| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| India Spices Market Size 2023 |

USD 8,843.14 million |

| India Spices Market, CAGR |

7.83% |

| India Spices Market Size 2032 |

USD 16,159.09 million |

Market Overview

The India Spices Market is projected to grow from USD 8,843.14 million in 2024 to an estimated USD 16,159.09 million by 2032, with a compound annual growth rate (CAGR) of 7.83% from 2024 to 2032. This robust growth is driven by increasing domestic consumption and rising demand in international markets. Spices, integral to Indian cuisine and culture, continue to see heightened popularity due to their culinary and medicinal benefits. The market’s expansion is also fueled by advancements in processing technologies and growing awareness of the health benefits associated with various spices.

Several factors drive the India spice market, including the growing preference for natural and organic food products. The increasing health consciousness among consumers leads to a surge in demand for spices known for their medicinal properties, such as turmeric, ginger, and garlic. Trends like the rising popularity of ethnic cuisines globally and the increasing application of spices in the food processing industry further boost market growth. Additionally, government initiatives to enhance spice production and export capacities contribute significantly to market dynamics.

Geographically, the India Spices Market shows a diverse distribution with significant regional variances. The southern and western regions of India, known for their rich spice production, hold the largest market share. States like Kerala, Tamil Nadu, Andhra Pradesh, and Maharashtra are prominent contributors due to favorable climatic conditions and established agricultural practices. Key players in the market include Everest Spices, MDH Spices, Badshah Masala, and ITC Spices, which drive innovation and market expansion through extensive distribution networks and product diversification strategies. Their efforts in quality enhancement and branding have solidified their presence in both domestic and international markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing health awareness and demand for natural products

One of the primary drivers of the India spice market is the increasing health consciousness among consumers. With a rising focus on health and wellness, people are more inclined to incorporate natural and organic food products into their diets. Spices such as turmeric, ginger, and garlic are renowned for their medicinal properties, including anti-inflammatory, antioxidant, and immune-boosting benefits. Turmeric, for instance, contains curcumin, which has been widely studied for its potential to prevent and treat various health conditions. As consumers seek healthier alternatives to synthetic additives, the demand for naturally sourced spices continues to surge. This trend is not only prevalent in urban areas but is also spreading to rural regions, reflecting a nationwide shift towards healthier eating habits. The increasing awareness of the health benefits associated with spices is thus significantly propelling market growth.

Expanding Applications in the Food and Beverage Industry

The India spice market benefits greatly from the expanding applications of spices in the food and beverage industry. Spices are integral to Indian cuisine, known for their rich and diverse flavors. Beyond traditional cooking, the food processing industry is increasingly utilizing spices to enhance the taste, aroma, and shelf life of various products. Spices are now key ingredients in ready-to-eat meals, snacks, beverages, and confectioneries. This diversification is driven by changing consumer lifestyles, which demand convenient yet flavorful food options. The rise of fast food chains, restaurants, and cafes that incorporate India spices into their menus further fuels this demand. Moreover, the growing popularity of ethnic and exotic cuisines globally has opened new avenues for India spices in international markets. As the food and beverage industry continues to innovate and expand, the demand for high-quality spices is set to increase, driving market growth.

Government Initiatives and Support

The Indian government plays a crucial role in promoting the spice industry through various initiatives and support measures. Programs aimed at enhancing agricultural practices, improving yield quality, and boosting export capacities have significantly benefited spice farmers and producers. The Spices Board of India, under the Ministry of Commerce and Industry, provides extensive support through schemes that focus on research and development, quality improvement, and market promotion. Financial incentives, subsidies, and training programs help farmers adopt better farming techniques and sustainable practices. Additionally, initiatives like the National Horticulture Mission and the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) aim to improve irrigation facilities and infrastructure, further aiding spice cultivation. These government efforts are pivotal in ensuring a steady supply of high-quality spices, thereby supporting market growth and enhancing India’s position as a leading spice producer and exporter globally.

Rising export demand and global market expansion

The growing international demand for India spices significantly contributes to the market’s expansion. India is one of the largest producers and exporters of spices, supplying a substantial portion of the global spice market. India spices are renowned for their quality, diversity, and distinct flavors, making them highly sought-after in international markets. The increasing popularity of Indian cuisine worldwide has further boosted spice exports. Countries in North America, Europe, and the Middle East are major importers of India spices, driven by the growing multicultural food preferences and the rising trend of healthy eating. The strategic efforts of India spice exporters to meet international quality standards and certifications have enhanced their competitiveness in the global market. Additionally, trade agreements and collaborations with foreign countries facilitate smoother export processes, opening new markets for India spices. The continuous rise in export demand not only boosts the market but also provides substantial revenue opportunities for India spice producers and exporters.

