Market Overview

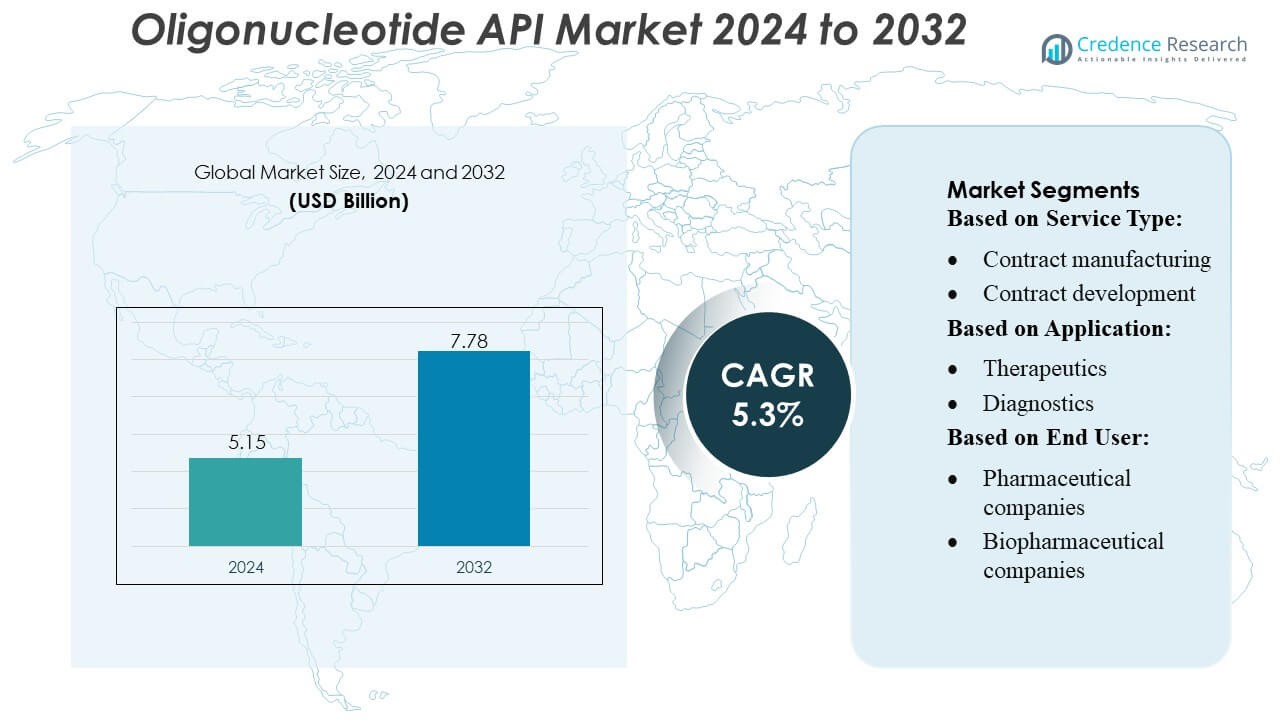

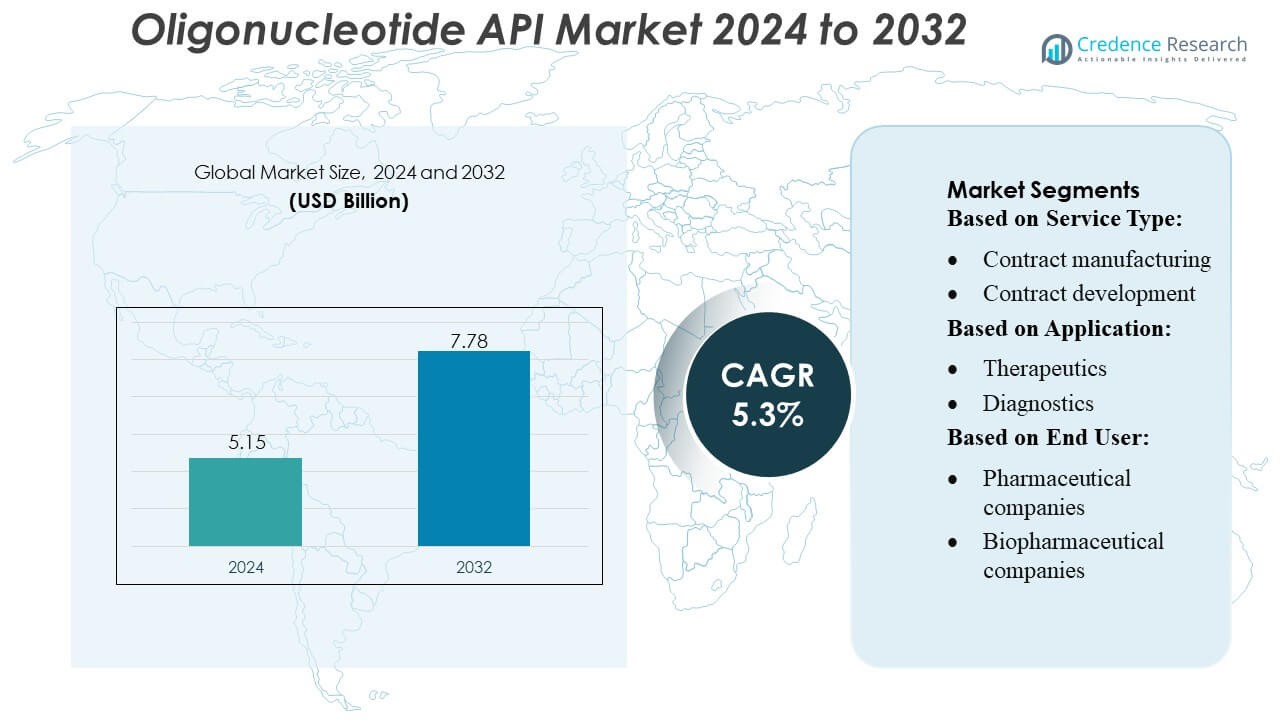

Oligonucleotide API Market size was valued USD 5.15 billion in 2024 and is anticipated to reach USD 7.78 billion by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Oligonucleotide API Market Size 2024 |

USD 5.15 Billion |

| Oligonucleotide API Market, CAGR |

5.3% |

| Oligonucleotide API Market Size 2032 |

USD 7.78 Billion |

The Oligonucleotide API Market is shaped by a strong group of CDMOs and specialized manufacturers, including Curia Global, Inc., Creative Peptides, Sylentis, S.A., CordenPharma, PolyPeptide Group, Merck KGaA, EUROAPI, Bachem, STA Pharmaceutical Co. Ltd., and Aurigene Pharmaceutical Services Ltd., each advancing synthesis technologies, purification capabilities, and GMP-compliant production. These companies strengthen competitiveness through automation, capacity expansion, and strategic partnerships with biopharmaceutical innovators developing RNA-, antisense-, and siRNA-based therapeutics. North America leads the global market with approximately 38–40% share, supported by advanced infrastructure, strong clinical pipelines, and high adoption of precision medicine and molecular diagnostics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Oligonucleotide API Market was valued at USD 5.15 billion in 2024 and is projected to reach USD 7.78 billion by 2032, registering a 3% CAGR during the forecast period.

- Market growth is driven by expanding demand for RNA-, antisense-, and siRNA-based therapeutics, supported by rising clinical pipelines and increasing outsourcing to CDMOs with advanced GMP manufacturing capabilities.

- Key trends include automation in synthesis, high-throughput purification, chemically modified oligos, and broader adoption of molecular diagnostics across PCR, NGS, and CRISPR workflows.

- Competitive activity intensifies as major players expand capacity, enhance regulatory compliance, and strengthen partnerships; however, manufacturing complexity and raw material constraints continue to restrain scalability.

