Market Overview

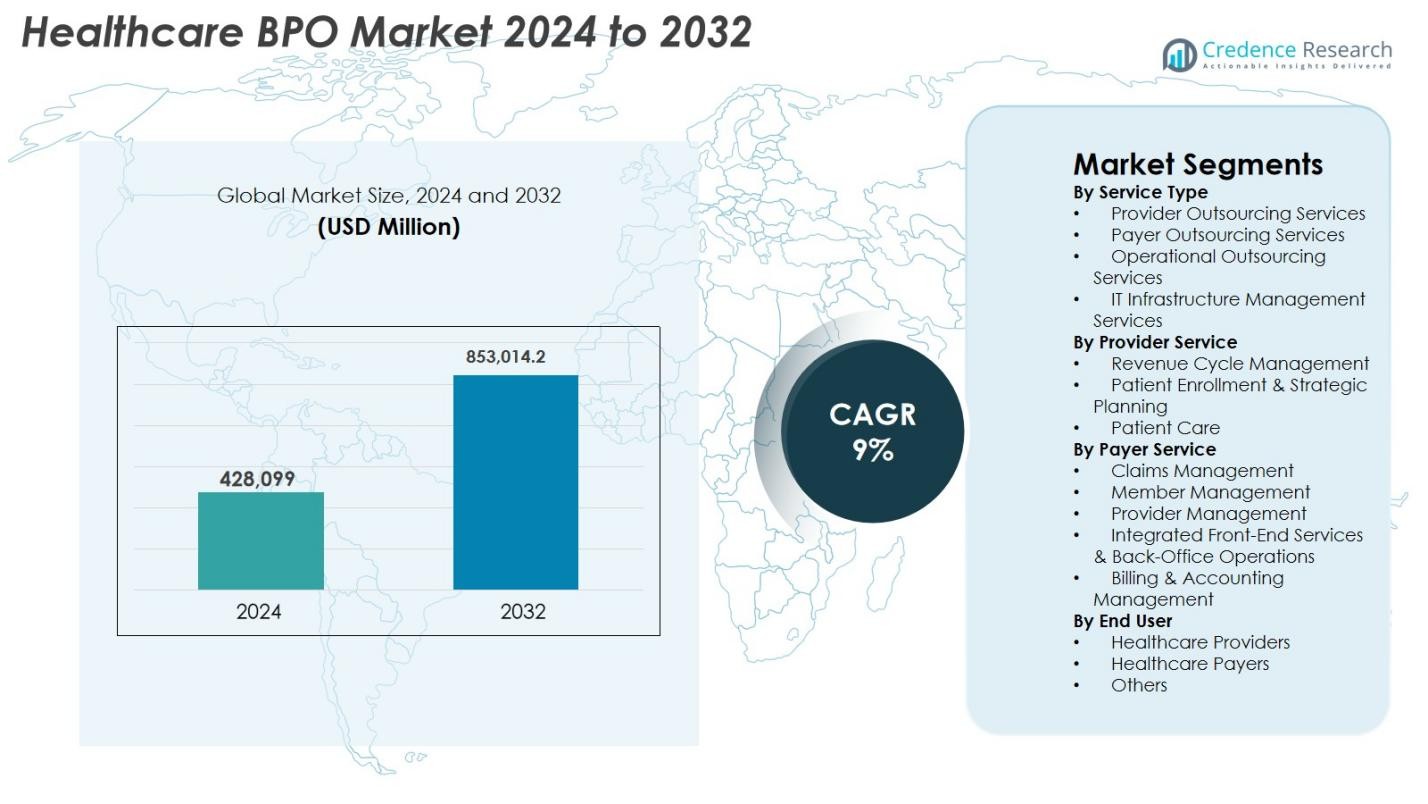

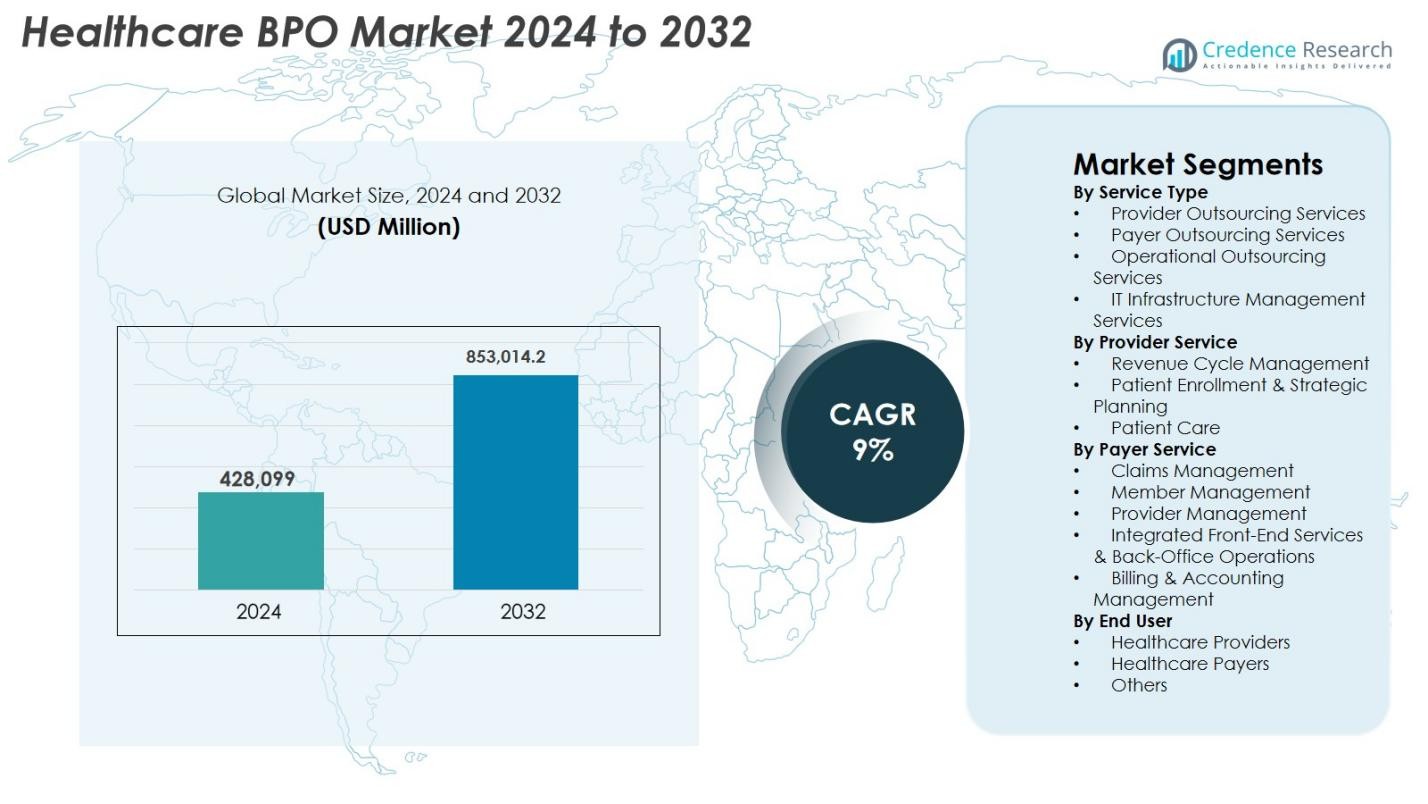

Healthcare BPO Market size was valued at USD 428,099 Million in 2024 and is anticipated to reach USD 853,014.2 Million by 2032, at a CAGR of 9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Healthcare BPO Market Size 2024 |

USD 642.64 Million |

| Healthcare BPO Market, CAGR |

9% |

| Healthcare BPO Market Size 2032 |

USD 853,014.2 Million |

The Healthcare BPO market is driven by major players such as Accenture, Cognizant, IBM, Genpact, IQVIA, Parexel, Infosys BPM, Wipro, Tata Consultancy Services (TCS), and GeBBS Healthcare Solutions, all of which enhance operational efficiency through advanced analytics, digital automation, and scalable delivery models. These companies support providers and payers in optimizing revenue cycle workflows, claims processing, patient engagement, and regulatory compliance. Regionally, North America led the market with a 41.3% share in 2024, supported by mature healthcare infrastructure and high outsourcing adoption, followed by Europe with 26.4%, while Asia-Pacific emerged as the fastest-growing region with 21.7% driven by expanding digital health ecosystems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Healthcare BPO market was valued at USD 428,099 Million in 2024 and is projected to reach USD 853,014.2 Million by 2032, growing at a CAGR of 9%.

