Market Overview:

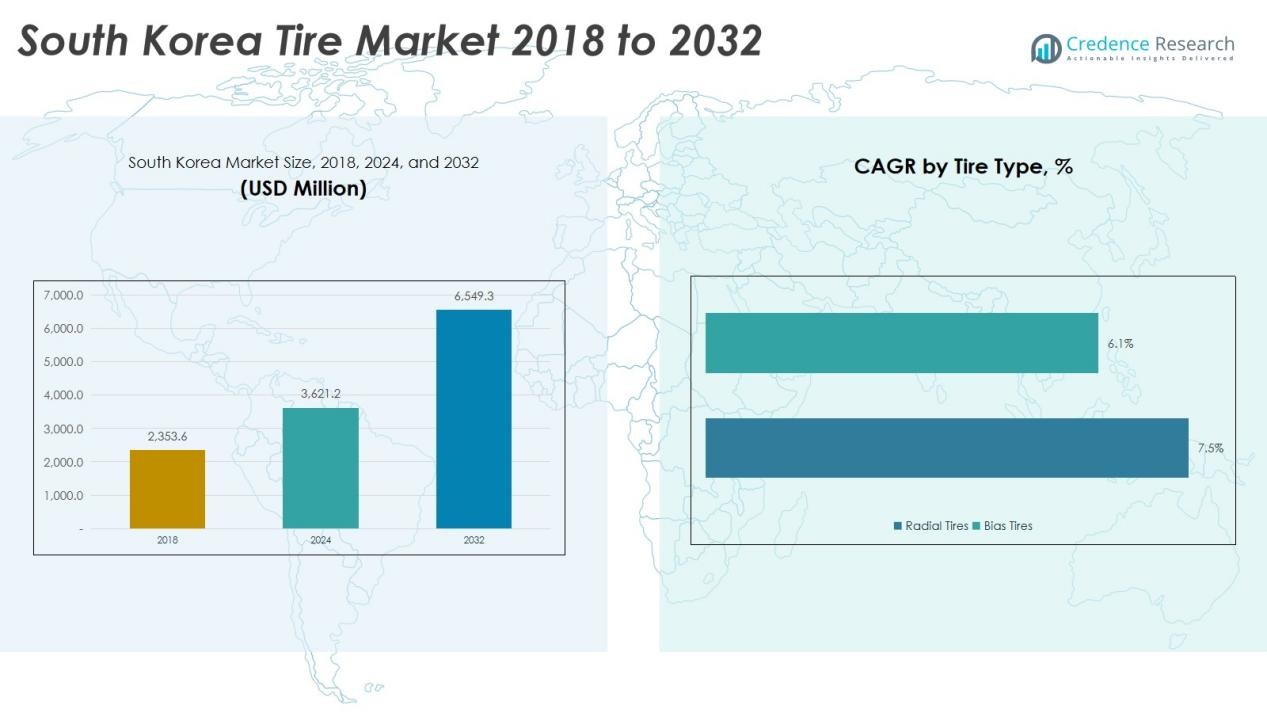

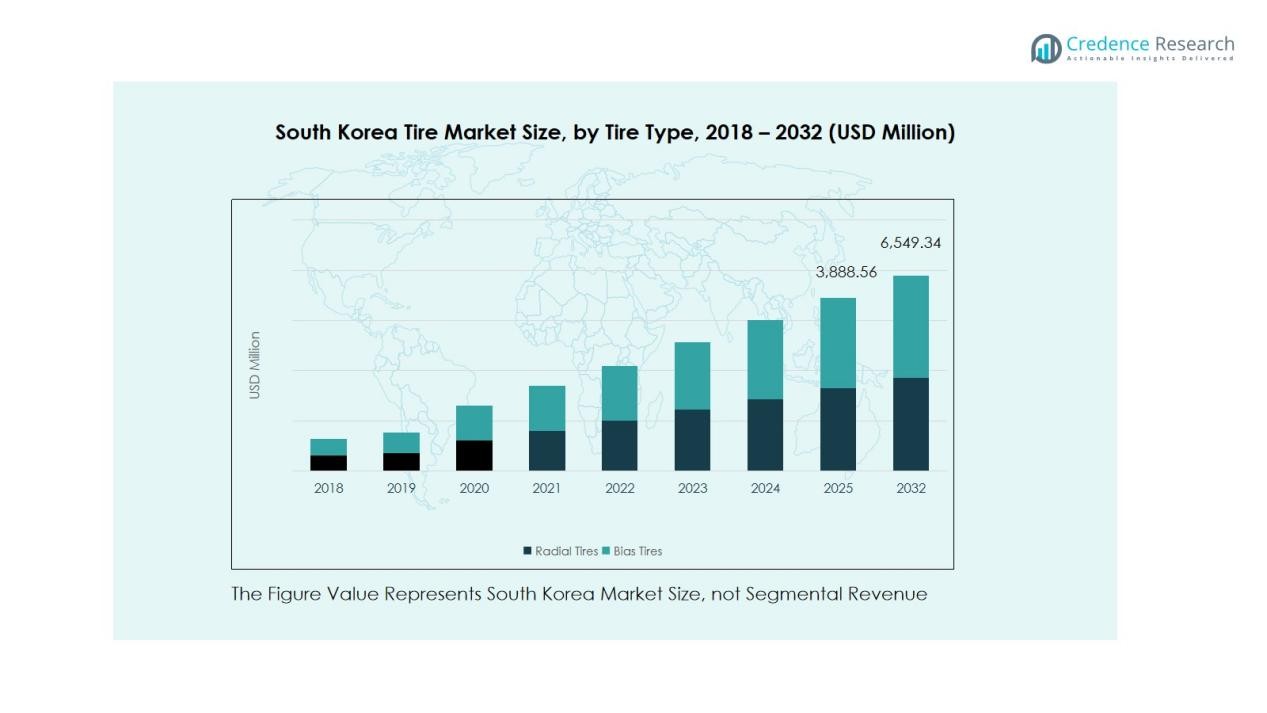

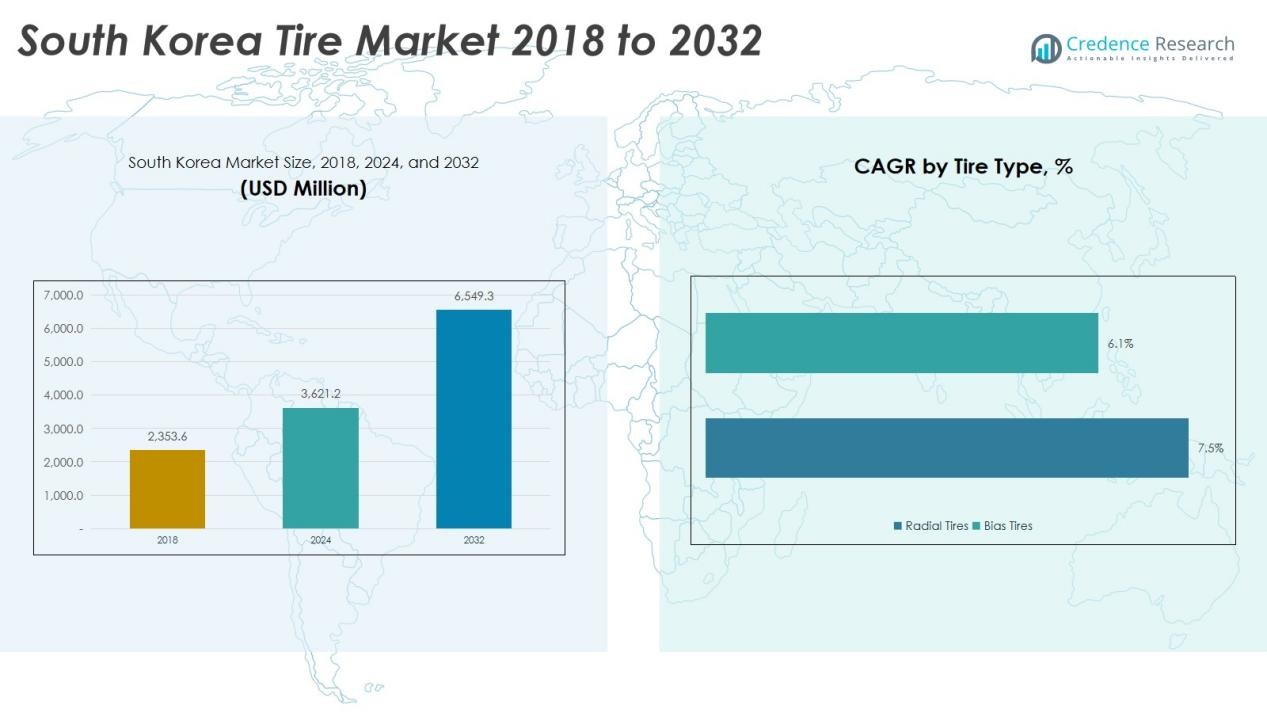

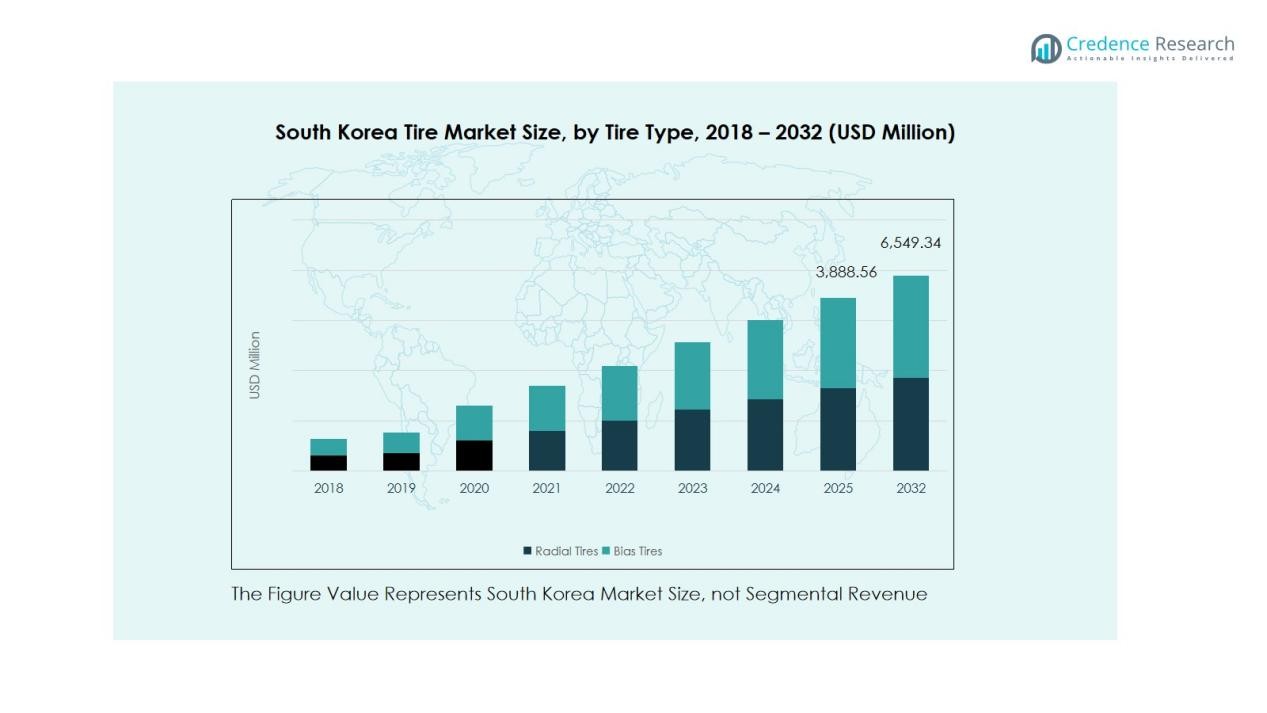

The South Korea Tire Market size was valued at USD 2,353.6 million in 2018 to USD 3,621.2 million in 2024 and is anticipated to reach USD 16,549.3 million by 2032, at a CAGR of 7.73% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| South Korea Tire Market Size 2024 |

USD 3,621.2 Million |

| South Korea Tire Market, CAGR |

7.73% |

| South Korea Tire Market Size 2032 |

USD 16,549.3 Million |

Key drivers include rising vehicle ownership, expanding logistics operations, and rapid urbanization. South Korea’s focus on sustainable mobility has accelerated demand for eco-friendly and low-resistance tires. Increasing investments in tire technology, including smart tire systems and durable tread compounds, enhance market competitiveness. The aftermarket segment continues to expand due to aging vehicle fleets and consumer awareness about tire safety and performance.