- North America leads with 38–40% share, followed by Europe and Asia-Pacific, while the therapeutics segment accounts for the largest application share, supported by strong investment in precision medicine and genetic disorder treatment.

Market Segmentation Analysis:

By Service Type

The contract manufacturing segment dominates the Oligonucleotide API Market with an estimated 62–65% share, driven by the rising outsourcing of large-scale production to specialized CDMOs with advanced synthesis platforms and regulatory expertise. Pharmaceutical and biotech companies rely on contract manufacturing partners to achieve cost efficiency, GMP-grade output, and accelerated timelines for clinical and commercial supplies. Contract development continues to expand steadily as innovators seek formulation optimization, analytical validation, and scalable process design, but manufacturing remains the key revenue contributor due to its higher volume requirements and extensive infrastructure needs.

- For instance, Curia operates a global network of more than 23 manufacturing and research facilities across North America, Europe and India, supported by over 3,500 professionals.

By Application

Therapeutics hold the dominant position with around 68–72% market share, supported by expanding adoption of antisense oligonucleotides, siRNA therapies, and mRNA-based treatments across genetic disorders, oncology, and rare diseases. Growing clinical pipelines and increasing regulatory approvals significantly boost demand for high-purity APIs tailored for systemic and targeted delivery. Diagnostics represent a growing segment due to the surge in molecular testing, while research applications benefit from continuous academic and industry-led exploration. However, the therapeutic category remains the primary driver as oligonucleotide-based drugs transition from niche applications into mainstream precision medicine.

