Market Overview

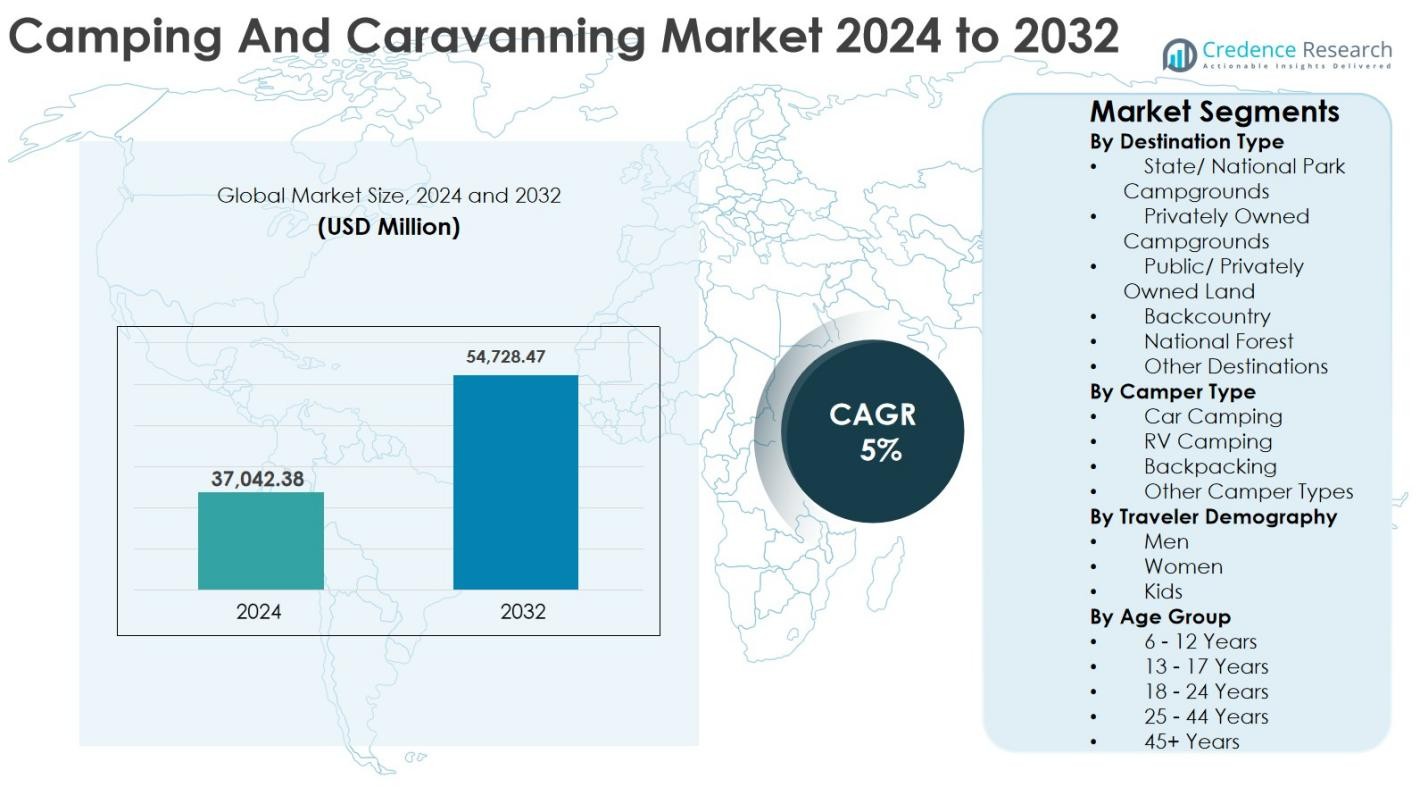

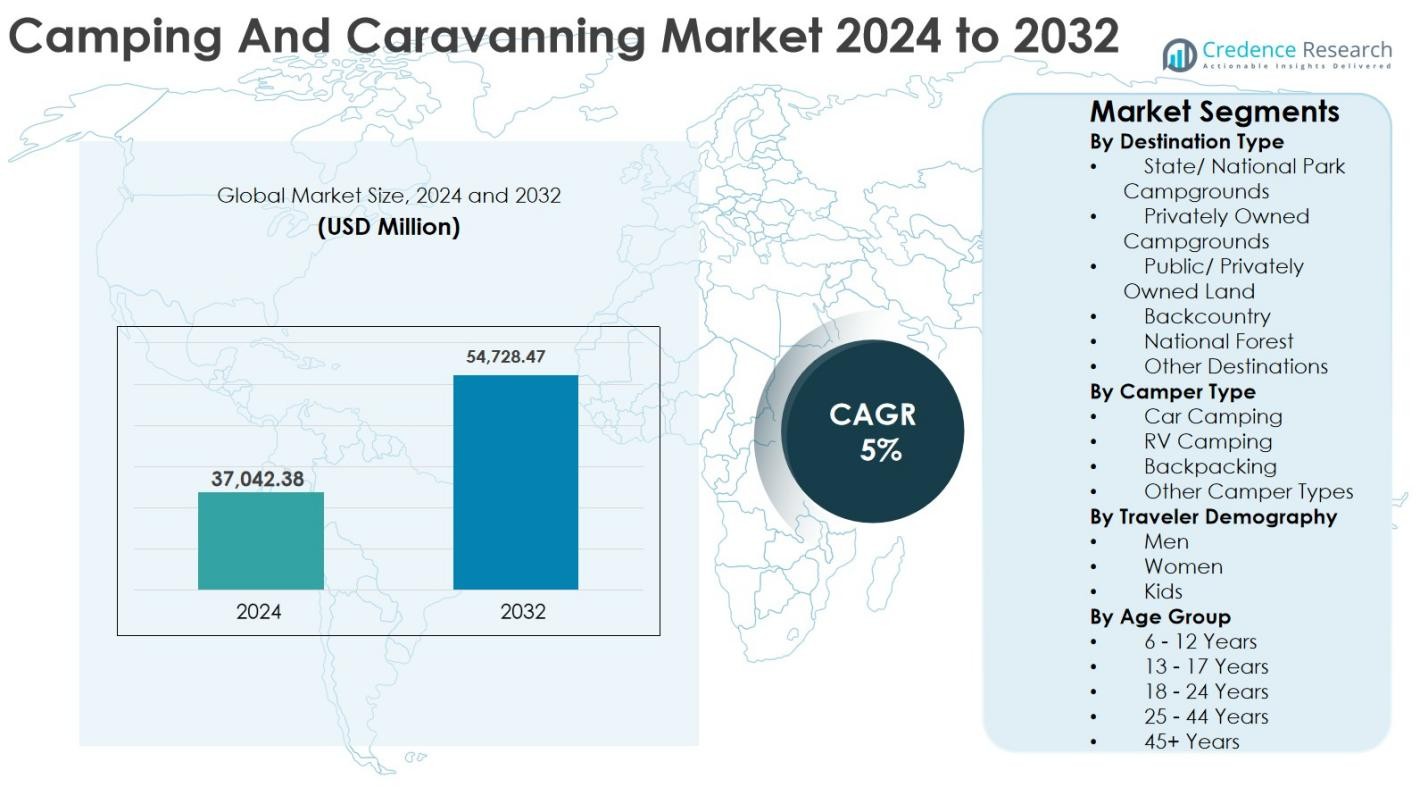

The Camping and Caravanning Market size was valued at USD 37,042.38 million in 2024 and is anticipated to reach USD 54,728.47 million by 2032, expanding at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Camping and Caravanning Market Size 2024 |

USD 37,042.38 Million |

| Camping and Caravanning Market, CAGR |

5% |

| Camping and Caravanning Market Size 2032 |

USD 54,728.47 Million |

The Camping and Caravanning market is shaped by a mix of established campground operators and digital travel platforms that focus on accessibility, experience enhancement, and flexible booking models. Key players such as RVshare, Kampgrounds of America (KOA), Hipcamp, Inc., Glamping Hub, Camplify, Yescapa, and Harvest Hosts strengthen their presence through platform expansion, premium camping offerings, and peer-to-peer rental services. These companies emphasize technology integration, destination diversification, and customer-centric services to capture rising outdoor tourism demand. Regionally, North America led the Camping and Caravanning market with an exact market share of 42% in 2024, driven by high RV ownership, extensive national and state park infrastructure, and strong domestic travel trends, followed by Europe as the second-largest regional contributor.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Camping and Caravanning market was valued at USD 37,042.38 million in 2024 and is projected to reach USD 54,728.47 million by 2032, growing at a CAGR of 5% driven by rising outdoor recreation and domestic tourism demand.

- Growing preference for nature-based travel, cost-effective vacations, and flexible mobility continues to drive market expansion, supported by increasing RV ownership, rental platforms, and improved campground infrastructure across developed and emerging economies.

- RV camping held the largest segment share of about 41% in 2024, while glamping and premium camping formats are gaining traction due to rising demand for comfort-oriented outdoor experiences and higher per-trip spending.

- The market remains moderately fragmented, with players such as RVshare, KOA, Hipcamp, Glamping Hub, Camplify, and Yescapa focusing on digital platforms, campground expansion, and differentiated service offerings.

- North America led with 42% market share, followed by Europe at 30%, Asia Pacific at 17%, Latin America at 6%, and Middle East & Africa at 5%, reflecting varied infrastructure maturity and tourism patterns.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Destination Type

The Camping and Caravanning market, by destination type, is led by State/National Park Campgrounds, which accounted for around 34% market share in 2024. This dominance is driven by well-developed infrastructure, scenic locations, safety standards, and affordability compared to private resorts. Increasing government investment in park facilities, improved campground amenities, and rising domestic tourism continue to strengthen this segment. Privately Owned Campgrounds follow closely, supported by premium services and family-oriented offerings. Growing interest in National Forest and Backcountry camping is further fueled by adventure tourism and demand for nature-immersive travel experiences.

- For instance, the U.S. National Park Service reported over 13 million overnight stays in campgrounds and backcountry sites in 2023 across parks such as Yellowstone and Yosemite, supported by maintained roads, ranger services, and organized campsites.

By Camper Type

By camper type, RV Camping emerged as the dominant sub-segment, holding 41% of the Camping and Caravanning market share in 2024. The segment benefits from rising RV ownership, comfort-driven travel preferences, and increasing availability of RV-friendly campgrounds. Technological advancements in RVs, including smart features and energy-efficient systems, further support growth. Car Camping remains a strong contributor due to low entry costs and flexibility, while Backpacking gains traction among younger travelers seeking adventure and sustainability. Expanding rental platforms and peer-to-peer RV sharing models continue to accelerate market participation.

- For instance, Hipcamp and Outdoorsy have expanded access to car‑accessible sites and RV rentals, enabling first‑time campers to participate without owning gear or vehicles.

By Traveler Demography

Based on traveler demography, Adults (Men and Women combined) dominated the Camping and Caravanning market with 68% share in 2024, driven by higher spending capacity and growing preference for experiential travel. Men accounted for the larger individual share, supported by adventure tourism and solo travel trends, while Women participation continues to rise due to safety-focused camp services and group travel options. The Kids segment is expanding steadily, fueled by family camping trips, educational outdoor activities, and increased promotion of nature-based recreation among households.

Key Growth Drivers

Rising Demand for Domestic and Nature-Based Tourism

The Camping and Caravanning market is strongly driven by the rising preference for domestic and nature-based tourism. Travelers increasingly seek outdoor recreational experiences that offer relaxation, adventure, and closer engagement with nature, particularly in the post-pandemic travel landscape. Camping provides cost-effective alternatives to hotels while enabling flexible travel plans, making it attractive to families, solo travelers, and adventure enthusiasts. Government initiatives promoting national parks, eco-tourism destinations, and rural tourism infrastructure further support market growth. Improved campground facilities, digital booking platforms, and accessibility enhancements encourage repeat visits. This shift toward experiential travel continues to expand participation across diverse demographics, strengthening long-term demand for camping and caravanning services.

- For instance, the Kampgrounds of America (KOA) 2024 North American Camping and Outdoor Hospitality Report notes that over half of campers say they are camping more than they did three years ago, with many prioritizing time in nature and stress relief.

Growth in RV Ownership and Rental Platforms

The increasing ownership of recreational vehicles and expansion of RV rental platforms significantly accelerate the Camping and Caravanning market. Consumers value RV travel for its comfort, privacy, and mobility, enabling long-distance trips without dependence on traditional accommodations. Peer-to-peer rental platforms and short-term leasing models reduce ownership barriers, attracting first-time users and younger travelers. Technological advancements in RV design, including fuel efficiency, compact layouts, and smart onboard systems, further enhance adoption. Additionally, expanding RV-friendly infrastructure such as service stations and designated parking areas supports broader usage, positioning RV camping as a mainstream travel option.

- For instance, Outdoorsy has reported millions of booked rental days globally, while RVshare notes strong uptake among Millennials and Gen Z using peer‑to‑peer rentals for road trips and remote work travel.

Increasing Participation from Families and Younger Travelers

Growing participation from families and younger travelers acts as a key driver in the Camping and Caravanning market. Families increasingly choose camping for educational and bonding experiences, while younger consumers are drawn to adventure, sustainability, and social experiences. Social media exposure, influencer-led travel content, and outdoor lifestyle branding positively shape consumer perceptions. Affordable entry options such as car camping, glamping, and short-duration trips broaden market reach. Educational outdoor programs, youth camping initiatives, and wellness-focused retreats further reinforce engagement, supporting consistent growth across age groups and income levels.

Key Trends & Opportunities

Expansion of Glamping and Premium Camping Experiences

The rapid expansion of glamping and premium camping represents a major trend and opportunity in the Camping and Caravanning market. Consumers increasingly seek comfort-driven outdoor experiences that combine nature with hotel-like amenities. Luxury tents, eco-lodges, and fully serviced caravans attract high-spending travelers and first-time campers. This trend creates opportunities for private operators to differentiate through design, sustainability, and personalized services. Integration of wellness offerings, curated experiences, and technology-enabled conveniences enhances customer satisfaction. As demand for upscale outdoor stays rises, glamping is expected to contribute significantly to market value growth.

- For instance, Under Canvas in the U.S. reports strong occupancy at its safari‑style tent resorts near national parks such as Yellowstone and Zion, offering king beds, ensuite bathrooms, and on‑site dining.

Digitalization and Online Booking Platforms

Digitalization is transforming the Camping and Caravanning market by improving accessibility, planning, and user experience. Online platforms enable real-time campground availability, dynamic pricing, and personalized recommendations. Mobile apps offering navigation, campsite reviews, and activity planning increase consumer confidence and convenience. Data-driven insights allow operators to optimize occupancy and target specific traveler segments. The integration of digital payments, contactless check-ins, and subscription-based camping services further enhances operational efficiency. Continued investment in digital ecosystems presents long-term growth opportunities for both public and private campsite operators.

- For instance, Kampgrounds of America (KOA) uses its KOA app and rewards program to support mobile booking, cashless payment, and guest profiling across its network of campgrounds.

Key Challenges

Seasonality and Weather Dependency

Seasonality and weather dependency remain significant challenges for the Camping and Caravanning market. Demand is highly concentrated during favorable weather conditions, leading to fluctuating revenue streams and underutilized assets during off-peak seasons. Extreme weather events, including heatwaves, storms, and wildfires, disrupt travel plans and reduce campsite occupancy. Operators face difficulties maintaining consistent staffing levels and managing fixed operational costs year-round. Limited seasonal predictability also affects consumer booking behavior. Addressing this challenge requires diversification of offerings, off-season promotions, and investment in all-weather infrastructure.

Environmental Regulations and Infrastructure Constraints

Environmental regulations and infrastructure limitations pose another critical challenge in the Camping and Caravanning market. Stricter land-use policies, conservation requirements, and waste management regulations increase compliance costs for operators. Overcrowding in popular destinations strains natural resources and campground facilities, leading to capacity constraints. Inadequate infrastructure in remote areas, including roads, utilities, and connectivity, restricts expansion potential. Balancing environmental sustainability with commercial growth remains complex. Operators must invest in eco-friendly practices and collaborate with authorities to ensure long-term market viability.

Regional Analysis

North America

North America dominated the Camping and Caravanning market with 42% market share in 2024, supported by a strong outdoor recreation culture, high RV ownership, and extensive campground infrastructure. The United States leads regional growth due to well-established national and state parks, advanced booking platforms, and widespread availability of RV-friendly facilities. Rising participation in road trips, family camping, and adventure tourism continues to drive demand. Canada also contributes steadily, supported by nature-based tourism and government investment in park maintenance. Strong disposable income levels and premium camping trends further reinforce regional market leadership.

Europe

Europe accounted for 30% of the Camping and Caravanning market share in 2024, driven by a mature caravanning culture and strong cross-border tourism. Countries such as France, Germany, the UK, and Italy remain key contributors due to well-developed campsite networks and high adoption of motorhomes and caravans. Growing preference for eco-tourism, sustainable travel, and countryside vacations supports regional growth. Government support for tourism infrastructure and increasing popularity of glamping experiences enhance market expansion. Seasonal travel patterns and strong domestic tourism further sustain demand across Western and Northern Europe.

Asia Pacific

Asia Pacific held 17% market share in 2024 and represents the fastest-growing region in the Camping and Caravanning market. Rising disposable incomes, expanding middle-class populations, and increasing interest in outdoor leisure activities drive growth across China, Australia, Japan, and South Korea. Australia remains a major contributor due to strong RV tourism and vast camping destinations. Improving tourism infrastructure, digital campground platforms, and growing youth participation further accelerate adoption. Government initiatives promoting domestic tourism and nature-based travel experiences support long-term regional expansion.

Latin America

Latin America captured 6% of the Camping and Caravanning market share in 2024, supported by growing adventure tourism and nature-focused travel. Countries such as Brazil, Chile, and Argentina benefit from diverse landscapes and increasing interest in outdoor recreation. While infrastructure remains less developed than in mature markets, rising domestic tourism and affordable camping options drive steady growth. Expansion of private campgrounds and increased promotion of eco-tourism destinations enhance regional appeal. Improving road connectivity and growing awareness of camping as a leisure activity continue to support gradual market development.

Middle East & Africa

The Middle East & Africa region accounted for about 5% of the Camping and Caravanning market share in 2024, driven by niche tourism segments and unique outdoor experiences. Desert camping, safari tourism, and luxury glamping drive demand in the Middle East, particularly in the UAE and Saudi Arabia. In Africa, nature reserves and wildlife tourism support selective growth. Infrastructure limitations and climatic conditions restrict large-scale adoption; however, government-backed tourism diversification strategies and investments in premium outdoor accommodations continue to create growth opportunities across the region.

Market Segmentations

By Destination Type

- State/ National Park Campgrounds

- Privately Owned Campgrounds

- Public/ Privately Owned Land

- Backcountry

- National Forest

- Other Destinations

By Camper Type

- Car Camping

- RV Camping

- Backpacking

- Other Camper Types

By Traveler Demography

By Age Group

- 6 – 12 Years

- 13 – 17 Years

- 18 – 24 Years

- 25 – 44 Years

- 45+ Years

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Camping and Caravanning market features a dynamic competitive landscape characterized by the presence of digital platforms, campground operators, and experience-focused travel providers. Key players such as RVshare, Kampgrounds of America (KOA), Hipcamp, Inc., Glamping Hub, Camplify, Yescapa, and Harvest Hosts focus on expanding campsite access, improving user experience, and leveraging technology-driven booking models. Platform-based companies emphasize peer-to-peer rentals, diversified destination listings, and flexible pricing to attract a broad consumer base. Established operators like KOA and Suncamp Holidays invest in campground expansion, premium amenities, and loyalty programs to strengthen brand presence. Players such as Trek Travel and Recreation.gov benefit from curated experiences and government-backed infrastructure access. Strategic partnerships, geographic expansion, and service differentiation through glamping, RV rentals, and digital integration remain central to sustaining market position and capturing evolving consumer demand.

Key Player Analysis

- Hipcamp, Inc.

- Suncamp Holidays

- RVshare

- Trek Travel

- Yescapa

- Recreation.gov

- Camplify

- Harvest Hosts

- Glamping Hub

- Kampgrounds of America (KOA)

Recent Developments

- In December 2025, Octane Lending Inc. partnered with Camping World Holdings, Inc. to launch a new financing solution under the Good Sam Powered by Octane brand, enabling flexible RV financing options for customers through Camping World’s dealer network

- In November 2025, First Camp Group AB entered into an agreement to acquire nine camping destinations in Germany and Switzerland from lodgyslife AG, strengthening its footprint in key European markets

- In November 2025, lodgyslife AG entered into a strategic partnership with First Camp Group to bundle its operational camping business with First Camp for growth across Germany and Switzerland, with additional acquisitions planned.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Destination Type, Camper Type, Traveler Demography Age Group and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Camping and Caravanning market will witness steady growth driven by sustained interest in outdoor and experiential travel.

- RV camping will continue to expand as rental platforms lower entry barriers for first-time users.

- Glamping and premium camping formats will gain wider acceptance among comfort-focused travelers.

- Digital booking platforms and mobile applications will enhance trip planning and campsite accessibility.

- Family and group camping will remain a core demand segment supported by recreational and educational activities.

- Younger travelers will increasingly influence market growth through adventure-oriented and sustainable travel preferences.

- Investment in campground infrastructure and modern amenities will improve overall service quality.

- Eco-friendly practices and low-impact camping solutions will shape operator strategies.

- Emerging markets will see higher participation due to rising disposable incomes and domestic tourism promotion.

- Strategic partnerships and service diversification will strengthen long-term market competitiveness.

Market Segmentation Analysis:

Market Segmentation Analysis: