Market Overview

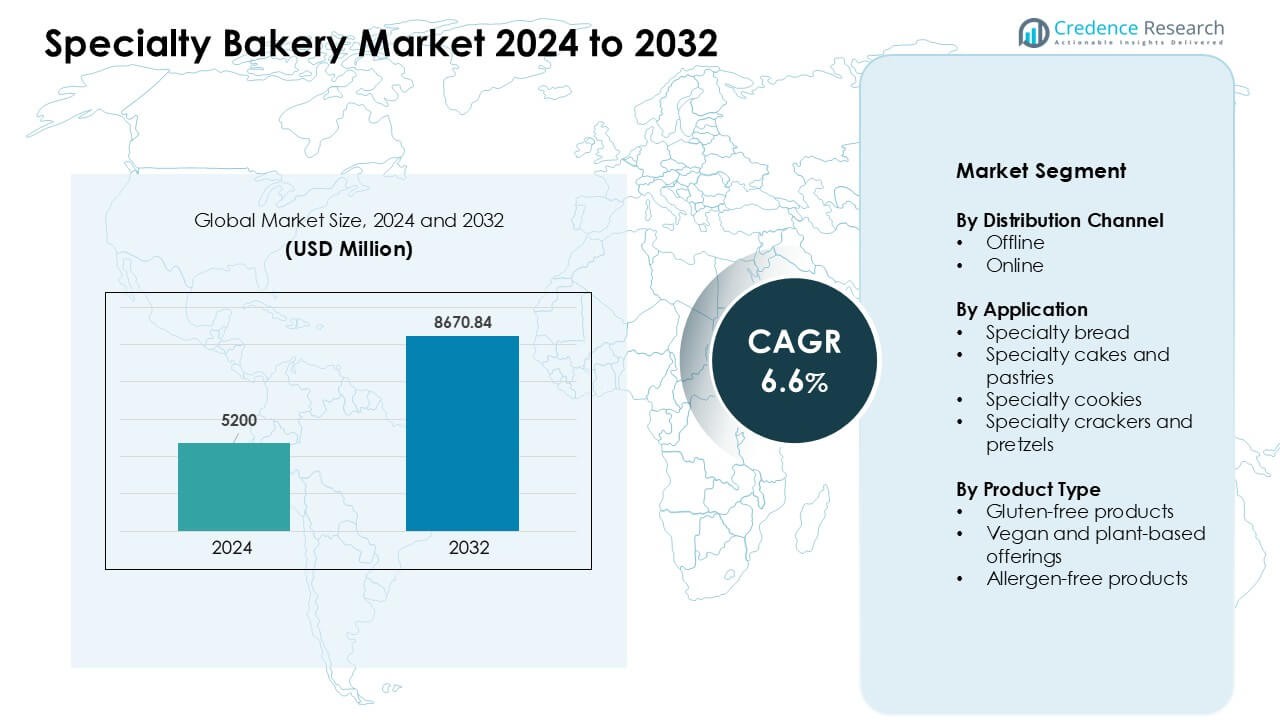

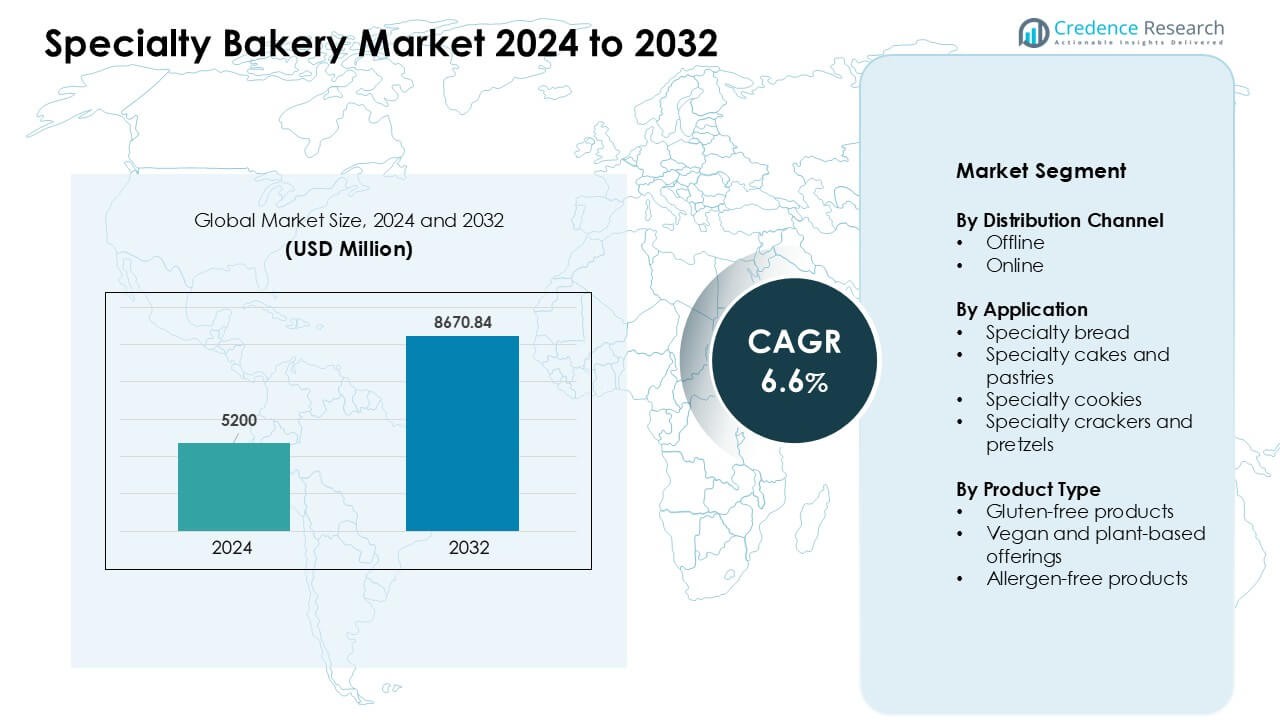

Specialty Bakery Market was valued at USD 5200 million in 2024 and is anticipated to reach USD 8670.84 million by 2032, growing at a CAGR of 6.6 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Specialty Bakery Market Size 2024 |

USD 5200 Million |

| Specialty Bakery Market, CAGR |

6.6% |

| Specialty Bakery Market Size 2032 |

USD 8670.84 Million |

The specialty bakery market is shaped by leading players such as EUROPASTRY SA, Conagra Brands Inc., Harry Brot GmbH, Britannia Industries Ltd., Corporativo Bimbo SA de CV, IL GERMOGLIO FOOD Spa, Associated British Foods Plc, Dawn Food Products Inc., ARYZTA AG, and Flowers Foods Inc. These companies strengthen their position through artisan product lines, gluten-free ranges, and strong retail partnerships. Many also expand online delivery reach to serve rising demand for premium and customized bakery items. North America remained the leading region in 2024 with about 37% share, driven by high spending on specialty bread, pastries, and allergen-free offerings across urban markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Specialty Bakery Market reached USD 5200 million in 2024 and is projected to grow at a 6.6 % CAGR, driven by rising demand for premium, gluten-free, vegan, and allergen-free products.

- Growth accelerated as health-focused buyers increased consumption of specialty bread and pastries, with specialty cakes and pastries holding about 39% share due to strong event-driven demand.

- Key trends include rapid product innovation using clean-label ingredients, expansion of artisan formats, and rising online customization, which boosts premium orders and repeat buying.

- Competitive activity intensified among EUROPASTRY SA, ARYZTA AG, Britannia Industries Ltd., Conagra Brands Inc., and Flowers Foods Inc., each investing in premium recipes, advanced baking tech, and wider distribution.

- North America led with roughly 37% share, supported by high spending on gourmet and allergen-free bakery products, while Europe followed with strong artisan traditions and growing vegan adoption.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Distribution Channel

Offline retail dominated the specialty bakery market in 2024 with about 68% share. Supermarkets, artisan bakeries, and gourmet stores drove this lead through strong footfall and wide product displays. Buyers valued fresh inventory, quick service, and the ability to compare flavor and texture before purchase. Growth in offline channels also came from rising demand for premium bread and cakes in urban areas. Online channels grew fast as digital platforms expanded same-day delivery, subscription boxes, and personalized bakery bundles that appealed to younger consumers.