- For instance, Creative Peptides does not only synthesize standard peptides — since 2018, the company has offered a full Peptide Nucleic Acid (PNA) synthesis service, allowing customers to commission PNA oligomers ranging from 3 to 100 monomers.

By End-user

Biopharmaceutical companies lead the market with an estimated 55–58% share, propelled by their strong investment in nucleic acid-based therapeutics, rapid expansion of RNA technology platforms, and rising collaborations with CDMOs for GMP-grade API supply. Pharmaceutical companies also contribute significantly as they diversify pipelines with oligo-based candidates and pursue strategic acquisitions in genetic medicine. Other end-users, including academic institutes and contract research organizations, support steady baseline demand for small-batch and research-grade oligonucleotides. Nonetheless, biopharmaceutical companies remain the dominant customer base due to their active involvement in clinical development and commercial-scale production.

Key Growth Drivers

1. Rapid Expansion of Oligonucleotide-Based Therapeutics

The expanding pipeline of antisense oligonucleotides, siRNA drugs, aptamers, and mRNA-based therapies remains a core growth driver for the Oligonucleotide API Market. Rising approvals for targeted genetic medicines, particularly for rare diseases and oncology, significantly increase demand for GMP-grade oligos with stringent purity requirements. Pharmaceutical and biotech companies accelerate investment in nucleic acid therapeutics to support precision medicine initiatives, leading to larger clinical trial volumes and commercial-scale production. This shift toward RNA and DNA-based drugs strongly boosts API manufacturing capacity and technological innovation.

- For instance, Sylentis operates a dedicated oligonucleotide manufacturing facility near Madrid covering approximately 10,000 m², capable of supporting production from milligram scale up to kilogram-scale output to serve both clinical and commercial needs.

2. Increasing Outsourcing to CDMOs for Cost and Quality Efficiency

Growing dependence on specialized CDMOs drives market expansion as companies seek to reduce operational complexity and ensure compliance with evolving regulatory standards. Outsourcing enables access to advanced synthesis platforms, automated purification technologies, and large-scale manufacturing capabilities that support both clinical and commercial supply. CDMOs offer flexible capacity, cost advantages, and strong regulatory documentation, making them preferred partners for innovators with limited in-house capabilities. The rising demand for scalable, high-purity oligos reinforces long-term outsourcing strategies, particularly among emerging biopharma companies and gene therapy developers.

- For instance, CordenPharma’s dedicated oligonucleotide manufacturing site in Boulder, Colorado operates synthesis reactors capable of producing batches up to 1.5 mol on solid-phase, enabling multi-kilogram API output suitable for late-stage and commercial supply.

3. Growing Adoption of Molecular Diagnostics and Genomic Testing

The surge in molecular testing for infectious diseases, oncology biomarkers, and genetic screening fuels consistent demand for research- and diagnostic-grade oligos. Increasing adoption of PCR, qPCR, NGS, and CRISPR-based assays across clinical laboratories expands consumption of primers, probes, and custom-designed sequences. High-volume diagnostic applications require cost-effective yet quality-assured APIs, encouraging manufacturers to scale capacity and enhance production precision. The broadening role of genomic medicine in patient stratification, early detection, and personalized therapy selection further supports sustained growth in oligonucleotide API requirements worldwide.

Key Trends & Opportunities

1. Advancements in Automated and Large-Scale Synthesis Technologies

The market benefits from continuous innovation in automated synthesizers, microfluidic platforms, and high-throughput purification systems that enable faster, more cost-efficient production of complex oligonucleotides. Manufacturers adopt novel solid-phase and liquid-phase synthesis methods to enhance yield, reduce solvent consumption, and integrate continuous manufacturing. These advancements help overcome traditional scale limitations and open opportunities for producing long, chemically modified, and highly stable sequences. Investments in automation also strengthen supply reliability, positioning suppliers to meet rising global demand for therapeutic and diagnostic applications.

- For instance, Torrance, California site are built around several OP400 synthesis lines for GMP production — a platform configuration designed for high-throughput and scalable output.