Major tire manufacturing hubs are concentrated in regions such as Gyeonggi-do and Chungcheong, where automotive production and export facilities are dominant. Seoul and surrounding metropolitan areas account for a significant share of replacement tire demand due to high passenger car density. Strong exports to markets like the U.S., Europe, and ASEAN nations also bolster South Korea’s tire industry outlook, supported by companies like Hankook, Kumho, and Nexen Tire.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The South Korea Tire Market was valued at USD 2,353.6 million in 2018, reached USD 3,621.2 million in 2024, and is forecasted to reach USD 16,549.3 million by 2032, growing at a CAGR of 7.73%.

- Gyeonggi-do holds around 35% of the market share due to its large automotive manufacturing and export facilities. Chungcheong follows with about 25%, supported by tire production plants and strong logistics infrastructure. Seoul and nearby metropolitan areas contribute roughly 20%, driven by high passenger car density and strong replacement demand.

- The fastest-growing region is Chungcheong, projected to expand rapidly due to expanding production capacity and government incentives for automotive investments.

- Pneumatic tires account for nearly 70% of total revenue, driven by their wide use in passenger and commercial vehicles.

- Radial tires represent about 65% of the tire type segment, supported by longer lifespan, higher fuel efficiency, and strong OEM demand.

Market Drivers:

Growing Automotive Production and Rising Vehicle Ownership

The South Korea Tire Market benefits from robust domestic vehicle manufacturing and rising car ownership. The country’s strong automotive industry, led by Hyundai, Kia, and Genesis, drives continuous tire demand for both OEM and replacement applications. Increasing middle-class income and urban mobility trends contribute to higher personal vehicle usage. It creates a stable foundation for tire manufacturers to expand production and introduce advanced tire models across all categories.

- For instance, the Hyundai Motor Company’s Ulsan plant has an annual production capacity of approximately 1.4 to 1.6 million vehicles, supporting consistent tire orders for both original and replacement equipment applications. Hyundai’s total global production for the entire company in 2024 was about 4.14 million vehicles.

Shift Toward Electric and Sustainable Mobility Solutions

The rapid adoption of electric vehicles (EVs) is creating new demand for tires designed for efficiency and durability. EV tires require enhanced load-bearing capacity, lower rolling resistance, and improved noise reduction. Tire producers in South Korea are investing in innovative compounds and tread patterns to meet these needs. It helps align the market with the government’s green mobility goals and supports the transition toward a cleaner transportation ecosystem.

- For instance, Kumho Tire launched its EnnoV PREMIUM line, which became the world’s first EV tire product to apply the HLC (High Load Capacity) structural design across all 29 sizes, capable of bearing the high loads of electric vehicles that are on average 300 kg heavier than internal combustion vehicles while handling high torque during initial acceleration.

Rising Focus on Tire Safety, Quality, and Performance Upgrades

Growing consumer awareness about safety, comfort, and fuel efficiency is driving replacement tire purchases. The demand for premium and high-performance tires has increased sharply among urban drivers and fleet owners. Manufacturers are enhancing traction control, tread wear life, and braking performance through advanced materials and smart sensors. It strengthens product differentiation and encourages steady growth across the replacement segment.

Expanding Export Capacity and Strategic Global Partnerships

South Korea’s strong tire export base supports sustained market growth. Leading brands are expanding into North America, Europe, and emerging Asian markets through strategic alliances and production investments. These partnerships help strengthen distribution networks and boost brand recognition globally. It reinforces South Korea’s position as a global tire manufacturing hub with advanced technology and reliable quality standards.