Report Scope

This report segments the India Spices Market as follow

Market Trends

Rising Popularity of Organic Spices

A significant trend in the India spice market is the increasing demand for organic spices. Consumers are becoming more health-conscious and are seeking products that are free from pesticides, chemicals, and genetically modified organisms (GMOs). This shift towards organic products is driven by the perceived health benefits and environmental sustainability associated with organic farming practices. The organic spice segment is witnessing robust growth as more consumers opt for cleaner, natural options in their diets.

Growth in E-commerce and Online Sales

The digital revolution has significantly impacted the India spice market, with e-commerce platforms playing a crucial role in spice distribution. Online grocery stores and dedicated spice e-commerce platforms offer a wide variety of spices, making it convenient for consumers to purchase high-quality products from the comfort of their homes. The COVID-19 pandemic further accelerated this trend, as lockdowns and social distancing measures led to a surge in online shopping. This trend is expected to continue, with increasing investments in digital marketing and enhanced online shopping experiences.

Increasing Export Opportunities

India’s spice industry is experiencing a boom in export opportunities. The global appetite for India spices, known for their quality and unique flavors, is on the rise. Countries in Europe, North America, and the Middle East are key importers, driven by the popularity of Indian cuisine and the growing trend of incorporating exotic spices into various culinary practices. India spice exporters are also focusing on meeting international quality standards and obtaining the necessary certifications to boost their presence in the global market. According to a survey, India exported spices and spice products to 159 destinations worldwide as of 2023–24 (until February 2024). The top destinations among them were China, the USA, Bangladesh, the UAE, Thailand, Malaysia, Indonesia, the UK, and Sri Lanka. These nine destinations comprised more than 70% of the total export earnings in 2023–24 (until February 2024).

Innovation in Spice Blends and Seasonings

There is a growing trend towards innovation in spice blends and seasonings. Manufacturers are developing unique spice mixes to cater to the diverse culinary preferences of consumers. These blends offer convenience and ease of use, particularly for urban consumers with busy lifestyles. The introduction of new flavors and fusion spices that combine traditional India spices with international flavors is also gaining popularity, catering to both domestic and international markets.

Focus on Sustainable and Ethical Sourcing

Sustainability and ethical sourcing are becoming increasingly important in the India spice market. Consumers are more aware of the environmental and social impacts of their purchases. As a result, there is a growing demand for spices sourced through fair trade practices and sustainable farming methods. Companies are responding by implementing sustainable supply chain practices and promoting fair trade certifications, which help build consumer trust and brand loyalty.

Advancements in Processing and Packaging Technologies

Technological advancements in processing and packaging are significantly impacting the spice industry. Improved processing techniques enhance the quality and shelf-life of spices, ensuring they retain their flavor and nutritional value. Innovative packaging solutions, such as resealable pouches and eco-friendly materials, are also gaining traction. These advancements help in maintaining the freshness of spices and cater to the increasing consumer demand for convenience and sustainability.

Emphasis on Traceability and Transparency

Consumers today demand greater transparency and traceability in the products they purchase. The spice industry is responding by implementing traceability systems that allow consumers to track the journey of their spices from farm to table. This trend is driven by the need to ensure quality, safety, and authenticity. Technologies such as blockchain are being explored to enhance traceability and build consumer confidence in the spice supply chain.

Market Restraints and Challenges

Fluctuating raw material prices

One of the significant restraints in the India spice market is the fluctuating price of raw materials. The production of spices is heavily dependent on climatic conditions, and any adverse weather events, such as droughts or excessive rainfall, can severely impact crop yields. This variability in supply leads to price volatility, affecting the cost structures of spice manufacturers. Additionally, the increasing cost of inputs such as fertilizers and labor further exacerbates the issue, making it challenging for producers to maintain stable pricing.

Quality Control and Adulteration Issues

Maintaining consistent quality is a major challenge for the India spice market. Adulteration and contamination of spices with inferior or harmful substances remain a persistent problem, undermining consumer trust and posing significant health risks. Ensuring strict quality control measures throughout the supply chain is essential but difficult to implement uniformly across the diverse and fragmented spice production landscape in India. The lack of standardized processing and handling practices contributes to these quality issues, presenting a formidable challenge for the industry.