- For instance, Grupo Bimbo the world’s largest bakery company operates over 249 industrial bakeries and plants globally, supported by more than 54,000 distribution routes, which enables massive offline distribution reach.

By Application

Specialty cakes and pastries held the dominant position in 2024 with roughly 39% share. Demand stayed high due to rising interest in custom cakes, festive orders, and premium dessert menus. Cafés and boutique bakeries pushed this segment with new flavors, healthier formulations, and visually rich designs. Specialty bread followed due to higher focus on nutrition, sourdough options, and artisanal textures. Cookies, crackers, and pretzels saw steady growth as snack buyers looked for clean labels, portion-controlled packs, and unique flavor blends.

- For instance, in its 2023 Annual Report, Grupo Bimbo announced that it achieved 95% positive nutrition in our daily bread, pastries and breakfast portfolio. This was confirmed by CEO Rafael Pamias in a press release.

By Product Type

Gluten-free products led the product type segment in 2024 with nearly 41% share. Many buyers chose gluten-free options due to growing awareness of celiac issues and rising preference for low-gluten diets. Bakers improved texture and taste using alternative flours like almond, millet, and rice, which supported wider acceptance. Vegan and plant-based items expanded quickly as consumers shifted toward ethical and dairy-free choices. Allergen-free products also gained traction as parents demanded safer snacks free from nuts, soy, and common triggers.

Key Growth Drivers

Rising Demand for Health-Focused Bakery Products

Health-oriented buying habits now shape specialty bakery growth. Many consumers choose gluten-free, vegan, and allergen-free items due to rising awareness of diet-related issues and lifestyle choices. Bakeries respond with clean labels, low-sugar recipes, and natural ingredients that attract both young adults and families. Strong demand for functional bread with high fiber or protein adds further momentum. Retailers also highlight healthier bakery lines through premium shelf space and strong marketing. This push increases overall visibility and builds trust among buyers who seek quality and safety. The trend supports sustained expansion across urban and suburban markets.

- For instance, La Americana Gourmet (part of Bonn Group of Industries) recently launched a “Protein Bread” that delivers 40 g of protein per loaf, aimed at fitness‑conscious consumers avoiding refined flour or additives.

Expansion of Premium and Artisan Offerings

Premium and artisan bakery products gain steady traction as buyers seek unique flavors, fresh textures, and gourmet designs. Demand rises for slow-fermented bread, custom cakes, filled pastries, and handcrafted cookies that offer a richer experience than mass-market options. Specialty bakeries invest in skilled chefs, advanced ovens, and creative formats to meet this need. Events, celebrations, and gifting trends also support growth, as customers look for personalized and visually appealing creations. Higher willingness to pay for quality strengthens margins and encourages product innovation. This shift helps specialty players build strong brand identity and repeat demand.

- For instance, global ingredient supplier Puratos India introduced in 2023 a set of millets‑based bakery and patisserie mixes including a “Millet Bread Mix” and a “Millet Cake Mix” enabling artisanal bakeries and cafes to bake healthier, millet‑rich loaves and cakes on‑site.

Growing Influence of E-Commerce and On-Demand Delivery

Digital platforms transform the specialty bakery market by offering convenience, customization, and wider access. Buyers enjoy pre-orders, same-day delivery, curated dessert boxes, and subscription plans that suit busy lifestyles. Many bakeries partner with delivery apps to expand reach without heavy infrastructure investment. Online menus highlight exclusive flavors and seasonal offers, which drive impulse purchases. Social media also boosts visibility through photo-driven marketing and influencer engagement. Personalization tools let customers design cakes or choose dietary preferences with ease. This digital shift accelerates sales and supports strong growth in both metropolitan and tier-two cities.