Market Trends:

Adoption of Smart Tire Technologies and Connected Mobility Solutions

The South Korea Tire Market is witnessing steady integration of smart tire technologies to enhance driving safety and efficiency. Tire makers are incorporating sensors that monitor temperature, pressure, and tread depth in real time. These innovations support predictive maintenance and reduce road accidents through early fault detection. It enables automakers and fleet operators to improve operational reliability and reduce downtime. The growing presence of connected vehicles and the expansion of IoT infrastructure strengthen this shift toward intelligent tire systems. Manufacturers continue to partner with automotive OEMs to develop data-driven tire solutions aligned with future mobility trends.

- For Instance, Hankook Tire is an original equipment (OE) supplier for Hyundai Motor Group’s electric vehicles, including the IONIQ 5 and IONIQ 6, providing specialized EV tires from its iON series which are optimized for electric vehicle performance needs such as low rolling resistance and noise reduction.

Growing Preference for Eco-Friendly and High-Performance Tire Materials

The shift toward sustainable manufacturing is shaping the tire industry’s direction in South Korea. Companies are adopting bio-based materials, recycled rubber compounds, and low rolling resistance designs to reduce carbon emissions. It helps meet national sustainability goals and rising consumer preference for green mobility products. The increasing adoption of performance tires designed for EVs and hybrid vehicles also drives material innovation. Manufacturers are optimizing tire structures to deliver higher grip, longer wear life, and reduced noise levels. This trend highlights a clear move toward environmentally responsible, high-technology tire production across domestic and export markets.

- For instance, Nexen Tire successfully developed a tire incorporating 70% sustainable raw materials, achieving a rolling resistance coefficient of 5.11N/kN, which meets the highest A-grade performance rating (less than 6.5) under European labeling standards, proving that eco-friendly materials do not compromise performance.

Market Challenges Analysis:

Rising Raw Material Costs and Margin Pressures

The South Korea Tire Market faces strong cost pressures due to fluctuating prices of natural rubber, synthetic rubber, and petroleum-based materials. Global supply disruptions and currency volatility amplify production expenses, particularly for export-oriented manufacturers. It forces producers to balance between maintaining profitability and ensuring competitive pricing. The high cost of logistics and energy also adds to operational challenges. Manufacturers are adopting cost-optimization strategies and automation to sustain margins in a price-sensitive environment.

Environmental Regulations and Competitive Market Landscape

Stringent environmental standards on tire disposal, emissions, and recycling pose compliance challenges for manufacturers. It increases the need for investment in sustainable production and waste management technologies. The market also experiences intense competition from imported low-cost tires, particularly from China and Southeast Asia. Domestic brands must continuously innovate and enhance product quality to protect market share. Rapid shifts in consumer demand toward EV and smart tires further intensify R&D costs and strategic complexity for leading players.

Market Opportunities:

Expansion in Electric Vehicle Tire Segment and Smart Mobility Solutions

The South Korea Tire Market holds strong growth opportunities in the electric and smart mobility sectors. The country’s fast-growing EV market demands tires with low rolling resistance, higher load capacity, and improved durability. It creates room for innovation in specialized tire compounds, advanced tread patterns, and noise-reduction designs. Manufacturers can strengthen partnerships with automakers to develop EV-specific product lines and secure long-term supply contracts. The expansion of smart city infrastructure and connected mobility systems further encourages adoption of intelligent tire technologies. This trend supports both domestic demand and export potential for advanced tire solutions.

Emergence of Eco-Friendly and High-Performance Tire Manufacturing

Sustainability initiatives are opening new business avenues for local tire producers. Companies are investing in renewable materials, green carbon black, and recyclable components to meet regulatory and consumer expectations. It aligns with South Korea’s carbon neutrality goals and global ESG standards. The focus on fuel-efficient and high-performance tires also presents strong potential across commercial and passenger segments. Partnerships with technology firms can accelerate the development of lightweight, energy-efficient tire models. These innovations position South Korean manufacturers as leaders in sustainable tire production and next-generation mobility solutions.