Stringent International Regulations

Exporting spices to international markets involves navigating a complex web of stringent regulations and standards. Different countries have varying requirements regarding pesticide residues, microbial contamination, and permissible levels of certain substances. Meeting these diverse regulatory standards requires significant investment in quality assurance and certification processes. For smaller spice producers, this can be particularly burdensome, limiting their ability to compete in the global market. Non-compliance with these regulations can lead to export rejections, financial losses, and damage to the industry’s reputation.

Competition from Other Spice-Producing Countries

India faces stiff competition from other major spice-producing countries, such as Vietnam, Indonesia, and China. These countries often offer spices at more competitive prices due to lower production costs or more efficient supply chains. This competition pressures India spice exporters to continuously enhance their value proposition through quality improvements, branding, and marketing efforts. However, the intense competition can erode market share and profitability, posing a significant challenge to maintaining India’s dominant position in the global spice market.

Supply Chain and Infrastructure Limitations

The spice industry in India is hindered by supply chain inefficiencies and inadequate infrastructure. Poor transportation networks, insufficient storage facilities, and a lack of advanced processing units contribute to post-harvest losses and reduced product quality. These limitations affect the timely delivery of fresh and high-quality spices to both domestic and international markets. Improving supply chain logistics and investing in infrastructure development are crucial to overcoming these challenges, but they require substantial financial resources and coordinated efforts from multiple stakeholders.

Limited Research and Development

The spice industry in India has traditionally seen limited investment in research and development (R&D). This lack of R&D hampers the industry’s ability to innovate and improve agricultural practices, processing technologies, and product development. Advancing R&D efforts is essential to address issues such as pest resistance, yield enhancement, and the development of value-added spice products. However, the current R&D efforts are insufficient to drive significant breakthroughs, posing a challenge to the sustained growth and competitiveness of the industry.

Market segmentation analysis

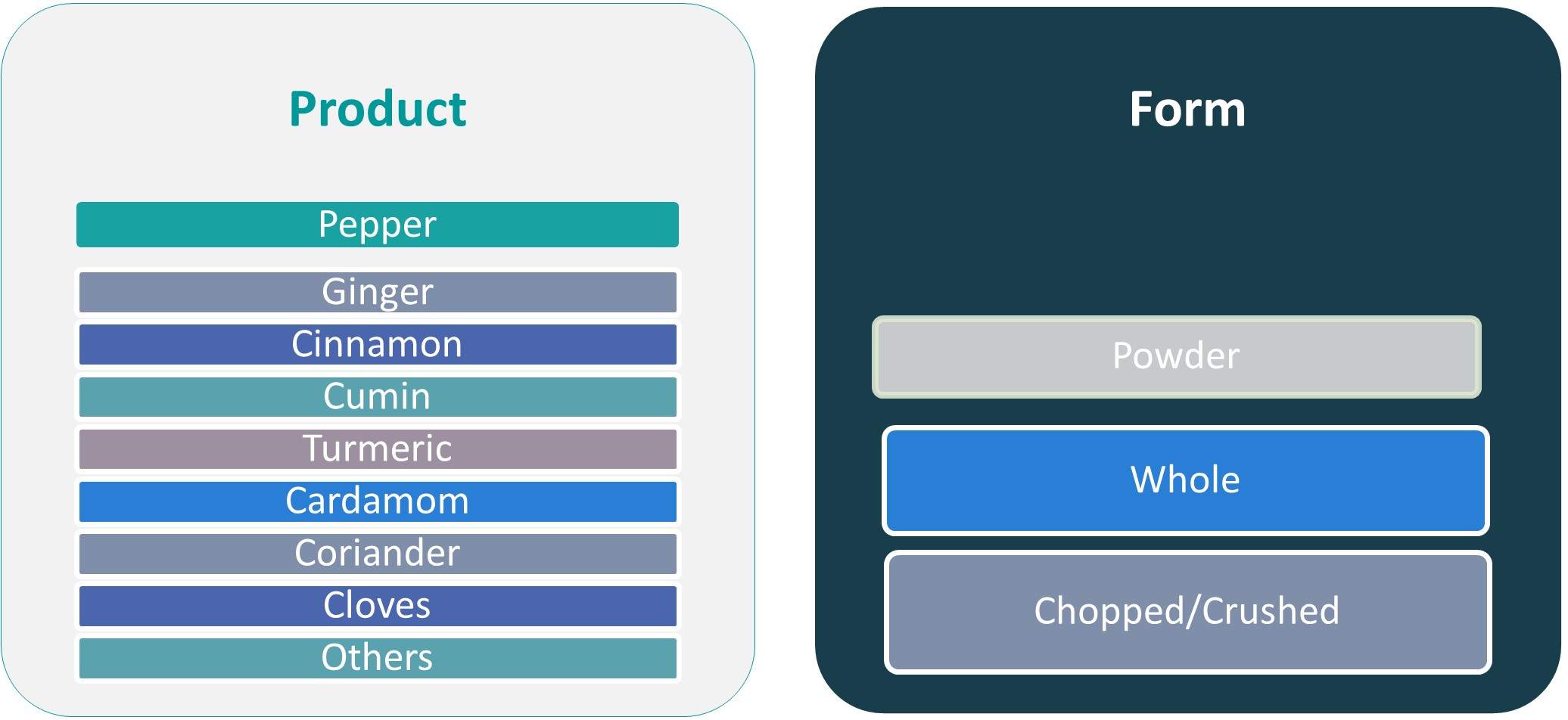

By Product

Pepper, renowned for its pungent flavor and medicinal properties, is widely consumed in India and holds a significant market share due to its versatile culinary and pharmaceutical applications. Ginger also occupies a prominent position, known for its anti-inflammatory and digestive benefits, and is used in various forms, such as fresh, dried, and powdered. Cinnamon, appreciated for its aromatic and health properties, is gaining popularity in the food processing and bakery sectors. Cumin, a staple in Indian cuisine, is valued for its distinctive flavor and digestive benefits, with consistent demand driven by its culinary importance. Turmeric, essential in both cuisine and traditional medicine, is highly sought after for its anti-inflammatory and antioxidant properties, fueling its use in dietary supplements, cosmetics, and the food industry. Cardamom, with its unique flavor and aroma, is a key ingredient in sweet and savory dishes, and its premium positioning is boosting demand in international markets. Coriander, used in both seed and leaf forms, is valued for its fresh, citrusy flavor and steady demand due to its extensive culinary use and health benefits. Other spices like fenugreek, mustard seeds, and fennel, though smaller in market share, collectively contribute significantly to the overall market, driven by their unique flavors and health benefits.

