Market Overview

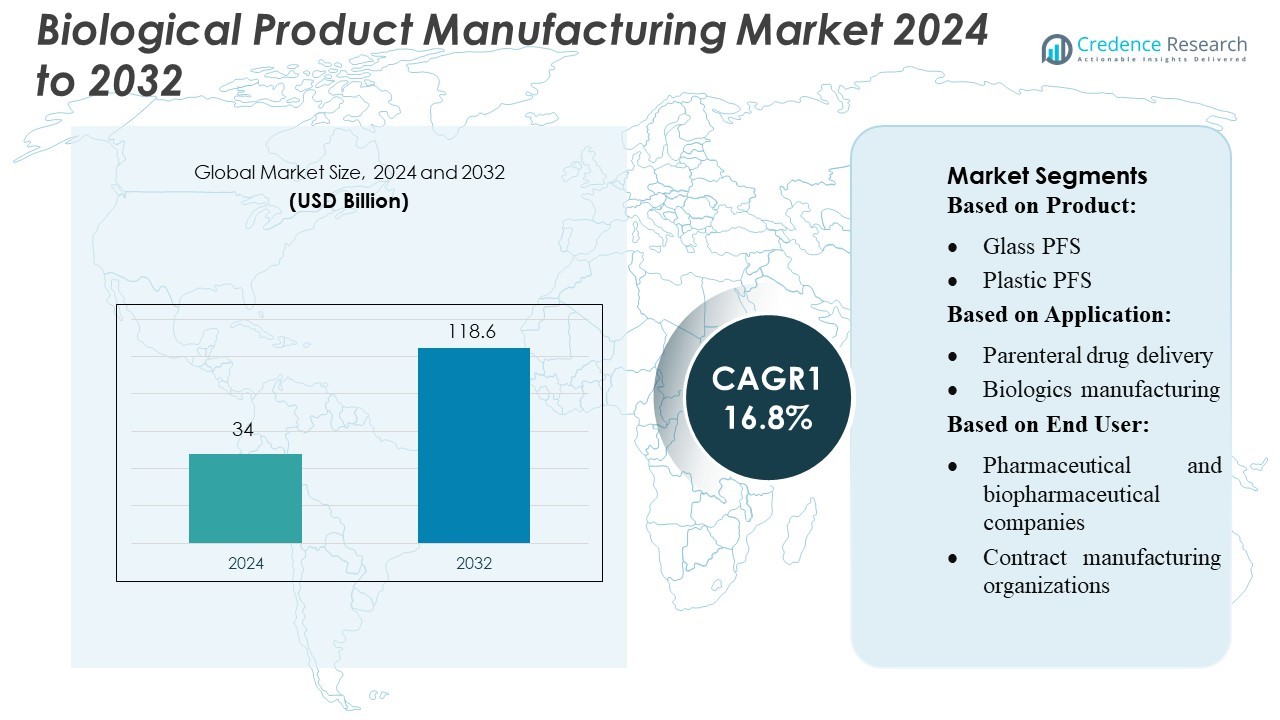

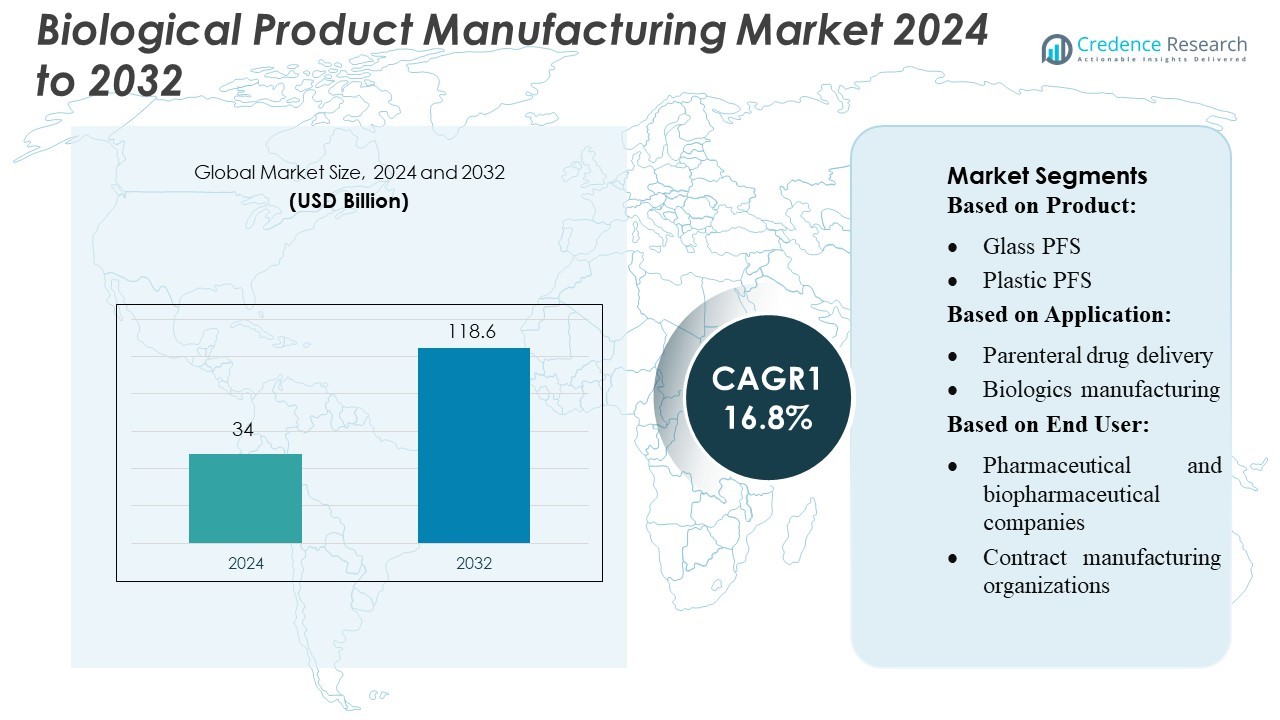

Biological Product Manufacturing Market size was valued USD 34 billion in 2024 and is anticipated to reach USD 118.6 billion by 2032, at a CAGR of 16.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Biological Product Manufacturing Market Size 2024 |

USD 34 Billion |

| Biological Product Manufacturing Market, CAGR |

16.8% |

| Biological Product Manufacturing Market Size 2032 |

USD 118.6 Billion |

The Biological Product Manufacturing Market includes several global leaders that expand production capacity, adopt advanced bioprocessing systems, and invest in next-generation biologics to strengthen their competitive position. These companies focus on high-efficiency platforms, strong quality control, and wider therapeutic portfolios to meet rising demand for vaccines, monoclonal antibodies, and cell-based therapies. Strategic partnerships and capacity expansions support faster scale-up and improved global supply reliability. North America leads the market with a 39% share, driven by advanced infrastructure, strong R&D pipelines, and early adoption of automated and single-use manufacturing technologies, reinforcing its dominance in global biologics production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Biological Product Manufacturing Market reached USD 34 billion in 2024 and will grow to USD 118.6 billion by 2032 at a 16.8% CAGR.

- Demand strengthens as companies adopt advanced bioprocessing tools, expand biologics pipelines, and increase production of vaccines, monoclonal antibodies, and cell-based therapies.

- Single-use systems, continuous processing, and automation shape major trends, while competition intensifies with capacity expansions and strategic partnerships across global facilities.

- High production complexity and strict regulatory requirements act as restraints, increasing compliance costs and slowing scale-up for emerging manufacturers.

- North America leads with a 39% share, followed by Europe at 28% and Asia-Pacific at 22%, while consumables remain the dominant segment with strong adoption across large and mid-sized biomanufacturers.

Market Segmentation Analysis:

By Product

Consumables hold the dominant share at 58%, driven by strong demand for prefilled syringes and vials across biologics and injectable formulations. Prefilled syringes lead this category due to their sterile configuration and reduced contamination risk, with glass PFS preferred for stability-sensitive biologics. Rising adoption of plastic PFS supports growth in high-volume vaccination programs. Vials remain essential in multi-dose biologics, while cartridges expand use in pen-injector systems. Instruments also grow as manufacturers adopt automated filling and inspection systems. Integrated systems gain traction because they improve line efficiency, reduce operator errors, and support high-throughput biologics fill-finish operations.

- For instance, Johnson & Johnson’s Janssen Biologics uses its PER.C6® cell line platform, which supports viral-vector production runs yielding up to 1×10¹⁴ viral particles per batch, and operates 2000-liter single-use bioreactor systems that feed directly into automated vial-filling equipment, reducing manual handling steps in downstream fill-finish workflows.

By Application

Parenteral drug delivery represents the dominant segment with a 47% share, supported by rapid growth in monoclonal antibodies, cell therapies, and recombinant proteins. Biologics manufacturing demand rises as companies scale production for high-potency injectables requiring sterile consumables and precision filling systems. Personalized medicine drives specialized packaging formats, including small-batch cartridges and custom PFS. Other applications, such as vaccines and hormonal therapies, strengthen market adoption across global production sites. Increasing regulatory focus on aseptic manufacturing encourages the use of automated inspection machines and contamination-control consumables across all application areas.

- For instance, Roche’s subsidiary Genentech broke ground on a new facility in Holly Springs, North Carolina. The planned 65,000 m² (700,000 square feet) facility is expected to be operational in 2029 and will incorporate advanced biomanufacturing technologies, automation, and digital capabilities to produce biologic medicines.

By End User

Pharmaceutical and biopharmaceutical companies lead the market with a 62% share, driven by expanding biologics pipelines and investments in high-speed fill-finish technologies. These companies adopt integrated systems to support large-scale sterile manufacturing and reduce operational downtime. Contract manufacturing organizations follow as they handle outsourced biologics production, relying on flexible consumables and modular filling lines suited for multi-product environments. Other end users, including research institutes and specialty manufacturers, contribute steady demand for small-batch consumables. Rising biologics approvals and stringent quality standards continue to strengthen the need for advanced, automation-ready consumables and instruments.

Key Growth Drivers

Rising Demand for Biologics

The growing need for targeted therapies drives strong demand for biologics. Pharmaceutical companies expand research pipelines to support new monoclonal antibodies, cell therapies, and recombinant proteins. Higher disease prevalence and wider acceptance of precision medicine also support market growth. Manufacturers invest in advanced bioprocessing systems to raise production output and reduce batch failures. This shift encourages rapid facility upgrades and greater use of continuous manufacturing. The demand trend strengthens global capacity expansion and creates consistent revenue opportunities for suppliers across the value chain.

- For instance, Samsung Biologics operates multiple bioreactors ranging from 1,000-litres to 15,000-litres, enabling both small-batch clinical and large-scale commercial production. The company’s Plant 4 was built with a capacity of 240,000 litres, bringing total capacity to 604,000 litres at Bio Campus I. automation, and digital capabilities to produce biologic medicines.

Expansion of Contract Manufacturing

The contract manufacturing sector grows as companies seek faster scale-up and lower operating costs. Biopharmaceutical firms outsource complex production tasks to gain access to specialized facilities and skilled talent. This model reduces capital risks and helps companies focus on research and commercialization. Contract manufacturers expand global networks to meet demand for flexible, high-volume biologics production. The rise of small and mid-sized biotech firms accelerates this shift. Strong collaboration models also improve delivery timelines and support wider adoption of advanced biologics.

- For instance, Sanofi inaugurated its “Modulus” Evolutive Vaccines Facility in Singapore. The facility is designed to deploy up to four vaccine production technologies simultaneously and is expected to be fully operational by mid-2026, creating around 200 skilled jobs in the region.

Advances in Bioprocessing Technologies

New bioprocessing tools raise production efficiency and improve product quality. Single-use systems reduce contamination risks and allow faster changeovers. Automated control platforms improve real-time monitoring and help maintain strong batch consistency. Companies integrate high-throughput screening and continuous bioprocessing to enhance productivity. These technologies shorten development cycles and support the production of complex biologics. Ongoing innovation in filtration, chromatography, and cell culture media further strengthens process reliability. This progress drives steady investment across both established and emerging markets.

Key Trends & Opportunities

Shift Toward Personalized Medicine

Personalized medicine adoption creates new opportunities for targeted biologics. Manufacturers build flexible systems to produce smaller, specialized batches. Demand rises for cell and gene therapies that address specific patient needs. Companies invest in advanced analytics to support precise production control. This shift helps diversify portfolios and attract partnerships in high-value therapeutic areas. Regulatory support for personalized treatments also accelerates market growth.

- For instance, Amgen announced a manufacturing expansion in North Carolina for a second drug-substance facility, investing US 1 billion and planning the facility to support its global network.

Growth of Single-Use Manufacturing

Single-use technologies offer faster setup, lower contamination risk, and reduced cleaning needs. Biopharmaceutical companies use these systems to improve cost control and scale production more efficiently. The flexible nature of single-use components supports quick product changeovers. This trend benefits small-batch biologics, clinical trial supplies, and multi-product facilities. Growing adoption across emerging markets strengthens demand for integrated single-use platforms.

- For instance, Novo Nordisk announced an investment of DKK 8.5 billion to build a new modular production facility in Odense, Denmark, spanning more than 40,000 m² and designed to manufacture multiple rare-disease therapies within the same line.

Rising Investment in Biomanufacturing Capacity

Global firms and governments increase spending to boost biologics production capacity. New facilities support vaccines, antibodies, and advanced therapies. These investments focus on expanding regional supply chains and reducing import dependence. Companies adopt modular plant designs to scale output quickly. This trend improves global manufacturing resilience and supports rapid response to public health needs.

Key Challenges

High Production Complexity

Biologics manufacturing requires strict process control, skilled labor, and advanced equipment. Any deviation in cell culture, purification, or storage can affect product safety. Companies face challenges in maintaining consistency across large batches. Complex quality checks increase production time and cost. Smaller firms struggle to manage these demands without strong technical resources. This barrier slows product development and raises operational risks across the industry.

Regulatory and Compliance Burden

Biopharmaceutical companies must meet strict global regulatory standards. Each biologic requires detailed documentation, validation, and testing across the manufacturing cycle. Changing regulatory guidelines add further complexity. Compliance delays can affect product timelines and raise operational costs. Firms must invest heavily in audits, monitoring systems, and specialized staff. These requirements create barriers for new entrants and increase financial pressure on existing manufacturers.

Regional Analysis

North America

North America holds a 39% market share, supported by strong biologics pipelines, advanced manufacturing facilities, and high investment in cell and gene therapy. The region benefits from rapid adoption of single-use technologies and strong regulatory guidance that improves product quality. Major pharmaceutical companies expand capacity to meet rising demand for monoclonal antibodies and precision therapies. Contract manufacturing organizations also strengthen the regional supply chain, offering scalable production models. Growing R&D spending, skilled talent, and continuous process innovations reinforce the region’s leadership in biologics manufacturing and help maintain a competitive global position.

Europe

Europe accounts for a 28% market share, driven by strong biopharmaceutical research, supportive regulatory frameworks, and expansion of manufacturing infrastructure across Western and Northern Europe. The region invests heavily in advanced bioprocessing, including automation and high-throughput platforms, to increase production efficiency. Strategic collaborations among public research institutes and private manufacturers accelerate biologics development. Growing demand for biosimilars strengthens production activities, especially in Germany, the U.K., and Switzerland. Government funding programs and rising focus on personalized therapies further enhance market growth and expand manufacturing capabilities across the region.

Asia-Pacific

Asia-Pacific holds a 22% market share, supported by rapid expansion of biologics manufacturing hubs in China, South Korea, Japan, and India. Strong government funding, lower production costs, and rising clinical trial activity drive regional growth. Companies invest in new facilities to meet rising demand for vaccines, biosimilars, and recombinant proteins. Multinational firms establish partnerships with regional manufacturers to strengthen local supply chains. Growing healthcare spending and rapid adoption of single-use systems improve production quality. The region’s emerging biotech clusters position Asia-Pacific as a fast-growing contributor to global biologics output.

Latin America

Latin America captures a 6% market share, driven by rising demand for biologics, expanding vaccination programs, and growing investment in local biomanufacturing. Brazil and Mexico lead the region with upgraded biologics facilities and increased participation in clinical research. Companies adopt modern bioprocessing tools to improve production reliability and meet regulatory standards. Public health spending supports wider use of monoclonal antibodies and advanced therapies. Strategic collaborations with global manufacturers strengthen technology transfer. Although infrastructure gaps remain, steady regulatory improvements and rising pharmaceutical investments continue to enhance the region’s biologics manufacturing capacity.

Middle East & Africa

The Middle East & Africa region holds a 5% market share, supported by growing investments in biopharmaceutical infrastructure and rising demand for advanced therapies. Gulf countries, especially the UAE and Saudi Arabia, expand biologics manufacturing through government-led initiatives and partnerships with global firms. Local production of vaccines and biosimilars strengthens supply security. Emerging African markets gradually adopt modern bioprocessing tools to meet public health needs. Training programs and regulatory improvements support industry development. Although production capacity remains limited, increasing healthcare spending and technology adoption drive steady regional growth.

Market Segmentations:

By Product:

By Application:

- Parenteral drug delivery

- Biologics manufacturing

By End User:

- Pharmaceutical and biopharmaceutical companies

- Contract manufacturing organizations

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Biological Product Manufacturing Market features leading companies such as Celltrion Healthcare Co., Ltd., Johnson & Johnson Services, Inc., AbbVie Inc., F. Hoffmann-La Roche Ltd., Bristol-Myers Squibb Company, Samsung Biologics, Sanofi, Amgen Inc., Eli Lilly and Company, and Novo Nordisk A/S. The Biological Product Manufacturing Market shows strong competition as companies focus on expanding production capacity, improving process efficiency, and advancing bioprocessing technologies. Many manufacturers invest in automated systems, single-use platforms, and continuous manufacturing to reduce costs and enhance product quality. Growth in biologics, biosimilars, and advanced therapies encourages firms to upgrade facilities and strengthen global supply chains. Strategic partnerships and contract manufacturing agreements help accelerate development timelines and scale operations. Regulatory compliance, robust quality management, and technology integration remain central to maintaining competitiveness. This landscape continues to evolve as manufacturers pursue innovation and regional expansion to meet rising global demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Celltrion Healthcare Co., Ltd.

- Johnson & Johnson Services, Inc.

- AbbVie Inc.

- Hoffmann-La Roche Ltd.

- Bristol-Myers Squibb Company

- Samsung Biologics

- Sanofi

- Amgen Inc.

- Eli Lilly and Company

- Novo Nordisk A/S

Recent Developments

- In May 2025, Samsung Biologics secured a biologics manufacturing contract with an undisclosed U.S. pharmaceutical company, extending its CDMO dealmaking streak through 2031.

- In May 2025, SCHOTT Pharma expanded its cartriQ portfolio by launching a 1.5 ml, ready-to-use (RTU) sterile cartridge for human use. This is the smallest sterile format in the cartriQ line and is designed to provide stable storage for sensitive drugs like insulin, GLP-1 medications, and hormone therapies. The new cartridge comes pre-washed, depyrogenated, siliconized, and steam-sterilized to allow pharmaceutical companies to immediately begin the filling process.

- In October 2024, Nipro-Corning collaboration to integrate Velocity Vial technology targets a broad range of critical pharmaceutical products, including injectable drugs, biologics, and vaccines. The technology is designed as a drop-in solution for existing fill-finish lines, making it easily adaptable for various types of essential medications.

- In July 2024, Debut launched BiotechXBeautyLabs. It enables large and small beauty brands to develop sustainable, clinically tested, high-performing, and differentiated biotech products with no upfront research cost and high speed.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for biologics will rise as targeted therapies gain wider adoption.

- Manufacturers will expand global facilities to support higher production volumes.

- Single-use systems will see stronger adoption for flexible, low-risk operations.

- Continuous bioprocessing will improve efficiency and reduce batch failures.

- Contract manufacturing services will grow as companies outsource complex tasks.

- Biosimilar production will increase as patents expire and healthcare demand rises.

- Automation and digital monitoring tools will enhance process control and quality.

- Personalized medicine growth will drive small-batch, high-value manufacturing models.

- Regulatory standards will tighten, pushing companies to upgrade compliance systems.

- Investments in cell and gene therapy facilities will accelerate across key regions.