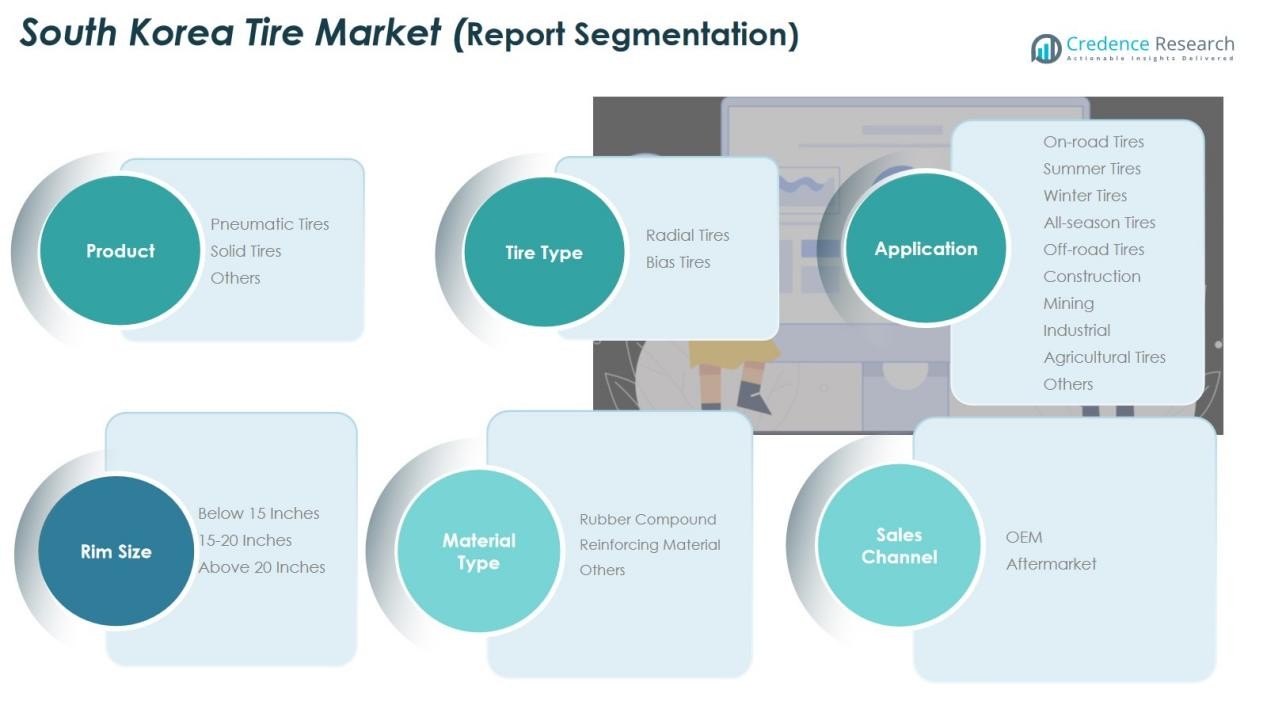

Market Segmentation Analysis:

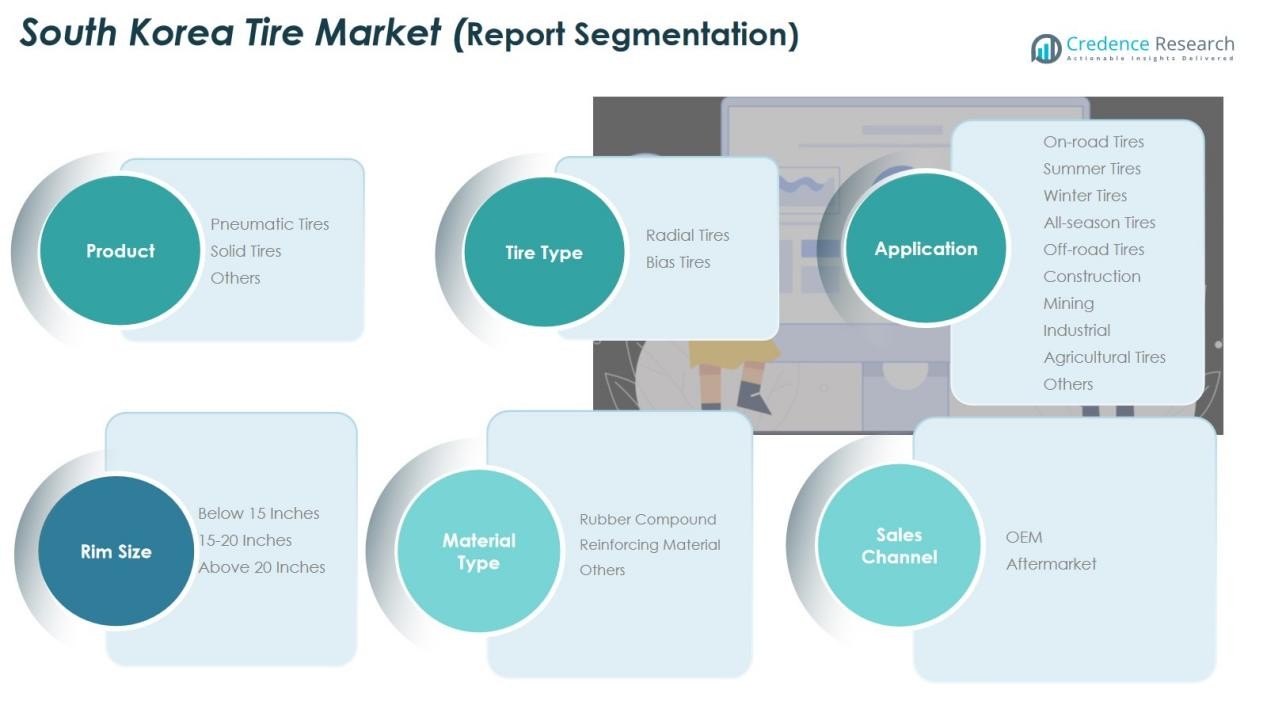

By Product Segment

The South Korea Tire Market features strong demand across pneumatic and solid tires, with pneumatic tires holding the dominant share. They are widely used in passenger and commercial vehicles due to their comfort, traction, and fuel efficiency. Solid tires serve specialized uses in industrial and heavy-duty machinery where durability is critical. It benefits from consistent investments in performance improvements, enhanced tread life, and puncture resistance. The introduction of lightweight materials also supports higher efficiency and lower maintenance costs across both categories.

- For instance, Hankook Tire introduced its Kinergy 4S2 all-weather tire in Europe in May 2018. This tire comes with a manufacturer’s limited tread life warranty of 60,000 miles (approximately 96,500 kilometers) in the U.S. market, exemplifying a robust blend of longevity and four-season performance.

By Application

On-road tires contribute significantly to market revenue, supported by high passenger vehicle ownership and expanding logistics operations. The segment includes summer, winter, and all-season tires, reflecting South Korea’s variable climate and performance preferences. Off-road tires account for a growing share driven by construction, mining, and agricultural machinery usage. It gains momentum from rising infrastructure projects and government-backed industrial development. Continuous innovation in tread design and compound formulation supports extended wear life and better stability in rugged conditions.

- For instance, the established Kumho KRA50 tire, which is designed as an all-position tire for regional, pickup and delivery, and bus applications on paved surfaces, offers features such as a deep tread pattern and an abrasion-resistant compound to provide extended tread wear

By Tire Type

Radial tires dominate the market due to superior comfort, stability, and fuel efficiency. They are preferred by OEMs and consumers for their longer lifespan and enhanced road performance. Bias tires maintain relevance in heavy-duty and off-road applications requiring higher load-bearing strength. It benefits from steady demand in industrial and agricultural sectors where durability outweighs comfort factors.

Segmentations:

By Product Segment:

- Pneumatic Tires

- Solid Tires

- Others

By Tire Type:

By Application:

- On-road Tires

- Summer Tires

- Winter Tires

- All-season Tires

- Off-road Tires

- Construction

- Mining

- Industrial

- Agricultural Tires

- Others

By Rim Size:

- Below 15 Inches

- 15–20 Inches

- Above 20 Inches

By Material Type:

- Rubber Compound

- Reinforcing Material

- Others

By Sales Channel:

Regional Analysis:

Dominance of Industrial and Automotive Hubs in Gyeonggi-do and Chungcheong

The South Korea Tire Market experiences strong growth across major industrial zones such as Gyeonggi-do and Chungcheong. These regions host leading automotive manufacturers and tire production facilities that supply both domestic and export markets. High vehicle ownership rates and consistent demand for replacement tires sustain strong regional sales. It benefits from well-developed logistics networks that connect suppliers and distributors efficiently. The concentration of R&D centers and skilled labor further strengthens South Korea’s competitive edge in tire manufacturing.

Metropolitan Demand Driven by Passenger Vehicles and Premium Tire Sales

Seoul and nearby metropolitan cities account for a large share of tire consumption. Urban areas record a high density of passenger cars, leading to sustained replacement cycles and premium tire adoption. Consumers in these markets prefer performance-oriented tires with improved fuel efficiency, traction, and noise reduction. It encourages manufacturers to introduce advanced models tailored to city driving conditions. Expanding e-commerce platforms and automotive service centers also boost aftermarket tire sales in urban clusters.

Export-Oriented Growth and Expanding Global Footprint

South Korea’s tire industry maintains a strong export profile, serving markets in North America, Europe, and Southeast Asia. Local manufacturers such as Hankook, Kumho, and Nexen Tire continue to expand overseas production bases to reduce costs and strengthen distribution reach. It supports steady foreign revenue inflows and enhances brand visibility globally. The government’s trade partnerships and focus on technology-driven exports further elevate South Korea’s position in the global tire supply chain. Emerging opportunities in electric mobility across global markets are expected to reinforce export growth over the next decade.

Key Player Analysis:

- Hankook Tire & Technology Co., Ltd.

- Kumho Tire Co., Inc.

- Nexen Tire Corporation

- Bridgestone Corporation

- Michelin

- Goodyear Tire and Rubber Company

- Continental AG

- Pirelli & C. S.p.A.

- Sumitomo Rubber Industries, Ltd.

- Yokohama Rubber Co., Ltd.

Competitive Analysis:

The South Korea Tire Market features a highly competitive landscape shaped by both domestic and international brands. Key participants include Hankook Tire & Technology Co., Ltd., Kumho Tire Co., Inc., Nexen Tire Corporation, Bridgestone Corporation, Michelin, Goodyear Tire and Rubber Company, Continental AG, Pirelli & C. S.p.A., Sumitomo Rubber Industries, Ltd., and Yokohama Rubber Co., Ltd. The competition centers on innovation, product quality, and distribution efficiency.

It is marked by continuous investment in R&D to enhance performance, safety, and sustainability. Local firms focus on expanding export capabilities, while global players strengthen regional partnerships to capture market share. Advanced tire technologies, such as run-flat and smart tire systems, are key differentiators among top competitors. The shift toward electric and eco-friendly vehicles encourages companies to redesign product lines with low rolling resistance and improved energy efficiency. Strategic collaborations and expanding OEM contracts define the current growth direction.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments:

- In June 2025, Hankook Tire & Technology launched the iON HT tire designed specifically for electric light-duty trucks, expanding its EV-focused product line.

- In September 2025, Kumho Tire launched the Road Venture RT, a new rugged-terrain tire line aimed at truck and SUV drivers, with 27 available sizes for off-road and on-road use.

Report Coverage:

The research report offers an in-depth analysis based on Product Segment, Tire Type, Application, Rim Size, Material Type and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The South Korea Tire Market is expected to advance through continued investments in tire innovation and automation.

- Growing adoption of electric and hybrid vehicles will create strong demand for specialized, low-resistance tires.

- Local manufacturers will expand export networks to strengthen competitiveness in North America and Europe.

- Smart tire technologies with integrated sensors will gain traction across fleet and passenger applications.

- Sustainability will remain central, driving adoption of recyclable materials and eco-friendly compounds.

- Rising aftermarket demand from passenger and light commercial vehicles will sustain domestic growth.

- OEM collaborations will increase as automakers seek advanced tire solutions for new models.

- Digital retail channels will reshape tire sales through online customization and doorstep delivery models.

- Government support for green manufacturing and carbon neutrality will encourage sustainable production practices.

- It is likely to evolve toward a technology-driven, export-focused, and sustainability-oriented industry over the coming decade.