Market overview

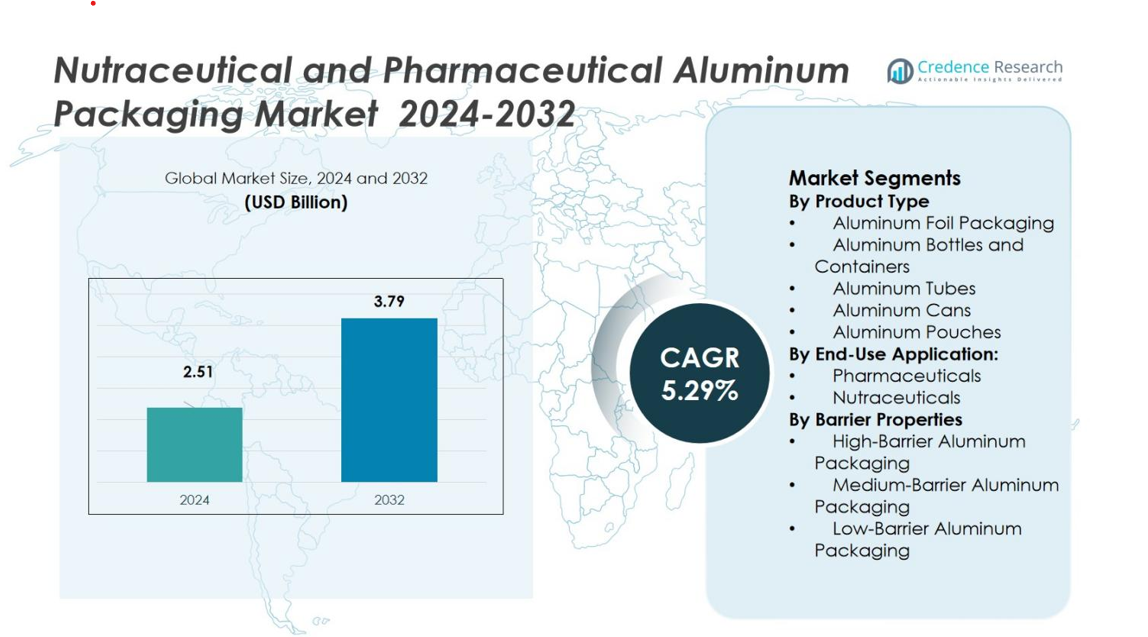

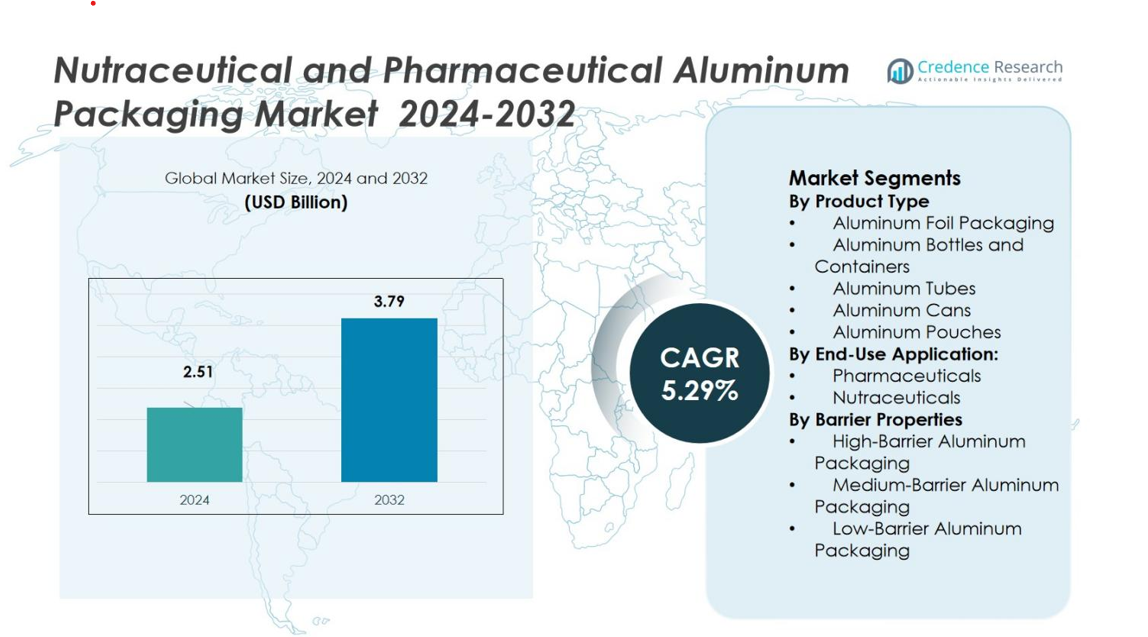

Nutraceutical and Pharmaceutical Aluminum Packaging Market size was valued USD 2.51 Billion in 2024 and is anticipated to reach USD 3.79 Billion by 2032, at a CAGR of 5.29% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Nutraceutical and Pharmaceutical Aluminum Packaging Market Size 2024 |

USD 2.51 Billion |

| Nutraceutical and Pharmaceutical Aluminum Packaging Market, CAGR |

5.29% |

| Nutraceutical and Pharmaceutical Aluminum Packaging Market Size 2032 |

USD 3.79 Billion |

The Nutraceutical and Pharmaceutical Aluminum Packaging Market features leading players such as Amcor plc, Ball Corporation, Huhtamaki Group, Alcoa Corporation and Bemis Company, Inc. driving innovation and global supply across rigid and flexible aluminum packaging formats. These companies deploy extensive R&D capabilities and leverage their expansive global manufacturing networks to meet the rising demand for protective, high‑barrier packaging solutions. Regionally, North America commands a dominant share of 38 % of the market, underpinned by strong pharmaceutical and nutraceutical industries and stringent regulatory standards, while Europe holds 32 % where sustainable packaging initiatives and stringent drug packaging requirements further propel demand.

Market Insights

- The Nutraceutical and Pharmaceutical Aluminum Packaging Market is valued at USD 2.51 Billion in 2024 and is expected to reach USD 3.79 Billion by 2032, growing at a CAGR of 5.29%.

- Growth is driven by the requirement for high‑quality packaging as the pharmaceutical and nutraceutical industries expand, with the Aluminum Foil Packaging sub‑segment holding 33% of the product‑type share and High‑Barrier packaging accounting for 56% of the barrier‑properties category.