- Strong market drivers include rising administrative burden, increasing patient volumes, and heightened demand for cost-efficient outsourced services, especially in revenue cycle management and claims processing.

- Key trends highlight rapid digital transformation, with AI-driven coding, automated claims workflows, and analytics-based decision support becoming standard across payer and provider outsourcing segments.

- The market features active participation from leading players such as Accenture, Cognizant, IBM, Genpact, IQVIA, Parexel, Infosys BPM, Wipro, TCS, and GeBBS Healthcare Solutions, each expanding service portfolios through technology integration.

- Regionally, North America led with a 41.3% share in 2024, followed by Europe at 26.4%, while Asia-Pacific held 21.7% and emerged as the fastest-growing region; within services, Provider Outsourcing Services dominated with a 41.7% share.

Market Segmentation Analysis

Market Segmentation Analysis

By Service Type

The Healthcare BPO market in 2024 was dominated by Provider Outsourcing Services, accounting for 41.7% of the segment, driven by rising administrative workloads, increasing patient volumes, and the need to reduce operational costs. Hospitals and clinics increasingly outsource coding, billing, transcription, and clinical documentation to improve accuracy and compliance with evolving healthcare regulations. Payer Outsourcing Services also gained traction due to growing demand for claims processing and fraud management, while Operational Outsourcing and IT Infrastructure Management Services expanded as organizations focused on automation, cloud migration, and digital transformation initiatives.

- For instance, Allina Health transferred roughly 2,000 IT and revenue-cycle management employees to Optum (part of UnitedHealth Group), enabling Allina to outsource not only billing and claims but also cloud/IT support and digital-billing infrastructure to improve automation and patient/provider billing experiences.

By Provider Service

Within provider-based outsourcing, Revenue Cycle Management (RCM) led the segment with a 48.2% share in 2024, fueled by the need to enhance reimbursement efficiency and minimize claim denials. Healthcare providers increasingly rely on outsourced RCM solutions to manage coding, charge capture, prior authorization, accounts receivable, and denial analytics. Patient Enrollment & Strategic Planning services also grew with rising adoption of digital onboarding systems, while Patient Care outsourcing expanded due to telehealth-driven administrative support needs. The shift toward value-based care, regulatory compliance requirements, and the push for operational transparency continue to strengthen demand across all provider service categories.

- For instance, Auxis partnered with a top U.S. healthcare provider operating hundreds of hospitals and clinics, outsourcing 12 RCM processes such as payment applications, insurance verification, medical billing, claims management, and collections from its Costa Rica delivery center.

By Payer Service

In the payer outsourcing segment, Claims Management dominated with a 39.5% share in 2024, supported by rising insurance enrollment, complex reimbursement structures, and the need to accelerate claims adjudication. Member Management services expanded as insurers focused on improving patient engagement and retention, while Provider Management outsourcing increased due to network optimization requirements. Integrated Front-End Services & Back-Office Operations and Billing & Accounting Management also saw strong growth, driven by automation, analytics adoption, and the demand for seamless administrative workflows. Payers increasingly outsource these functions to reduce cycle times, enhance accuracy, and support scalable digital operations.