2. Growing Opportunities from RNA Therapeutics and Vaccine Development

The rapid evolution of mRNA vaccines and RNA interference therapies creates substantial long-term opportunities in the Oligonucleotide API Market. Increasing interest in self-amplifying RNA, circular RNA, and next-generation delivery systems accelerates demand for high-quality building blocks. Pharmaceutical and biotech companies are expanding partnerships to secure stable oligo supply chains for infectious disease vaccines, cancer immunotherapies, and rare disease treatments. The success of RNA-based platforms encourages broader industry adoption and fuels investment in high-capacity manufacturing, unlocking strong commercial potential over the next decade.

- For instance, EUROAPI reports a CDMO project portfolio including 18 large-molecule projects (peptides, oligonucleotides, lipids) out of a total of 79 CDMO projects across various modalities.

3. Expanding Use of Oligos in CRISPR and Gene Editing Technologies

CRISPR-based gene editing continues to create new growth avenues, as guide RNAs and donor oligos are essential components of genome modification workflows. Increasing use in agricultural biotech, functional genomics, and therapeutic gene editing drives demand for precision-designed sequences with high fidelity and low off-target potential. Expanding R&D in ex vivo and in vivo gene correction accelerates the need for high-quality oligo APIs that meet strict regulatory criteria. This trend strengthens market opportunities as gene editing transitions from research settings to clinical pipelines.

Key Challenges

1. High Manufacturing Complexity and Quality Compliance Requirements

Producing therapeutic-grade oligonucleotides involves highly complex synthesis processes, sophisticated purification systems, and stringent quality controls to meet global regulatory expectations. Manufacturers face technical challenges related to impurity management, sequence length constraints, and the need for advanced analytical tools. Scaling production while maintaining consistency across batches increases operational costs and requires significant capital investments. Regulatory agencies continue to tighten standards for nucleic acid-based APIs, creating compliance burdens that may limit entry for smaller producers and lead to capacity bottlenecks across the industry.

2. Supply Chain Constraints and Limited Availability of Raw Materials

The market faces persistent supply chain challenges due to limited global availability of key raw materials such as high-quality phosphoramidites, specialty reagents, and modified nucleotides. Dependence on a small group of suppliers increases vulnerability to disruptions and price fluctuations, particularly during periods of demand surge. Long lead times and capacity shortages hinder production planning for both clinical and commercial-scale projects. These constraints push manufacturers to invest in backward integration, supplier diversification, and strategic inventory management to ensure uninterrupted API availability.

Regional Analysis

North America

North America dominates the Oligonucleotide API Market with an estimated 38–40% share, supported by strong biopharmaceutical R&D investments, advanced manufacturing capabilities, and rapid adoption of nucleic acid therapeutics. The region benefits from a high concentration of CDMOs, favorable FDA regulatory pathways for oligo-based drugs, and expanding clinical pipelines in genetic disorders, oncology, and rare diseases. Increasing approvals for antisense and siRNA therapies accelerate demand for GMP-grade APIs, while established diagnostic testing infrastructure continues to drive consumption of primers and probes. Strategic collaborations and capital expansion projects further reinforce regional leadership.

Europe

Europe holds roughly 27–29% of the market, driven by strong biotechnology hubs, growing investment in genomic research, and rising adoption of advanced molecular diagnostics. The region’s regulatory emphasis on high-quality production standards accelerates demand for GMP-certified API manufacturing, while expanding interest in rare disease therapies supports oligo-based drug development. CDMOs in Germany, Switzerland, and the UK continue to enhance capacity for long and chemically modified oligos, attracting outsourcing partnerships from global pharma. Increased funding for CRISPR research, mRNA vaccines, and genetic engineering strengthens the region’s position as a significant contributor to market growth.

Asia-Pacific

Asia-Pacific accounts for 24–26% market share and stands as the fastest-growing region due to expanding biopharmaceutical infrastructure, lower production costs, and increasing government support for genomic medicine. Countries such as China, India, South Korea, and Japan rapidly scale oligonucleotide synthesis capabilities to meet rising regional and global demand. The region’s growing focus on RNA therapeutics, infectious disease diagnostics, and precision medicine boosts consumption of both therapeutic- and research-grade APIs. Expanding CDMO capacity and foreign investment further accelerate market penetration, positioning Asia-Pacific as a key manufacturing and innovation hub for oligonucleotide technologies.

Latin America

Latin America holds a smaller 6–7% market share, but the region is witnessing steady growth driven by increasing adoption of molecular diagnostics and rising investment in clinical research. Countries like Brazil and Mexico are expanding PCR and NGS testing capabilities, which boosts demand for primers and probes. Biopharmaceutical development remains limited, but collaborations with global CDMOs and technology transfer initiatives are increasing access to high-quality APIs. Growing interest in personalized medicine and infectious disease surveillance further strengthens the region’s market potential, although infrastructure limitations and cost barriers continue to slow large-scale therapeutic adoption.