Key Trend & Opportunity

Product Innovation Through Alternative Ingredients

The market sees strong innovation as bakers replace traditional ingredients with healthier or more sustainable options. Growing use of almond, coconut, quinoa, and sorghum flours improves texture and nutrition. Plant-based fats, natural sweeteners, and organic inclusions support clean eating preferences. This innovation creates room for premium pricing and strengthens consumer loyalty. Bakers can expand portfolios to target fitness-focused users, children needing allergen-safe snacks, and older buyers seeking low-glycemic options. The opportunity lies in merging taste with health benefits, allowing brands to differentiate and compete in crowded retail environments.

- For instance, Bakers can expand portfolios to target fitness‑focused users, children needing allergen-safe snacks, and older buyers seeking low‑glycemic options. The opportunity lies in merging taste with health benefits, allowing brands to differentiate and compete in crowded retail environments.

Rising Popularity of Customization and Seasonal Themes

Customization becomes a major appeal across specialty bakeries as buyers look for personalized products for events, milestones, and gifts. Bakeries gain traction with themed cakes, seasonal pastries, and adjustable flavor options. Digital tools support this shift by allowing easy design uploads, flavor selection, and real-time previews. Seasonal menus such as festive cookies, holiday bread, and limited-edition pastries let brands boost traffic and generate higher margins. This trend encourages constant creativity and helps bakeries stand out in competitive markets. Strong consumer engagement builds repeat orders and strengthens brand presence.

- For instance, Seasonal menus such as festive cookies, holiday breads, and limited‑edition pastries let brands boost traffic and generate higher margins. This trend encourages constant creativity and helps bakeries stand out in competitive markets. Strong consumer engagement builds repeat orders and strengthens brand presence.

Key Challenge

High Production Costs and Raw Material Volatility

Specialty bakery production faces rising costs due to premium ingredients, skilled labor, and advanced equipment. Almond flour, plant-based fats, natural flavorings, and gluten-free blends often carry high price tags. Supply fluctuations in dairy, nuts, and grains increase uncertainty and squeeze margins. Small bakeries struggle to absorb these costs without raising prices, which can impact demand. Logistics and packaging expenses further add pressure. Maintaining consistent quality while managing cost swings becomes a daily challenge. This issue limits scalability for many players and forces bakeries to refine sourcing strategies or adopt lean operations.

Short Shelf Life and Complex Quality Control

Specialty bakery products typically avoid heavy preservatives, which reduces shelf life and raises operational risk. Fresh bread, pastries, and allergen-free items require strict handling to maintain taste and safety. Temperature control, hygiene standards, and cross-contamination prevention demand strong monitoring. Failures in these areas can cause waste, financial loss, or customer dissatisfaction. Online delivery adds extra complexity due to travel time and varying storage conditions. Maintaining consistent freshness across both offline and online channels becomes difficult. This challenge pushes bakeries to invest in improved packaging, training, and real-time quality checks.

Regional Analysis

North America

North America led the specialty bakery market in 2024 with roughly 37% share. Buyers favored premium bread, gluten-free products, and custom cakes as health awareness and event-driven demand increased. Large retail chains expanded fresh bakery sections, while local artisan shops gained traction through unique flavors and clean-label claims. Strong adoption of e-commerce boosted personalized orders and subscription bakery boxes. The U.S. drove most revenue due to high spending on gourmet pastries and allergen-free snacks. Canada followed with steady growth linked to rising plant-based and organic bakery preferences across urban markets.

Europe

Europe accounted for about 31% share in 2024 and remained a mature yet innovative region. Demand rose for artisanal bread, vegan pastries, and low-sugar snacks supported by strong bakery traditions and strict quality standards. Germany, France, and the U.K. drove momentum with steady uptake of premium and seasonal bakery lines. Retailers expanded specialty counters featuring sourdough, heritage grains, and handcrafted desserts. Growth also came from rising foodservice activity and café culture. Sustainability and clean ingredients shaped product upgrades, while allergen-free and plant-based offerings gained wider acceptance.

Asia-Pacific

Asia-Pacific held nearly 22% share in 2024 and expanded rapidly as urban consumers shifted toward premium and Western-style bakery items. Demand grew for specialty cakes, filled pastries, and healthier bread formats that blend local flavors with global trends. China and Japan drove adoption through strong café networks and rising gifting culture. India saw fast growth due to rising income levels and wider acceptance of vegan and gluten-free offerings. Online delivery platforms boosted visibility for boutique bakeries. The region’s young population and interest in new flavors support long-term expansion.