Key Growth Drivers

Growing Need for Cost Reduction and Operational Efficiency

A major driver of the Healthcare BPO market is the escalating pressure on healthcare providers and payers to optimize operational efficiency while managing rising administrative and clinical costs. Outsourcing revenue cycle management, claims adjudication, medical billing, and patient engagement functions allows organizations to streamline workflows, reduce errors, and improve financial performance without expanding internal labor resources. As labor shortages, regulatory complexity, and reimbursement challenges intensify, healthcare institutions increasingly adopt outsourced solutions to ensure uninterrupted operations. BPO partners provide advanced analytics, automation tools, and specialized expertise that improve turnaround times and reduce claim denials. This cost-efficiency imperative is especially significant for hospitals with declining margins and insurers managing high claim volumes. The ability to scale operations rapidly and deploy technology-driven tools makes outsourcing not only a cost-saving measure but a strategic priority for long-term sustainability.

- For instance, Optum launched its Optum Integrity One solution, using AI to automate RCM tasks from point-of-care through final coding and billing demonstrating how outsourced partners provide automation and reduce manual overhead for providers.

Rising Healthcare Data Volume and Digital Transformation

The rapid rise in healthcare data generation driven by EHR systems, telehealth growth, diagnostic imaging, wearable devices, and remote monitoring platforms has increased demand for outsourcing partners with strong data management and analytical expertise. Healthcare organizations rely on BPO providers to process, secure, and analyze large datasets needed for claims processing, clinical documentation, and patient engagement. Digital transformation initiatives such as robotic process automation (RPA), cloud migration, AI-driven coding, and automated claims workflows further boost outsourcing adoption. Providers struggling with legacy systems and limited IT capability increasingly depend on externally managed digital infrastructure. As regulations tighten around data accuracy, interoperability, and cybersecurity, BPO partners offering scalable, compliant, and advanced digital solutions gain significant market traction, making digitalization a key driver of sustained industry expansion.

- For instance, BPO outsourcing article highlighted how third-party providers are increasingly managing EHR data, claims processing data, patient records and analytics enabling healthcare organisations to “process, secure, and analyse large datasets needed for clinical documentation, billing, and patient engagement

Increasing Regulatory Complexity and Compliance Burden

Growing regulatory complexity across healthcare systems continues to drive strong demand for specialized outsourcing services. Compliance with HIPAA, ICD-10, CMS guidelines, and value-based reimbursement frameworks requires extensive documentation, strict reporting accuracy, and continuous workforce training. Healthcare organizations face substantial financial penalties for billing inaccuracies, coding errors, and data privacy breaches, prompting them to partner with BPO vendors equipped with experienced compliance teams. Outsourcing ensures consistent audit readiness, improved documentation accuracy, and reduced administrative pressure. With global regulatory frameworks evolving rapidly including data protection regulations and mandatory digital reporting healthcare providers and insurers depend on outsourced compliance expertise to mitigate risk. This rising compliance burden positions BPO partners as essential contributors to operational integrity and financial sustainability.

Key Trends & Opportunities

Expansion of Automation, AI, and Predictive Analytics

Automation and AI are reshaping the Healthcare BPO industry by improving accuracy, reducing manual workloads, and enabling data-driven decision-making. AI-powered claims adjudication, automated medical coding, NLP-driven documentation, and machine learning–based fraud detection significantly enhance process efficiency. Predictive analytics supports denial prevention strategies, financial forecasting, and patient risk stratification, providing added value to both payers and providers. BPO vendors that integrate RPA, cloud platforms, and interoperable data systems offer faster, more accurate, and cost-effective services. As healthcare organizations shift to digital-first operating models, automation-driven BPO services emerge as a major opportunity, enabling scalable, high-performance workflows that meet evolving industry demands.

- For instance, McLaren Health Plan implemented HealthRules Payer, achieving over 90% first-pass auto-adjudication rates, which reduced manual intervention and supported membership growth to over 620,000.

Global Growth in Telehealth and Remote Patient Services

The expansion of telehealth, virtual care, and remote patient monitoring has created substantial opportunities for Healthcare BPO providers. As healthcare organizations scale digital service delivery, they require external support for virtual appointment scheduling, remote patient onboarding, telehealth billing, remote monitoring data processing, and digital care coordination. BPO partners equipped with multilingual communication tools, secure digital platforms, and patient engagement technologies play a crucial role in managing these emerging workflows. With hybrid care models becoming standard, especially in chronic disease management and post-acute care, outsourcing enables healthcare systems to maintain operational efficiency. Growing investments in telemedicine infrastructure across emerging markets further strengthen opportunities for specialized BPO solutions.

- For instance, Amwell integrated Converge its unified telehealth platform with outsourced clinical support services, enabling automated virtual intake, remote patient onboarding, and telehealth documentation for hospitals adopting hybrid care models.

Rising Concerns Over Data Security and Privacy

Data security remains one of the most significant challenges in the Healthcare BPO market, as sensitive medical information is a primary target for cyberattacks. The increasing adoption of cloud platforms, digital integrations, and remote work models heightens exposure to data breaches and unauthorized access. Ensuring HIPAA-compliant operations, encrypted data transfer, and continuous cybersecurity monitoring is essential but resource-intensive. Any breach can lead to major financial penalties and reputational damage for both healthcare providers and outsourcing partners. As ransomware attacks and digital fraud escalate, BPO vendors must invest heavily in cybersecurity infrastructure, workforce training, and compliance monitoring making data protection one of the industry’s most persistent challenges.

Dependence on Skilled Workforce and Rising Talent Gaps

The Healthcare BPO industry faces growing challenges related to workforce availability, skill shortages, and rising training costs. Medical coding, billing, claims adjudication, and regulatory compliance roles require specialized knowledge that is increasingly difficult to maintain due to high turnover and global competition for talent. Evolving coding standards, payer guidelines, and regulatory frameworks further increase the need for continuous staff upskilling. Labor cost inflation in major outsourcing hubs also impacts operational margins. Despite significant advances in automation, skilled staff remain essential for complex case management, error resolution, and compliance auditing. Maintaining a stable, well-trained workforce remains a critical operational challenge for BPO providers.

Regional Analysis

North America

North America dominated the Healthcare BPO market with a 41.3% share in 2024, driven by high healthcare expenditure, advanced digital infrastructure, and strong adoption of outsourcing across payer and provider organizations. The region benefits from mature reimbursement systems, extensive regulatory compliance requirements, and a strong presence of global BPO vendors offering specialized RCM, claims management, and IT-enabled services. Increasing telehealth penetration, labor cost pressures, and the need to optimize administrative efficiency further strengthen outsourcing demand. The U.S. remains the primary contributor, supported by large insurance networks, expanding patient data volumes, and continuous investments in automation-driven healthcare operations.

Europe

Europe accounted for a 26.4% share in 2024, supported by the region’s growing emphasis on cost optimization, digital transformation, and regulatory alignment across healthcare systems. Countries such as the U.K., Germany, and France increasingly outsource documentation, billing, and analytics-driven services to improve operational efficiency and meet evolving data protection requirements under GDPR. The rising burden of chronic diseases and expanding public health programs drive demand for scalable BPO solutions. Investments in AI-based claims management and cloud-enabled healthcare platforms also accelerate adoption. European providers favor partners with strong compliance capabilities and multilingual service delivery to support diverse patient populations.

Asia-Pacific

Asia-Pacific emerged as the fastest-growing region with a 21.7% market share in 2024, fueled by rapid healthcare digitalization, expanding medical insurance coverage, and the presence of major outsourcing hubs such as India and the Philippines. Healthcare providers and payers increasingly adopt BPO services to enhance documentation accuracy, improve claims turnaround time, and support high-volume administrative workloads. Cost advantages, skilled labor availability, and strong expertise in technology-enabled services position the region as a preferred outsourcing partner globally. Rising investments in telehealth, data analytics, and healthcare IT infrastructure further strengthen Asia-Pacific’s role as a strategic growth engine for the market.

Latin America

Latin America captured a 6.1% share in 2024, driven by rising healthcare system modernization, increasing adoption of electronic health records, and expanding payer outsourcing needs. Countries such as Brazil, Mexico, and Colombia are accelerating investments in digital health solutions and administrative automation, creating opportunities for BPO providers. The region benefits from growing demand for claims processing, billing services, and multilingual patient support. However, varying regulatory environments and limited IT infrastructure in some countries pose challenges to widespread adoption. Despite these constraints, improving healthcare access and rising insurance enrollments continue to strengthen the region’s outsourcing potential.