- Trends include rising adoption of sustainable and recyclable aluminum packaging and increased integration of smart packaging technologies (such as QR codes and tamper‑evident seals) in response to shifting consumer and regulatory expectations.

- Despite the growth, the market faces restraints from escalating raw material costs and stringent regulatory compliance pressures that raise production costs and create entry barriers for new suppliers.

- Regionally, North America commands a 38% share of the market in 2024, followed by Europe with 32%, Asia‑Pacific with 20%, Latin America with 6%, and Middle East & Africa with 4%, reflecting both mature demand and emerging‑market growth opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The Aluminum Foil Packaging sub-segment dominates the market, accounting for 33% of the overall product type share. This dominance is driven by its superior barrier properties, which protect pharmaceutical tablets, capsules, and nutraceutical products from moisture, oxygen, and light. The demand for aluminum foil is further supported by the increasing regulatory requirements for drug stability and packaging integrity. Other segments such as Aluminum Bottles and Containers and Aluminum Tubes follow, with applications for liquids and topical formulations gaining momentum. Aluminum Cans and Aluminum Pouches are niche markets but are seeing growth due to trends in premium packaging and the rise of e-commerce.

- For example, Aphena Pharma Solutions manufactures aluminum tubes for eye creams, veterinary ointments, and pain gels, leveraging their airtight design to prevent contamination and maintain product integrity during repeated use.