Middle East & Africa

The Middle East & Africa region captures 4–5% share, supported by expanding healthcare modernization efforts and rising utilization of molecular diagnostic tools. Growth is primarily concentrated in Gulf countries, where investments in genomic medicine, advanced laboratory infrastructure, and digital health initiatives are accelerating demand for oligo-based reagents. While therapeutic-level oligonucleotide development remains nascent, increased cancer screening, infectious disease testing, and academic research contribute to steady API consumption. Limited manufacturing capacity and reliance on imports present challenges, yet growing government initiatives to strengthen biotechnology capabilities signal long-term opportunities in the region.

Market Segmentations:

By Service Type:

- Contract manufacturing

- Contract development

By Application:

By End User:

- Pharmaceutical companies

- Biopharmaceutical companies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Oligonucleotide API Market features a competitive landscape shaped by leading players such as Curia Global, Inc., Creative Peptides, Sylentis, S.A., CordenPharma, PolyPeptide Group, Merck KGaA, EUROAPI, Bachem, STA Pharmaceutical Co. Ltd., and Aurigene Pharmaceutical Services Ltd. the Oligonucleotide API Market is defined by a mix of global CDMOs, specialized oligo manufacturers, and integrated biopharmaceutical service providers that continuously expand capability portfolios to meet rising therapeutic and diagnostic demand. Companies focus on scaling GMP-compliant production, adopting advanced solid-phase and liquid-phase synthesis technologies, and enhancing purification processes to support high-purity, chemically modified, and complex oligonucleotides. Competition intensifies around technical expertise, regulatory readiness, and the ability to deliver flexible capacities across clinical and commercial volumes. Market participants strengthen their positions through strategic collaborations, facility expansions, and investment in automation that improves yield, reduces cost, and accelerates turnaround times. Increasing emphasis on end-to-end development services, robust analytical platforms, and secure supply chains further shapes competitive differentiation, while emerging regional manufacturers add pressure by offering cost-competitive solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Curia Global, Inc.

- Creative Peptides

- Sylentis, S.A.

- CordenPharma

- PolyPeptide Group

- Merck KGaA

- EUROAPI

- Bachem

- STA Pharmaceutical Co. Ltd.

- Aurigene Pharmaceutical Services Ltd.

Recent Developments

- In January 2025, Maravai LifeSciences acquired relevant assets and intellectual property from Molecular Assemblies (MAI). Fully Enzymatic Synthesis technology (Molecular Assemblies’ proprietary) is expected to enhance oligonucleotide and mRNA manufacturing capabilities within TriLink BioTechnologies.

- In December 2024, Co-Dx and CoSara Diagnostics Pvt. Ltd opened an oligonucleotide synthesis facility in Ranoli, India. Aligned with the “Make in India” initiative, the facility is designed to manufacture Co-Primers oligos in-house.

- In April 2024, Aurigene Pharmaceutical Services Ltd. Entered into a partnership agreement with Vipergen ApS, a small-molecule drug discovery service provider which aims to accelerate innovation in drug discovery by increasing success rates and reducing timelines through screening a more billion small-molecule compounds.

- In May 2023, PolyPeptide and Numaferm announce partnership to leverage their expertise for the more sustainable production of peptide-based APIs. This partnership aimed to leverage PolyPeptide’s cGMP manufacturing capacities, regulatory expertise, and market access along with Numaferm’s biochemical production platform and sustainable peptide manufacturing expertise.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as oligonucleotide-based therapeutics gain wider clinical acceptance across genetic and rare diseases.

- Manufacturers will increase investment in high-throughput and automated synthesis technologies to enhance scalability and purity.

- CDMOs will strengthen their role as outsourcing partners due to rising demand for GMP-grade oligos and flexible production capacity.

- Regulatory agencies will refine guidelines for nucleic acid therapeutics, driving higher quality and analytical requirements.

- RNA-based platforms, including siRNA, antisense, and mRNA, will accelerate commercial demand for advanced API capabilities.

- Molecular diagnostics will contribute sustained growth as PCR, NGS, and CRISPR-based testing becomes more routine.

- Supply chain resilience will become a priority, prompting companies to diversify raw material sources and expand backward integration.

- Innovation in chemically modified and long oligonucleotides will broaden application potential in drug development.

- Geographic expansion in Asia-Pacific will increase manufacturing competitiveness and global production capacity.

- Strategic partnerships and capacity expansion projects will shape competitive positioning and long-term growth trajectories.