Middle East & Africa

The Middle East & Africa region held a 4.5% share in 2024, supported by ongoing healthcare infrastructure upgrades, growing emphasis on digital health adoption, and expanding public–private partnerships. Gulf countries such as the UAE and Saudi Arabia are leading outsourcing adoption due to their focus on healthcare modernization, insurance digitization, and administrative efficiency enhancement. BPO demand is rising for coding, billing, and patient engagement services as regional providers adopt international quality standards. Although limited skilled workforce availability and slower digital maturity remain challenges in parts of Africa, increasing investments in healthcare IT and insurance penetration are gradually expanding regional growth opportunities.

Market Segmentations

By Service Type

- Provider Outsourcing Services

- Payer Outsourcing Services

- Operational Outsourcing Services

- IT Infrastructure Management Services

By Provider Service

- Revenue Cycle Management

- Patient Enrollment & Strategic Planning

- Patient Care

By Payer Service

- Claims Management

- Member Management

- Provider Management

- Integrated Front-End Services & Back-Office Operations

- Billing & Accounting Management

By End User

- Healthcare Providers

- Healthcare Payers

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Healthcare BPO market features a diverse and expanding landscape of global and regional players that offer specialized services across revenue cycle management, claims processing, patient engagement, medical billing, and IT-enabled healthcare operations. Leading companies such as Accenture, Cognizant, IBM, Genpact, IQVIA, Parexel, Infosys BPM, Wipro, Tata Consultancy Services (TCS), and GeBBS Healthcare Solutions maintain strong market presence through advanced digital capabilities, large-scale delivery networks, and compliance-focused service models. These firms invest heavily in automation, AI-driven analytics, cloud platforms, and interoperability solutions to enhance operational accuracy and reduce processing cycles for healthcare providers and payers. Strategic partnerships, mergers, and expansion of nearshore and offshore delivery centers further intensify competition, enabling players to offer cost-effective, high-quality outsourcing solutions. As healthcare systems pursue digital transformation and regulatory compliance, vendors differentiate through domain expertise, scalable platforms, and technology-enabled service portfolios.

Key Player Analysis

- Genpact

- Infosys BPM

- GeBBS Healthcare Solutions

- Accenture

- Parexel

- IBM

- Tata Consultancy Services (TCS)

- Cognizant

- IQVIA

- Wipro

Recent Developments

- In July 2025, Capgemini announced acquisition of WNS Global Services for US$3.3 billion a move signalling major consolidation in BPO and an increased push for AI-powered business services including healthcare BPO.

- In April 2025, TDCX acquired Open Access BPO the move adds new delivery locations (Davao, Manila, Taipei) and expands TDCX’s capacity to support health-tech and other outsourcing services.

- In September 2024, EQT Private Capital Asia agreed to acquire a controlling stake in GeBBS Healthcare Solutions, a global healthcare outsourcing firm marking one of the largest recent private-equity acquisitions in healthcare BPO (~US$ 850 million).

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Service Type, Provider Service, Payer Service, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as healthcare providers and payers increase outsourcing to reduce administrative pressure and improve efficiency.

- AI, automation, and predictive analytics will transform outsourced workflows, enhancing accuracy and reducing manual intervention.

- Revenue cycle management outsourcing will rise as organizations seek faster reimbursements and better denial prevention.

- Digital transformation will drive greater adoption of cloud-based BPO platforms and integrated data solutions.

- Telehealth expansion will generate new outsourcing needs in virtual care coordination and remote patient support.

- Global BPO hubs will strengthen domain expertise and invest in advanced technology to enhance service delivery.

- Increasing regulatory complexity will deepen dependence on outsourcing partners for compliance and accurate documentation.

- Cybersecurity enhancements will become a priority as data protection requirements intensify across the healthcare ecosystem.

- Payer organizations will expand outsourcing to streamline claims management and member services.

- Emerging markets will become key growth centers as demand for cost-effective, scalable healthcare BPO solutions rises.

Market Segmentation Analysis

Market Segmentation Analysis