By End-Use Application

The Pharmaceuticals application holds the largest share of the market, comprising over 60%. This is driven by the critical need for secure, tamper-proof packaging for prescription medications, where regulatory standards demand high-quality, protective packaging. Meanwhile, the Nutraceuticals segment is growing at a rapid pace, fueled by rising consumer interest in health and wellness products. With an increasing preference for preventive healthcare solutions, nutraceutical packaging has seen a surge in demand for premium and convenient packaging solutions, particularly in vitamins, dietary supplements, and functional foods.

- For instance, Amcor offers innovative nutraceutical packaging solutions like blisters and sachets specifically designed for vitamins and dietary supplements to preserve product integrity and enhance consumer convenience.

By Barrier Properties

The High-Barrier Aluminum Packaging sub-segment leads the barrier properties segment, holding the largest market share of approximately 56%. This dominance is attributed to its ability to provide the highest protection against environmental factors, which is critical for both sensitive pharmaceuticals and high-value nutraceuticals. As a result, it is the preferred choice for high-potency drugs and premium nutraceutical products. Medium-Barrier Aluminum Packaging follows with a share of around 28%, offering a cost-effective solution for products requiring moderate protection. Low-Barrier Aluminum Packaging holds the smallest share at 16%, serving applications where cost-efficiency is prioritized over maximum shelf stability.

Key Growth Drivers

Rising Demand for High-Quality Packaging

The increasing demand for high-quality, protective packaging is a key growth driver for the Nutraceutical and Pharmaceutical Aluminum Packaging Market. As both pharmaceutical and nutraceutical industries expand globally, there is a heightened need for packaging that ensures product integrity. Aluminum’s superior barrier properties against moisture, light, and oxygen make it a preferred choice for preserving the potency of sensitive medications and supplements. Additionally, regulatory requirements for tamper-evident packaging and extended shelf life drive the demand for advanced aluminum packaging solutions.

- For instance, Alu-Alu blister packaging, used by leading pharmaceutical companies, creates an impermeable barrier against moisture and oxygen, preventing drug degradation and maintaining stability throughout the product’s shelf life

Growth in Preventive Healthcare and Nutraceuticals

The rising awareness and adoption of preventive healthcare significantly contribute to the growth of the nutraceuticals sector. As consumers increasingly prioritize health and wellness, there is growing demand for dietary supplements, functional foods, and herbal products. Aluminum packaging, with its ability to protect nutraceutical products from environmental factors and ensure product safety, is critical in meeting the needs of this expanding market. The shift towards healthier lifestyles and the growing reliance on nutraceuticals as part of everyday wellness routines further boosts packaging demand.

- For instance, Berry Global Inc. produces ClariPPil bottles made from clarified polypropylene, focusing on sustainability and consumer convenience by providing packaging that protects dietary supplements while enabling recyclable solutions.

Pharmaceutical Industry Expansion

The pharmaceutical industry’s growth, particularly the increasing production of biologics, high-potency drugs, and specialty medications, is another key driver for aluminum packaging demand. With a rising focus on high-value treatments and biologics that require stringent protection from contamination, aluminum packaging offers a secure, reliable solution. Furthermore, global expansion of pharmaceutical manufacturing, especially in emerging markets, continues to create new opportunities for aluminum packaging, as it ensures product safety and complies with international regulatory standards for drug packaging.

Key Trends & Opportunities

Eco-Friendly and Sustainable Packaging Solutions

As sustainability becomes an integral focus across industries, the demand for eco-friendly aluminum packaging is on the rise. Consumers and businesses alike are becoming more eco-conscious, favoring recyclable and biodegradable packaging materials. Aluminum, known for its recyclability, presents an opportunity for manufacturers to align with sustainability goals. Additionally, innovations in using recycled aluminum for packaging are gaining traction, reducing environmental impact while still offering superior product protection, opening new market opportunities for sustainable packaging solutions in both pharmaceuticals and nutraceuticals.

- For instance, German organic food brand Byodo now uses aluminum tubes made from 100% recycled aluminum for products like mustard and mayonnaise, significantly reducing CO2 emissions in production while maintaining product quality.

Adoption of Smart Packaging Technologies

Smart packaging technologies are gaining momentum in the nutraceutical and pharmaceutical sectors. Incorporating features such as RFID tags, QR codes, and tamper-evident seals, smart packaging ensures product traceability and enhances security. These technologies allow consumers and manufacturers to track product authenticity, expiration dates, and storage conditions, adding value to aluminum packaging solutions. As e-commerce continues to expand, the adoption of smart packaging to ensure product safety and provide real-time information presents a significant opportunity for growth in the market.

- For instance, Schreiner MediPharm has developed RFID-enabled pharmaceutical packaging that allows hospitals to achieve 100% transparency on medication inventory and expiration management, reducing medication errors through automated reordering and recall processes.

Key Challenges

Rising Raw Material Costs

The rising cost of raw materials, particularly aluminum, poses a significant challenge for the packaging industry. With fluctuating prices of aluminum and other essential materials, packaging manufacturers face increased production costs. These price hikes can impact the overall cost structure, especially for nutraceutical and pharmaceutical packaging, where tight margins are common. Manufacturers must find ways to manage these increased costs while still offering competitive pricing to their customers, which may involve seeking more cost-efficient production methods or using recycled materials.

Regulatory and Compliance Pressure

The stringent regulatory requirements in both the pharmaceutical and nutraceutical sectors present a challenge for packaging manufacturers. Ensuring that aluminum packaging complies with varying regulations across different countries can be complex and time-consuming. Manufacturers must stay updated with changing packaging standards, labeling requirements, and safety protocols, which can increase operational costs and extend time-to-market. Additionally, the risk of non-compliance, which could lead to fines or product recalls, requires constant attention to regulatory details and consistent quality assurance measures in the packaging process.

Regional Analysis

North America

North America dominates the Nutraceutical and Pharmaceutical Aluminum Packaging Market, holding a significant market share of 38% in 2024. The growth in this region is driven by the high demand for high-quality, tamper-proof packaging solutions in the pharmaceutical and nutraceutical sectors. Strict regulatory frameworks and a focus on premium product packaging further boost the market. The U.S. is a major contributor due to its expansive pharmaceutical industry and increasing consumer focus on health and wellness, particularly in the nutraceutical sector. Additionally, advancements in packaging technologies and the rise of eco-friendly solutions present further growth opportunities.

Europe

Europe holds a market share of 32% in the Nutraceutical and Pharmaceutical Aluminum Packaging Market, driven by the region’s strong pharmaceutical industry and increasing demand for nutraceutical products. Stringent packaging regulations and a rising consumer preference for sustainable packaging solutions further accelerate the market’s growth. Countries like Germany, France, and the UK are key players in this market due to their robust healthcare systems and growing adoption of preventive healthcare products. The shift toward eco-friendly, recyclable aluminum packaging is also gaining momentum, supported by regulatory pressures and growing environmental awareness among consumers.

Asia-Pacific

Asia-Pacific is witnessing the fastest growth in the Nutraceutical and Pharmaceutical Aluminum Packaging Market, with a projected market share of 20% in 2024. This growth is driven by the expanding pharmaceutical and nutraceutical industries in countries like China, India, and Japan. The region’s growing population, rising health awareness, and increased consumption of nutraceuticals contribute to this growth. Additionally, the increasing demand for pharmaceutical packaging that ensures safety and product integrity in emerging markets is further fueling the market. Rising investments in healthcare infrastructure and the adoption of advanced packaging technologies also drive regional expansion.

Latin America

Latin America holds a market share of 6% in the Nutraceutical and Pharmaceutical Aluminum Packaging Market. The region is seeing steady growth due to the increasing awareness of health and wellness, alongside a rising demand for pharmaceuticals and nutraceuticals. Brazil, Mexico, and Argentina are leading markets, with their growing healthcare sectors driving demand for secure and reliable packaging. The need for cost-effective packaging solutions is also a key factor, with manufacturers focusing on providing high-quality yet affordable aluminum packaging options. Sustainability trends and eco-conscious consumer behavior are also beginning to influence market dynamics in the region.

Middle East & Africa

The Middle East & Africa region holds a smaller market share of 4% in the Nutraceutical and Pharmaceutical Aluminum Packaging Market. However, the region is poised for growth due to the expanding healthcare infrastructure, particularly in countries like the UAE, Saudi Arabia, and South Africa. Increased investments in pharmaceutical manufacturing and a rising demand for nutraceutical products are key drivers of this growth. The demand for high-quality, protective aluminum packaging is growing as healthcare and wellness trends gain traction. Additionally, governments’ push for regulatory standards and eco-friendly packaging solutions is contributing to the market’s gradual expansion in this region.

Market Segmentations:

By Product Type

- Aluminum Foil Packaging

- Aluminum Bottles and Containers

- Aluminum Tubes

- Aluminum Cans

- Aluminum Pouches

By End-Use Application:

- Pharmaceuticals

- Nutraceuticals

By Barrier Properties

- High-Barrier Aluminum Packaging

- Medium-Barrier Aluminum Packaging

- Low-Barrier Aluminum Packaging

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Nutraceutical and Pharmaceutical Aluminum Packaging Market is highly competitive, with key players such as Amcor plc, Ball Corporation, Huhtamaki Group, Alcoa Corporation, and Bemis Company Inc. leading the industry. These companies dominate the market due to their extensive product portfolios, strong R&D capabilities, and global manufacturing networks. Amcor plc, for instance, is recognized for its innovative packaging solutions that cater to the growing demand for sustainability, offering recyclable and eco-friendly aluminum packaging products. Similarly, Ball Corporation’s focus on aluminum can packaging for both pharmaceutical and nutraceutical sectors helps address the demand for tamper-proof, safe, and environmentally conscious packaging. Competition is intensifying as companies invest in advanced technologies like smart packaging, automation, and sustainable solutions to meet evolving consumer preferences and regulatory requirements. Additionally, regional players in Asia-Pacific and Latin America are expanding their market share by offering cost-effective alternatives and leveraging local manufacturing capabilities. Partnerships and acquisitions are also key strategies used by players to strengthen their market presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, Constantia Flexibles completed the acquisition of a majority stake in Aluflexpack AG (a flexible packaging producer for food & pharmaceutical markets), strengthening its barrier foil/film packaging footprint in pharmaceutical & nutraceutical segments.

- In October 2025, Tournaire launched a “next‑generation aluminium bottle range” (Omni Plus) designed to advance circular packaging in nutraceuticals/pharmaceuticals.

- In October 2025, Pillumina, Inc. launched the world’s first fully‑recyclable aluminium pharmacy packaging system comprising an aluminium child‑safety cap plus aluminium bottle

Report Coverage

The research report offers an in-depth analysis based on Product Type, End Use Application, Barrier Properties and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for sustainable and eco-friendly packaging will continue to rise, driving innovations in recyclable and biodegradable aluminum packaging solutions.

- Increased health consciousness among consumers will fuel the growth of the nutraceutical packaging segment, as more individuals seek preventive health products.

- Stringent regulatory frameworks will further strengthen the need for secure, tamper-evident, and high-quality packaging solutions in both the pharmaceutical and nutraceutical markets.

- Advanced packaging technologies, such as smart packaging with RFID and QR codes, will become more prevalent, enhancing product traceability and consumer engagement.

- Growing investments in the pharmaceutical industry, particularly in biologics and specialty drugs, will increase demand for high-barrier aluminum packaging solutions.

- The expansion of e-commerce will lead to a surge in demand for lightweight, durable, and cost-effective aluminum packaging formats, especially for nutraceuticals.

- The trend of personalized nutrition and customized supplement products will drive the need for flexible aluminum packaging formats tailored to small-scale production runs.

- As global healthcare access improves, especially in emerging markets, the demand for affordable, high-quality aluminum packaging solutions will increase.

- The integration of automation and AI in packaging processes will enhance production efficiency, reduce costs, and meet the growing demand for high-quality packaging at scale.

- Collaborative efforts between packaging manufacturers and pharmaceutical companies will lead to the development of innovative, compliance-driven packaging solutions that ensure safety and product integrity across global markets.