Segments

Based on product

- Pepper

- Ginger

- Cinnamon

- Cumin

- Turmeric

- Cardamom

- Coriander

- Others

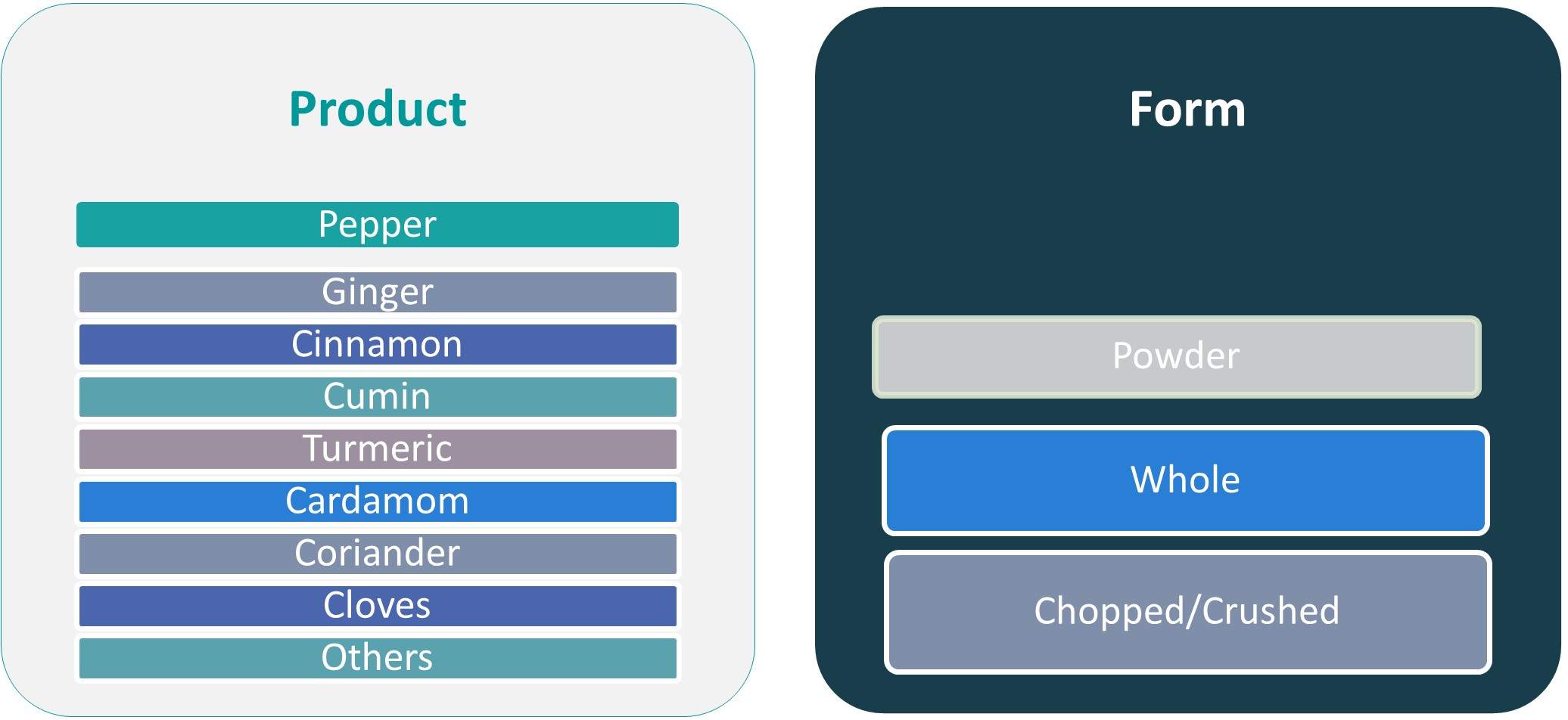

Based on Form

- Powder

- Whole

- Chopped/Crushed

Regional Analysis

Southern Region (40%)

The southern region of India, encompassing states like Kerala, Tamil Nadu, Andhra Pradesh, and Karnataka, dominates the India Spices Market with a 40% market share. This region is renowned for its diverse spice production, particularly black pepper, cardamom, and turmeric. Kerala, often referred to as the “spice garden of India,” is a major producer of black pepper and cardamom. Tamil Nadu and Andhra Pradesh are significant producers of turmeric and chili. The favorable climatic conditions, coupled with rich soil and established agricultural practices, contribute to the high yield and quality of spices from this region. The southern region’s robust infrastructure for processing and exporting further strengthens its market position.

Western Region (30%)

The Western region, including Maharashtra, Gujarat, and Rajasthan, holds a 30% market share in the India Spices Market. This region is particularly noted for the production of cumin, coriander, and fennel. Gujarat is a leading producer of cumin and fennel, while Maharashtra is known for its high-quality turmeric and chili production. The Western region benefits from well-developed supply chain logistics and strong export networks, making it a significant contributor to the domestic and international spice markets. The region’s focus on organic spice farming and adherence to international quality standards has also boosted its market share

Northern Region (20%)

The northern region, comprising states like Uttar Pradesh, Punjab, Haryana, and Uttarakhand, accounts for 20% of the market share. This region is a major producer of mustard seeds, fenugreek, and asafoetida. Uttar Pradesh and Punjab are known for their extensive cultivation of mustard seeds and fenugreek, while Uttarakhand specializes in high-quality asafoetida production. The northern region’s spice market is driven by its agricultural diversity and the adoption of advanced farming techniques. The region also benefits from strong government support and investment in agricultural infrastructure, which enhances its productivity and market presence.

Eastern Region (10%)

The eastern region, including West Bengal, Odisha, Assam, and Bihar, contributes to 10% of the India Spices Market. This region is known for its unique spice varieties, such as ginger, bay leaves, and various indigenous spices. West Bengal and Assam are prominent producers of ginger and bay leaves, while Odisha and Bihar focus on turmeric and chili. The eastern region’s spice market is supported by its rich biodiversity and traditional farming practices. However, the region faces challenges in terms of infrastructure and market access, which impact its overall market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key players

- Kerry Group PLC

- Sensient Technologies Corporation

- Dohler GmbH

- Frontier Co-op

- Olam International

Competitive Analysis

The India Spices Market is highly competitive, with key players such as Kerry Group PLC, Sensient Technologies Corporation, Dohler GmbH, Frontier Co-op, and Olam International leading the industry. These companies have established strong market positions through extensive distribution networks, product innovation, and adherence to high-quality standards. Kerry Group PLC and Sensient Technologies Corporation leverage their global presence and advanced processing technologies to offer a wide range of spice products. Dohler GmbH focuses on natural and sustainable solutions, catering to the growing demand for organic spices. Frontier Co-op emphasizes fair trade practices and community engagement, appealing to ethically conscious consumers. Olam International capitalizes on its robust supply chain and large-scale production capabilities to maintain a competitive edge. These companies continuously invest in research and development, ensuring they stay ahead of market trends and consumer preferences, thereby driving the overall growth of the India spice market.

Recent Developments

In November 2022, Catch Salts & Spices, a brand under DS Group, launched a new advertising campaign featuring actors Akshay Kumar and Bhumi Pednekar. This campaign aims to strengthen the brand’s market position by leveraging the popularity of these prominent celebrities. By associating with well-known figures, Catch Salts & Spices intends to enhance its visibility and appeal to a broader consumer base. This strategic move is part of DS Group’s efforts to consolidate its presence in the competitive spice market and drive brand recognition and loyalty among consumers.

In September 2020, Norwegian conglomerate Orkla acquired Kerala-based Eastern Condiments Pvt Ltd., a renowned producer of spices and masala powders. This acquisition aligns with Orkla’s strategy to expand its footprint in the Indian market and bolster its position in the rapidly growing food and beverage sector. Eastern Condiments is a well-established brand with a strong presence in southern and western India, offering a wide range of spice and masala powders, pickles, rice, and other food products. The acquisition enables Orkla to tap into Eastern Condiments’ extensive distribution network and regional market expertise.

In July 2022, Emami Agrotech, the food manufacturing division of the Emami Group, introduced its new brand, Mantra Spices. The brand offers pure and blended powder spices and tastemakers, manufactured using cryogenic grinding technology in Jaipur, India. This advanced technique, which pulverizes spices and herbs at freezing temperatures, ensures the preservation of their natural flavors and nutritional values. The launch of Mantra Spices signifies Emami Agrotech’s commitment to innovation and quality, aiming to cater to the growing demand for high-quality spices in the Indian market and enhance its product portfolio.

Market Concentration and Characteristics

The India Spices Market is characterized by a moderate to high level of market concentration, with a mix of large, established players and numerous small and medium-sized enterprises (SMEs) contributing to the market dynamics. Leading companies like Everest Spices, MDH Spices, and ITC Spices dominate the market with their extensive product ranges, strong brand recognition, and widespread distribution networks. These companies invest heavily in marketing, innovation, and quality control to maintain their competitive edge. Meanwhile, SMEs and regional players add to the market’s diversity by offering unique, locally sourced spices and catering to niche segments. The market is also marked by significant export activity, with India spices being highly sought after globally for their quality and distinct flavors. Technological advancements in processing and packaging, along with increasing consumer demand for organic and sustainably sourced spices, further shape the market’s characteristics.

Report Coverage

The research report offers an in-depth analysis based on product and form. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The India Spices Market is expected to continue its robust growth trajectory, driven by rising domestic consumption and increasing export demand.

- The demand for organic spices is projected to rise significantly as consumers become more health-conscious and prefer natural food products.

- Innovations in processing and packaging technologies will enhance spice quality and shelf life, meeting the growing consumer demand for convenience and freshness.

- The e-commerce segment will see substantial growth, providing consumers with easy access to a wide variety of spices and promoting direct-to-consumer sales models.

- India spices will continue to penetrate international markets, supported by strategic marketing initiatives and adherence to global quality standards.

- Companies will focus on developing new spice blends and seasonings to cater to evolving culinary trends and diverse consumer preferences.

- Ongoing government initiatives aimed at improving agricultural practices and supporting spice farmers will boost production and enhance market competitiveness.

- There will be an increased emphasis on sustainable and ethical sourcing practices, driven by consumer demand for environmentally friendly products.

- The health benefits of various spices will be a key marketing focus, aligning with the global trend towards functional foods and wellness products.

- Increased investment in research and development will lead to innovations in spice cultivation, processing, and product development, driving long-term market growth.