

- Cafes & Bars

- Cloud Kitchen

- Full Service Restaurants

- Quick Service Restaurants

Based on Outlet:

- Chained Outlets

- Independent Outlets

Based on Industry Type:

- Leisure

- Lodging

- Retail

- Standalone

- Travel

Based on Geography:

- Dubai

- Abu Dhabi

- Sharjah

- Ajman

- Fujairah

Regional Analysis

Dubai

Dubai holds a significant share in the UAE Food Services market, accounting for 38% of the overall revenue. It remains the largest contributor due to its status as a global business hub, luxury tourism destination, and cosmopolitan population. The city attracts a high volume of international visitors and expatriates, driving demand for diverse food service offerings, including fine dining, quick service restaurants, cafes, and cloud kitchens. It supports premium, theme-based, and experiential dining concepts that cater to affluent consumers and tourists. Major malls, entertainment hubs, and business districts further enhance footfall and operational opportunities. It benefits from a strong presence of international food chains and local operators who leverage brand recognition and innovative offerings. Continuous investment in technology, delivery platforms, and digital ordering strengthens operational efficiency and customer engagement.

Abu Dhabi

Abu Dhabi represents 27% of the UAE Food Services market, supported by a mix of government, corporate, and leisure-driven demand. It serves as the political and administrative capital, hosting international conferences, exhibitions, and business events that elevate demand for catering and premium dining services. It emphasizes fine dining, hotel-based food services, and leisure-oriented restaurants, catering to both residents and high-spending tourists. It supports growth of cloud kitchens and digital delivery models that expand accessibility and convenience. It benefits from government initiatives promoting tourism and hospitality, which encourage new market entrants. Operators focus on high-quality service standards, international cuisine, and curated dining experiences to meet consumer expectations. Abu Dhabi also experiences seasonal peaks aligned with cultural events and international gatherings.

Sharjah

Sharjah accounts for 15% of the UAE Food Services market, reflecting its growing residential base and cultural tourism appeal. It supports family-oriented dining, casual eateries, and budget-friendly quick service options. It emphasizes accessibility, community engagement, and localized menu offerings to capture resident demand. It benefits from integration with retail complexes, leisure centers, and cultural attractions that drive footfall. Operators leverage affordability, operational efficiency, and diverse menu choices to attract both locals and tourists. It encourages expansion of independent outlets and chain restaurants that provide convenience and variety. Food delivery and mobile ordering platforms further enhance service reach across urban and suburban areas.

Ajman

Ajman contributes 10% to the UAE Food Services market, driven by rising urbanization, residential development, and a growing expatriate population. It supports small-scale restaurants, cafes, and quick service outlets that cater to daily dining needs. It benefits from proximity to Dubai and Sharjah, attracting spillover demand and enabling market expansion for both independent and chained operators. It emphasizes affordability, convenience, and menu customization to serve local and international consumers. Operators focus on efficient operations, timely delivery services, and innovative offerings to gain a competitive edge. It presents opportunities for cloud kitchens and delivery-centric business models.

Fujairah

Fujairah represents 5% of the UAE Food Services market, primarily serving a smaller resident population and limited tourist inflow. It relies on standalone restaurants, hotel dining services, and local cafés to meet the demand of residents and visiting tourists. It emphasizes personalized service, regional cuisine, and niche offerings to differentiate from larger markets. Operators focus on maintaining quality, operational efficiency, and cost-effectiveness. Digital platforms and delivery services are gradually expanding, creating new revenue channels. It provides opportunities for market entrants aiming to establish early presence in a less saturated environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Deli and Meal LLC

- Alghanim Industries & Yusuf A. Alghanim & Sons WLL

- Galadari Ice Cream Co. LLC

- Americana Restaurants International PLC

- CKE Restaurants Holdings Inc.

- Alamar Foods Company

- ream International

- BinHendi Enterprises

- Emirates Fast Food Company

- Apparel Group

Competitive Analysis

Key players in the UAE Food Services market include Alamar Foods Company, Americana Restaurants International PLC, BinHendi Enterprises, Alghanim Industries & Yusuf A. Alghanim & Sons WLL, CKE Restaurants Holdings Inc., D.ream International, Emirates Fast Food Company, Deli and Meal LLC, Galadari Ice Cream Co. LLC, and Apparel Group. These leading operators leverage strong brand recognition, extensive outlet networks, and diversified menu offerings to maintain market dominance. They focus on expanding both chained and independent outlets to capture urban and suburban consumer segments.The players emphasize technological integration, including digital ordering systems, mobile apps, and delivery platforms, to enhance operational efficiency and customer convenience. Innovation in menu offerings, theme-based dining, and premium experiences enables differentiation in a highly competitive market. Strategic partnerships with international brands and local suppliers strengthen supply chain reliability and service quality.Market leaders invest in staff training, customer engagement, and loyalty programs to retain consumers and attract new clientele. They monitor evolving consumer preferences for health-conscious, sustainable, and experiential dining to adapt offerings effectively. Efficient cost management, scalability of operations, and data-driven decision-making support profitability and long-term growth. These strategies collectively reinforce their competitive position and drive market expansion across key UAE regions.

Recent Developments

- In May 2025, CKE Restaurants Holdings Inc., launched digital self-order kiosks across all UAE locations to enhance customer experience and reduce wait times.

- In April 2025, Americana Restaurants International PLC opened 5 new Quick Service Restaurant (QSR) outlets in Sharjah and Ajman to strengthen regional presence.

- In March 2025, Deli and Meal LLC launched a cloud kitchen model in Dubai to expand online food delivery services and reach new residential areas.

Market Concentration & Characteristics

The UAE Food Services market exhibits a moderately concentrated structure with a mix of large international operators and strong local players. It is characterized by the presence of leading companies such as Alamar Foods Company, Americana Restaurants International PLC, BinHendi Enterprises, and Alghanim Industries & Yusuf A. Alghanim & Sons WLL, which maintain extensive outlet networks, strong brand recognition, and diversified menu offerings. It also includes a growing number of independent restaurants, boutique cafés, and cloud kitchens that target niche consumer segments and local preferences. Market competition drives innovation in menu design, service models, and technological integration, including digital ordering and delivery platforms. It benefits from high urbanization, expatriate population growth, and tourism, which create consistent demand across emirates. Operational efficiency, supply chain management, and strategic partnerships remain key success factors for both large chains and smaller operators. Consumer focus on health-conscious, sustainable, and experiential dining further shapes market dynamics, encouraging differentiation and specialized offerings. The coexistence of high-volume quick service restaurants and premium experiential outlets demonstrates a diverse and adaptable market structure. It continues to evolve with shifting consumer behavior, digital adoption, and regulatory frameworks that support food safety, quality standards, and service consistency. This combination of established players, emerging operators, and dynamic consumer trends defines the competitive and operational characteristics of the UAE Food Services market.

Report Coverage

The research report offers an in-depth analysis based on Type, Outlet, Industry Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UAE Food Services market is expected to continue strong growth driven by urbanization and tourism.

- Digital ordering and delivery platforms will expand to enhance customer convenience.

- Cloud kitchens and virtual restaurants will gain traction across major emirates.

- Consumer demand for health-conscious and sustainable menu options will increase.

- Premium and experiential dining concepts will attract both residents and tourists.

- Expansion of international food chains will strengthen competitive dynamics.

- Independent and boutique outlets will diversify offerings to target niche segments.

- Technological integration in operations will improve efficiency and reduce costs.

- Government initiatives promoting tourism and hospitality will support market growth.

- Data-driven insights will guide menu innovation, outlet expansion, and marketing strategies.