Latin America

Latin America captured around 6% share in 2024 with steady demand for artisanal bread, festive cakes, and regional pastries. Brazil and Mexico led growth through rising café culture and increased interest in premium desserts. Specialty bakeries introduced vegan and allergen-free items for health-conscious buyers. Economic shifts kept price sensitivity high, but consumers still sought premium items for celebrations and weekend treats. Online bakery delivery expanded reach in major cities. Product innovation using local ingredients strengthened brand appeal and supported gradual market expansion across the region.

Middle East & Africa

The Middle East & Africa region held close to 4% share in 2024 and showed rising interest in premium bakery formats. Urban centers in the UAE and Saudi Arabia drove demand for gluten-free pastries, luxury cakes, and Western-style bread. Growth came from expanding retail chains, specialty cafés, and tourism-driven bakery consumption. Buyers valued customized desserts for events and gifting. Africa saw gradual adoption of specialty bread and cookies, supported by rising middle-class spending. Limited cold-chain infrastructure and price sensitivity slowed broader penetration, but premium bakery demand continues to rise.

Market Segmentations:

By Distribution Channel

By Application

- Specialty bread

- Specialty cakes and pastries

- Specialty cookies

- Specialty crackers and pretzels

By Product Type

- Gluten-free products

- Vegan and plant-based offerings

- Allergen-free products

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the specialty bakery market includes major players such as EUROPASTRY SA, Conagra Brands Inc., Harry Brot GmbH, Britannia Industries Ltd., Corporativo Bimbo SA de CV, IL GERMOGLIO FOOD Spa, Associated British Foods Plc, Dawn Food Products Inc., ARYZTA AG, and Flowers Foods Inc. These companies expand their portfolios with gluten-free bread, vegan pastries, artisan cakes, and allergen-free snacks to meet changing consumer needs. Many invest in advanced baking technology, clean-label recipes, and premium ingredients to strengthen brand loyalty. Partnerships with supermarkets, cafés, and online delivery platforms widen reach. Boutique bakeries also add pressure with unique flavors and seasonal creations, making innovation and digital engagement essential for long-term competitiveness.

Key Player Analysis

- EUROPASTRY SA

- Conagra Brands Inc.

- Harry Brot GmbH

- Britannia Industries Ltd.

- Corporativo Bimbo SA de CV

- IL GERMOGLIO FOOD Spa

- Associated British Foods Plc

- Dawn Food Products Inc.

- ARYZTA AG

- Flowers Foods Inc.

Recent Developments

- In 2025, Associated British Foods plc agreed to acquire Hovis Group, expanding its UK bread and bakery portfolio and strengthening the Allied Bakeries business with a larger branded sliced-bread platform.

- In 2025, Flowers Foods Inc. announced its 2025 innovation lineup, adding new breads and sweet baked goods and extending flavors in existing brands to capture demand for premium and specialty bakery products across U.S. retail channels.

- In April 2025, Relaunched “Britannia Gobbles” cakes with a refreshed recipe and packaging (softer/tastier positioning), a product action within Britannia’s cakes/bakery portfolio.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Distribution Channel, Application, Product Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as consumers continue shifting toward healthier and cleaner bakery options.

- Demand for gluten-free, vegan, and allergen-free lines will grow across mass and premium segments.

- Artisan and handcrafted bakery formats will gain wider retail presence in urban areas.

- Online delivery and customization platforms will strengthen long-term sales momentum.

- Seasonal and themed bakery offerings will drive repeat buying and higher premium pricing.

- Technology adoption in baking, packaging, and quality control will improve efficiency and consistency.

- Sustainability efforts will rise, with brands focusing on eco-friendly ingredients and reduced waste.

- Emerging markets will see faster adoption of Western-style specialty bakery products.

- Partnerships between bakeries, cafés, and retail chains will increase product visibility and reach.

- Innovation in alternative flours and plant-based ingredients will shape new product development.

Market Segmentation Analysis:

Market Segmentation Analysis: